Furlough's further furlong

- Published

The Job Retention Scheme has been retained across the UK, while England enters a new month of lockdown. But it's not clear it will also be there if Scotland needs to deploy it at a time when England does not.

Businesses welcome the return of furlough, but there's dismay in some sectors about the implications for their costs.

Furlough has supported 9.6m people to stay in jobs, though 9% of them went on to lose their jobs. That goes for 19% of young people.

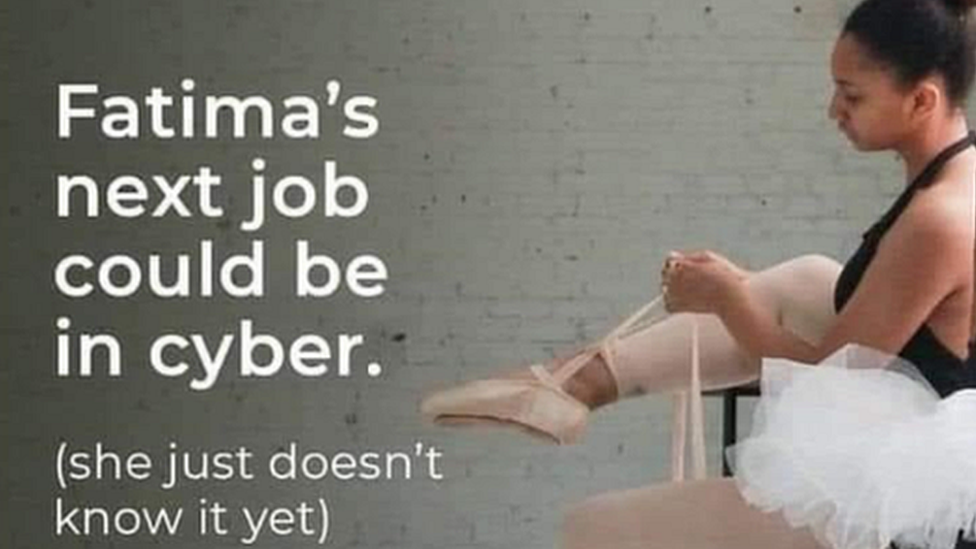

Furlough goes on. We were due to be starting a new era of economic recovery and transition to a new jobs market from this morning. Ballet dancers were to reskill as cyber security consultants, at least according to the poster. But that's not how it's turned out.

In mid-summer and many times after that, we were told Halloween would be the end of it, for sure. But less than five hours from the end of October, the prime minister announced that it goes on, at least to 2 December.

That's with the announcement that England is going back into lockdown. We're back to the furlough scheme as it was in August.

The government pays 80% of normal pay for those on furlough, and employers pay about 5% of their total pay bill in National Insurance and pension contributions. Plus employers can take furloughed workers back part-time. So that's more generous than September or October.

Some important details: neither the employer nor the employee needs to have previously used the furlough scheme. That's important for many people who have shifted jobs in recent months, and for new firms. To qualify, you have to have been on the payroll and registered for PAYE tax before midnight on Friday 30 October.

Downing Street criticised a government-backed advert suggesting a ballet dancer should retrain in cyber security before it was taken down

You can be furloughed for as little as seven days. There has previously been a three-week minimum.

There are grants being paid to firms forced to close, and local councils in England are getting £20 per head of population to help out - a total of £1.1bn. There should be a share of that distributed through the funding formula for Scotland, Wales and Northern Ireland.

There's no mention yet of what happens to the Self-Employed Income Support Scheme, which was due to fall, from 1 November, to 40% of past year's profits to cover the next three months. That's for the limited number of self-employed people who qualify.

Meanwhile, the Financial Conduct Authority, the industry regulator, said mortgage lenders should extend payment holidays to a maximum of six months. So if you've already taken a six month holiday from payments, you may not get that continued.

Half a million closures

We were due for a new system that required people in firms that did not have to close to work at least 20% of their normal hours. In that case the UK government would pay out nearly half of normal earnings. That system required two big revisions, and even after that, it is not being introduced, at least until early December.

Meanwhile, furlough applies across the UK, though the need for it is lower in Scotland, for now. There's a lot less that has to close.

I'm told that governments in Scotland and Wales and Northern Ireland all asked for a return to full furlough support in order to let them put in place tight restrictions they deemed necessary to suppress viral infection. Downing Street said no as there isn't enough money.

But now that England requires lockdown, there is enough money - borrowed money. That's clearly going to rankle and doesn't sound like a partnership of equals.

There will be talks on Sunday between the Scottish government and the Treasury about how this is to apply, given that Scotland does not require closure of half million non-essential shops, car showrooms, betting shops almost all hospitality, pubs, bars, cafes, restaurants other than takeaways, most hotels, leisure, indoor entertainments, from bingo to bowls, hairdressers and beauty salons.

And that's the issue raised by Nicola Sturgeon, the first minister saying that a crucial point is whether support on the scale announced for English businesses will be available if Scotland needs to impose further restrictions later - or if it is only available if Scotland happens to require a full lockdown at the same time as a lockdown in England.

There's relief across business that furlough has been extended, but absolute dismay from some sectors about this happening in November.

Shops are carrying a lot of Christmas stock, and they foresee a lot of business going to the big online retailers. People they were about to recruit but were not yet on the books will not qualify for furlough.

The British Retail Consortium says the new English lockdown will cause "untold damage" in the run-up to Christmas, costing countless jobs, setting back the recovery and, it says, with only minimal effect on virus transmission. For Scottish shops, which can remain open, this raises questions about supply chains being disrupted.

The UK Hospitality trade body says its members need more support than in spring. It'll have to sustain them through winter, and they're looking for a clear roadmap out of here.

The Food and Drink Federation said the extended furlough scheme is "extremely welcome", but the lockdown decision still threatens calamity if they don't see a detailed rescue package within only three days.

Independent retailers fear that there will be many more permanent closures, having lost quarter of shops from the first lockdown. And brewers face having to pour a lot of stale beer down the drain in December, with replacement costs. Fixed costs go on, even if the pay bill is covered by furlough, and they say the supply chain for hospitality tends to be forgotten.

Let's not forget travel, which will affect those Scots who travel through English airports, now facing a ban on international travel, so flights are likely to be cut back sharply. Airports and airlines say they require an immediate additional economic support package throughout winter, and a roll-out of a traveller testing regime.

Job search

So far, the furlough scheme has helped 9.6m people stay in jobs, though not all at the same time. It's come down a long way from its peak. And it's cost more than £40bn.

This week, we had interesting insights into what's happened to the people on furlough, from the Resolution Foundation think tank. It found 9% of people furloughed at some point had lost their jobs by September.

Among young people, that's as high as 19%, so furlough had helped delay the point that were going to lose their jobs anyway.

It found that, of people who were self-employed in February, 10% were unemployed seven months later, so they've been much less well protected.

A really important finding from this research is that people have been losing jobs, as they did in past recessions, but much more than in the past, they've not been getting back into jobs. So there are big outflows from work, and poor outflows back into work. That's particularly true of young people.

One of the reasons is that people are looking to get back into jobs like the ones they left, notably those in hospitality and leisure. The signs are that they're not going to sectors where there are recruitment shortages, such as social care.

And that raises a big challenge about re-skilling people to have the skills and confidence to seek out the work opportunities that are out there.