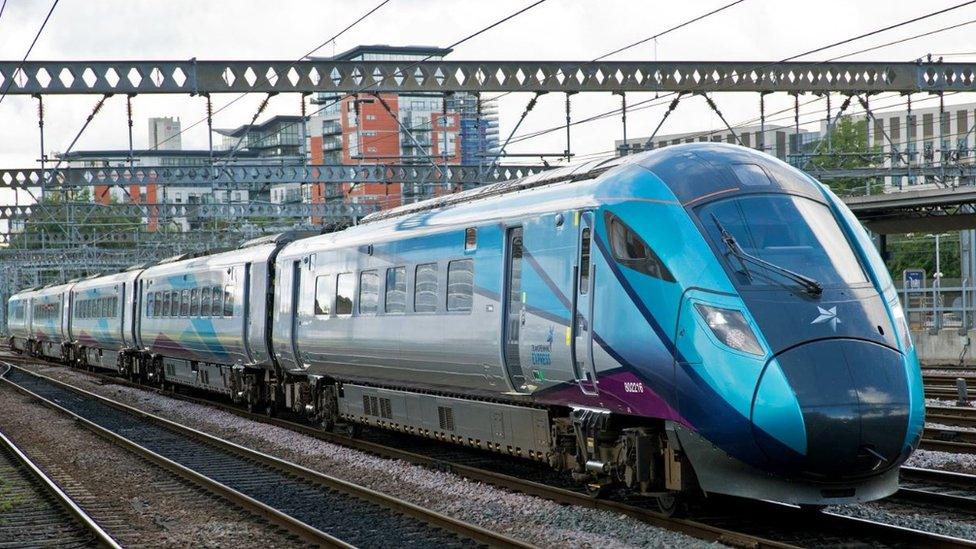

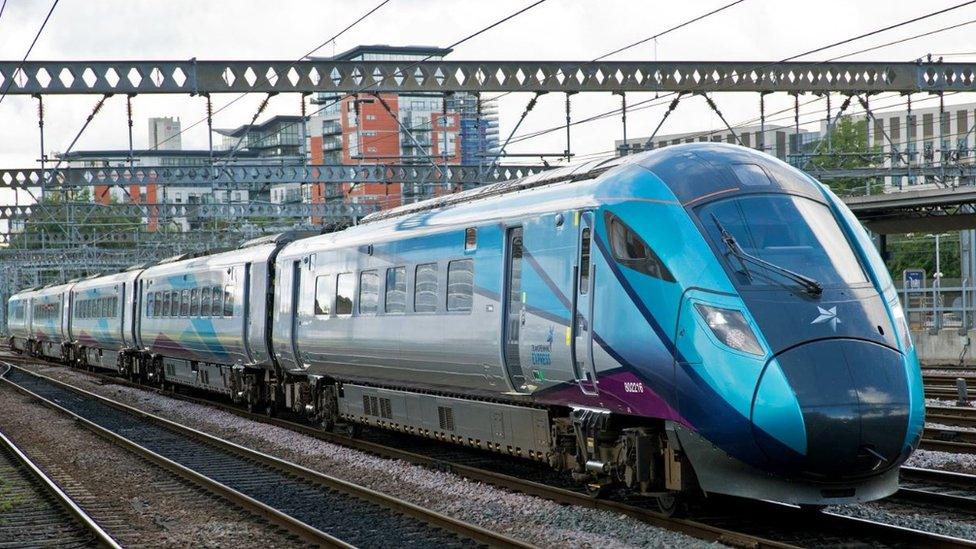

FirstGroup 'on track' despite TransPennine Express franchise loss

- Published

FirstGroup was stripped of its TransPennine Express franchise recently over poor service

FirstGroup has said it expects to keep results on track this year, despite ongoing rail strike action and losing its TransPennine Express franchise.

The transport giant said it expected "broadly consistent" earnings from its trains business in the year to next March.

Its group results are also forecast to be in line with its expectations.

However, the company warned that the "economic and industrial relations backdrop remains challenging".

FirstGroup saw its TransPennine Express franchise - covering the north of England and Scotland - taken over by the UK government at the end of May after months of poor performance.

The franchise contributed £8.5m in the last financial year to the group's rail division income.

It said the past few years had been "among the most challenging in the history of the UK's rail industry" as it grappled with the pandemic and changing passenger habits, as well as industrial action.

FirstGroup's full-year results showed overall revenue down year-on-year by 15%, at £4.76bn.

Pre-tax profits fell sharply to £128.7m from £654.1m, due to the sale of its First Student, First Transit and Greyhound businesses.

However, it said that with this impact stripped out, underlying earnings more than doubled to £82.1m.

Fare cap boost

The Aberdeen-based group's results for the past year were boosted by rising demand, with a government scheme to cap bus fares at £2 in England helping to boost passenger numbers following pandemic disruption.

The government last month announced it would extend the fare cap until the end of October, with plans for it to rise to £2.50 in November and remain at that level for a year.

FirstGroup said its bus business saw revenues surge to £902.5m from £789.9m the year before, as total passenger numbers jumped by a fifth.

Its First Rail division - which runs around a quarter of the UK rail market - saw underlying earnings leap to £124.8m from £87.8m as passengers also returned to railways.

The company has launched a plan to buy back £115m of shares after offloading its businesses in North America, helping the stock leap more than 15% higher in morning trading on Thursday.

- Published11 May 2023

- Published23 April 2023