Small firms to get deposit return scheme support

- Published

Small breweries have complained they could be forced out of business by the scheme

Changes have been announced to the plans for a deposit return scheme for cans and bottles in Scotland.

Concerns had been raised about the impact of the recycling programme on small businesses.

The body set up to run the scheme - due to go live in August - has now announced extra support for small firms.

Circularity Scotland announced £22m of cashflow support to remove upfront charges from some companies.

The minister in charge, Green MSP Lorna Slater, said the move would give businesses "the clarity and confidence they need" to take part in the system.

But opposition parties still want the plans put on hold so they can be reviewed.

The Scottish Conservatives claimed the "last-minute" changes were an acknowledgment that its design was flawed.

The deposit return scheme (DRS) aims to improve recycling rates for certain bottles and cans by providing a financial incentive to recycle and pick up litter.

A 20p deposit will be added to cost of items sold in Scotland.

The customer can get that money back when they take the empty container to a return point, either over-the-counter at a shop or using an automated reverse vending machine.

Producers have until the end of the month to register for the scheme, which will require them to declare how many items they intend to put on the Scottish market. They will then be invoiced for deposits and fees.

Many small businesses have warned that while they support the general sentiments, the scheme will impose unacceptable costs and other strains while they are still recovering from the Covid pandemic.

In particular they are worried about cashflow impact of paying deposits and administrative fees in advance, as well as pressure to produce special barcodes on products destined for the Scottish market.

Circularity Scotland, a private non-profit company set up to administer the DRS, has now said firms selling fewer than three million units a year will not have to pay deposits and fees for the first month of the scheme.

Producers will also be given two months' credit terms for payments.

Firms producing fewer than 25,000 units a year will also be given the option of using stick-on barcodes.

How does the scheme work?

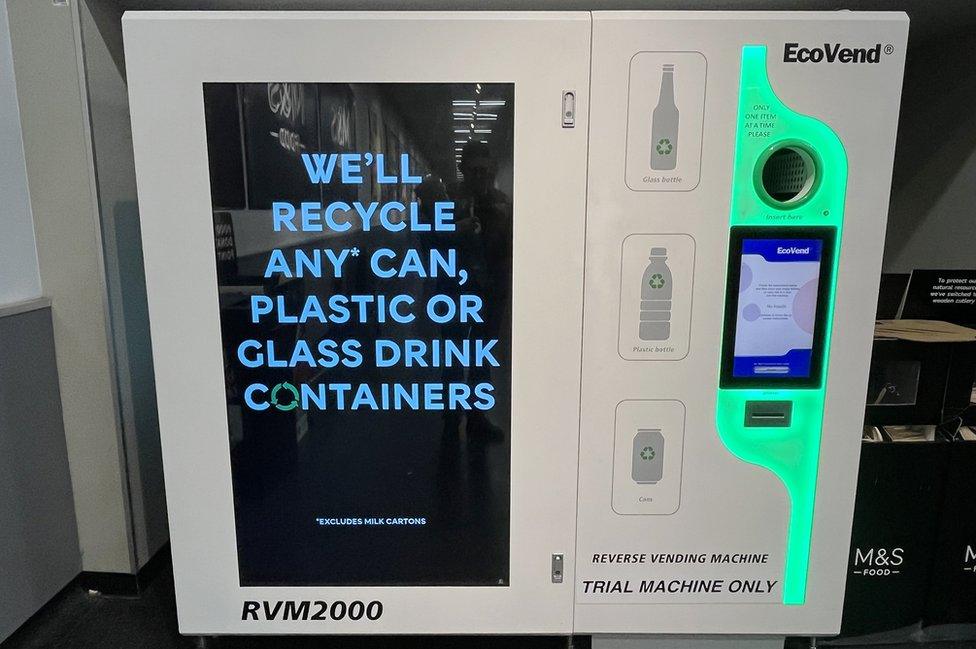

Reverse vending machines, like this one in Renfrewshire, are already being trialled in Scotland

Producers have to pay the 20p deposit, as well as a small fee, to the scheme's administrator for every item they produce that is destined for sale in Scotland.

They can recoup the 20p by adding it to cost of their products when they sell it to wholesalers - who in turn pass it on to retailers.

The deposit gets passed down the chain, eventually to the customer who pays 20p more for the bottle or can.

The customer gets this back when they hand the used container in at a return point, either over the counter, or using a reverse vending machine.

Retailers will act as return points - and will reimburse customers from their own funds, but can claim this back from the scheme's administrator.

Circular Economy Minister Lorna Slater said she hoped the changes would address many concerns raised by smaller producers such as craft brewers.

She said: "It addresses initial cash flow challenges, and provides a pragmatic and simple solution to the issues raised around barcodes for smaller product lines.

"This is a package that gives businesses the clarity and confidence they need to be part of Scotland's deposit return scheme."

The Scottish Conservatives - who have called for the scheme to be paused - claimed the "last-minute" changes were an acknowledgment that its design was flawed.

MSP Maurice Golden said: "This sudden discovery of £22m just days before the deadline for firms to register is not enough to make it fit for purpose in its current form.

"Instead of this desperate bid to save face, Lorna Slater should swallow her pride and accept that the scheme should be paused at once for an independent review to address the numerous concerns of business."

Mr Golden said a well-designed scheme could be beneficial, but that in its current form it was unworkable.