Scots oil firm wins £1bn payout from Indian government

- Published

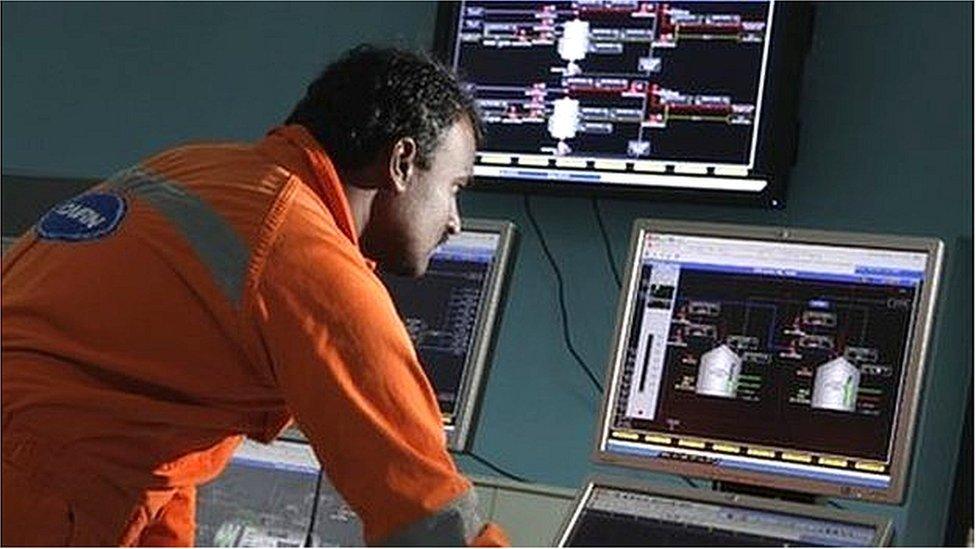

Edinburgh-based Cairn Energy explores for oil throughout the world and has been in dispute with the Indian government for some time

Scots oil explorer Cairn Energy has won more than £1bn in a court ruling, following a long-running legal battle over an Indian government tax bill.

The firm had been blocked from selling a 10% stake in the company it created.

It was told it owed US$1.6bn (£1.19bn) in retrospective tax, so that stake was seized by the government and sold off.

Cairn's fight against the Indian law to capture the taxable value of past corporate deals has been closely watched by international investors.

Along with a tax bill the Delhi government claimed from Vodafone, the drawn-out proceedings have been seen as test cases for the country's reliability and predictability as an investment partner.

The case was finally decided this week by a tribunal in the Hague, under the terms of the UK's investment treaty with India.

On Wednesday, Cairn announced a $1.2bn (£893m) pay-out, plus interest and expenses, which should total roughly $1.4bn (£1.04m).

The Indian government was reported in Indian media to be considering further legal recourse.

It was in 2004 that the Edinburgh-based firm struck black gold in the Thar desert of Rajasthan, near the border with Pakistan. It developed the Mangala field, India's largest, along with two nearby finds, together containing approximately 2.2 billion barrels of oil.

In 2006, the company split its Indian operations from the UK company, creating the Cairn India subsidiary. Most of that was later sold to Vedanta, raising more than $8bn (£5.9bn).

After announcing it would sell its final 10% stake in Cairn India, then valued at around $1bn (£0.74bn), the Indian government blocked the sale in 2014, and launched a tax investigation.

This looked into the restructuring of Cairn Energy eight years earlier, when the Cairn India subsidiary was set up. The Edinburgh firm says the arrangements were fully disclosed and cleared with the finance ministry in Delhi.

Edinburgh staff cuts

In March 2015, the Indian tax authority demanded $1.6 billion (£1.19bn), claiming that the creation of the subsidiary had been to avoid tax. Cairn immediately lodged a legal challenge through the UK-India Bilateral Investment Treaty.

As a consequence, the Scots firm lost a large share of its market value. It had to sell a stake in the Catcher oil field in the North Sea, and cut staff at its Edinburgh head office.

The 10% stake in Cairn India lost value after the oil price fell sharply from August 2014. In 2018, the Indian government sold the stake it had seized in lieu of unpaid tax, for an estimated $600m (£445m) to $700m (£519m).

The Indian government may seek further legal action

The legal challenge was heard in 2018 at the Court of Arbitration in the Hague, the tribunal for international business disputes. Its 582-page ruling was delivered to Cairn Energy and the Indian government on Tuesday night.

A company source said the funds now owed by the Indian government are effectively owed to Cairn's shareholders, including many of the US and UK's biggest institutional investors.

He said they are watching closely to see if the Delhi government accepts a ruling by the Court of Arbitration, and that will shape their future attitude to investment in the country.

Leading political figures in India have acknowledged that retrospective action to make claims against international investors has been a problem for the country's reputation.

Since exiting its successful venture in India, Cairn Energy went on to explore and develop a major gas find off the coast of Senegal. It sold that stake earlier this year, and from that it is returning $250m (£185m) to shareholders.

Following the announcement of the tribunal ruling on Wednesday, the Cairn Energy share price rose 35%.

Related topics

- Published30 June 2011

- Published18 August 2015

- Published7 October 2014