First-time buyers in Scotland at 'seven-year-low'

- Published

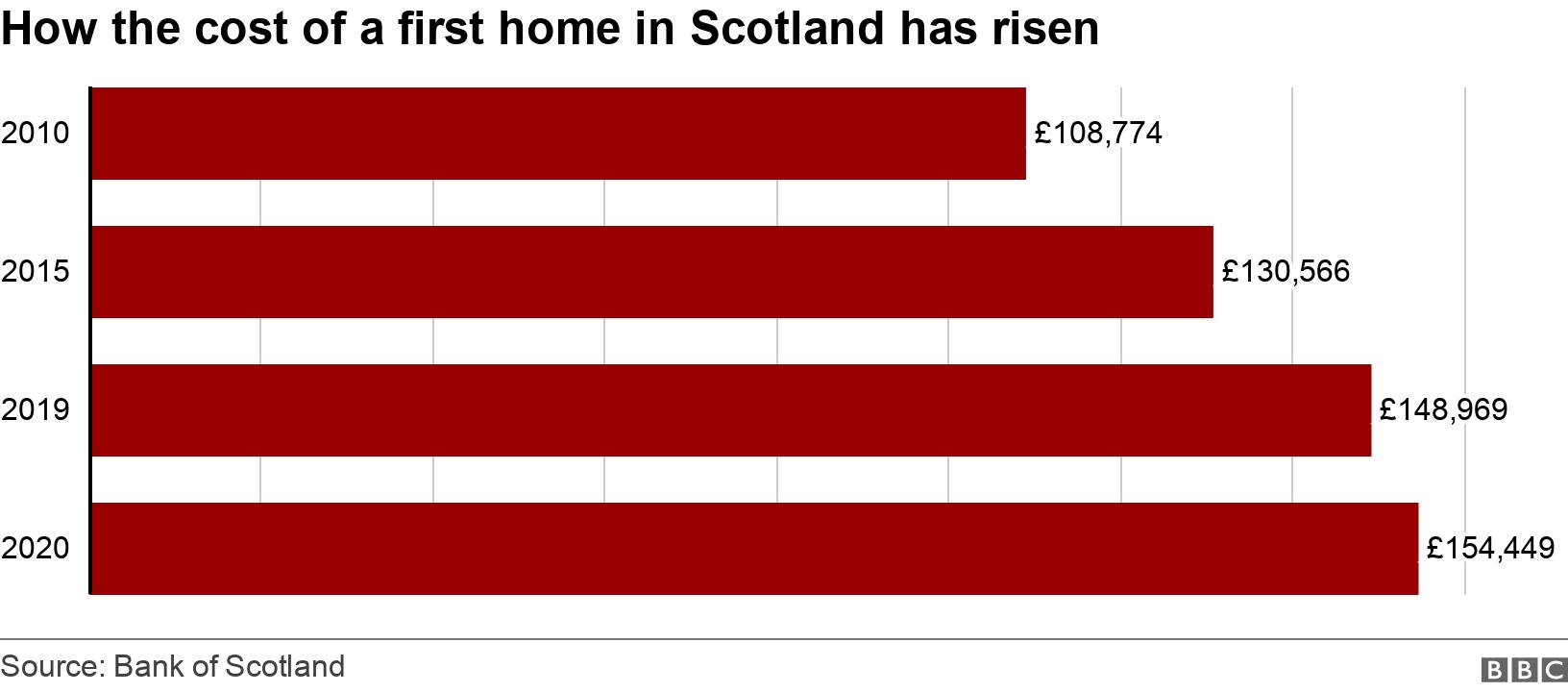

House prices have increased by 42% in the past decade

The number of first-time buyers is Scotland has reached a seven-year low, according to the Bank of Scotland.

There were 10,158 first-time buyers in the first half of the year, compared with 15,570 over the same period in 2019 - a fall of 35%, the bank said.

The average deposit for a first-time buyer is now £31,257.

The Bank of Scotland said many people looking to buy their first home were reconsidering options as the coronavirus pandemic hit the country.

Despite the fall, first-time buyers still made up 51% of the property market - up from 37% in 2009.

House prices in Scotland have increased 42% in the past decade, with North Ayrshire the most affordable area to buy at just 3.2 times the average local salary for a home.

The average cost of a first home in Scotland is now £154,449, compared with £108,774 in 2010.

Graham Blair, mortgages director at Bank of Scotland, said: "While a number of first-time buyers were unable to take their first step onto the housing ladder during lockdown, we are already seeing activity levels growing as buyers kick off their property searches once again and look to make the most of the government support available.

"With properties in the capital costing more than five times the average local salary while other areas remain affordable, the challenges facing first-time buyers are heavily influenced by where in the country they are house-hunting."

The average age of a first-time buyer continues to rise gradually, from 29 a decade ago to 31 in 2020.

In Edinburgh, first-time buyers are putting down the largest deposits, with an average of £49,575 - equating to 24% of the property price.

This is followed by Stirling at 23%, then Moray and the Highlands where buyers are putting down deposits of 22%.