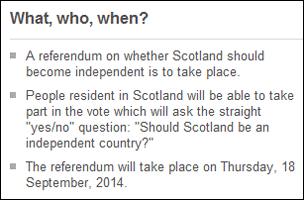

Scottish independence: Energy market claims analysed

- Published

The future of the energy market has become a key debate in the referendum campaign

The question of whether energy bills would rise in the event of Scottish independence has come into sharp focus.

Shadow Energy Secretary Caroline Flint has insisted householders would pay more post-yes, but the Scottish government's Energy Minister Fergus Ewing hit back saying her claim was about "making political threats".

Both politicians spoke to BBC Radio Scotland's Good Morning Scotland programme.

Here, Euan Phimister, external, professor of economics at Aberdeen University with expertise in energy markets, looks at their claims and counter claims.

Caroline Flint (pro-Union): Energy bills would go up in an independent Scotland because bill payers in the rest of the UK (rUK) would not want to continue subsidising the Scottish renewable sector. A third of the UK's renewable subsidy currently goes to Scotland, while Scots pay only one tenth of the cost.

Fergus Ewing: "It is a shame that Caroline Flint is more concerned about making political threats than addressing the reality of the electricity market in the UK."

Fergus Ewing (pro-independence): This is not the full picture. Even bigger subsidies go to nuclear power in England, which Scottish bill payers are contributing to.

Euan Phimister (expert): "Bills are going to rise in all cases due to increased subsidy to renewables and nuclear (in the UK case), replacement of infrastructure and of power plants which are coming offline due to environmental regulations.

"How much they will rise is ultimately uncertain. It is true that if an independent Scotland chose to support renewables at the current level and no subsidy was coming from the rUK, this would represent a burden either for Scottish bill payers or for Scottish taxpayers. However, an independent Scotland would have choices, for example cutting some subsidies which could alleviate this."

Fergus Ewing (pro-independence): A UK-wide energy market would serve an independent Scotland and the rUK best. Scotland and the rUK would continue to work together in the best interests of all.

Caroline Flint: "Because of our [UK] partnership there is a sharing of both the risks and the rewards when it comes to energy."

Caroline Flint (pro-Union): The market would be hugely changed by independence and would move to a purely commercial relationship, leading to energy bills going up in Scotland.

Euan Phimister (expert): "Independence would clearly change the relationship and there could be no guarantee that electricity produced in Scotland would definitely be bought by consumers in rUK. However, Fergus Ewing's point about OFGEM predictions about the low margins of capacity over demand over the next few years are correct and it likely that rUK electricity demand for Scottish electricity overall would remain significant.

"This is also where it is I think important to distinguish between existing capacity and new capacity. Existing capacity across the UK already supplies the electricity market on a 'commercial basis 'and that would remain the case, even if the subsidy was cut because all the capital costs have already been made. However, for investment to be made in new renewable capacity (or nuclear) by commercial companies, then they do still need the promise of subsidy. So the threat after independence is possibly more to the future development of renewables rather than paying for existing installed capacity."

Caroline Flint (pro-Union): England helps keep the lights on in Scotland by providing energy from nuclear power when the wind isn't blowing in Scotland. Scotland would continue to need this capacity in the future.

Fergus Ewing (pro-independence): Scotland is keeping the lights on for the rUK at the moment. The rUK's capacity over its demand is very precarious, more so than in Scotland. Scotland currently exports 26% of its energy to England and Wales - an increase of 45% since 2010. - the rest of the UK needs Scotland's surplus energy now, and would continue to need it if Scotland became independent.

Euan Phimister (expert): "Both are right but also somewhat miss the point about markets. The whole point of a market for energy is that it is balanced across the system at any point in time, so there will always be parts of the system which are in deficit or surplus. Markets work better when they are integrated, which explains why at European level (EU plus Norway) they are attempting to construct a market to allow a wider system to balance.

"Patterns of trade can change over time and it is quite possible in the longer term that in a pan-European market, Scotland's production of electricity would be less important for the rUK, but the argument also holds the other way too, i.e. the rUK market would be less important for Scotland's exports."

Caroline Flint (pro-Union): The rest of the UK could meet its renewables targets without Scotland's help.

Fergus Ewing (pro-independence): Scotland is key to helping the rest of the UK meets its renewables targets, and would be just as important after independence.

Euan Phimister (expert): "The latest figures from DECC, external show the UK produced 4.1% of all UK energy consumption against the 2020 target of 15%. This is slightly above the predicted level for this stage but attaining the 2020 target is still very challenging.

"Renewable electricity production is a key part of attaining this target, so while it may be possible for the rUK, without the output from Scotland it would be much more difficult to achieve. Also, implementation of the current Electricity Market Reforms (EMR) plus the proposed cap on wholesale market prices if Labour wins the next election, have increased uncertainty and arguably negatively affected the investment plans of the energy firms. If so, this will have made the targets even more difficult to meet."

Caroline Flint (pro-Union): The rest of the UK doesn't need energy from Scotland all the time. Post-independence it could choose to import from the likes of France, the Netherlands and Norway.

Fergus Ewing (pro-independence): Import capacity from mainland Europe is limited, so the UK government can't assume the capacity would be there. The EU market couldn't deliver same day energy to the UK.

Euan Phimister (expert): "The rUK doesn't decide who it imports from, the consumers do and they would want to have electricity at the lowest price. So supply would sometimes be from France, the Netherlands, Norway or Scotland, depending on relative prices across the various markets.

"Fergus Ewing's answers assume that nothing changes i.e. no investments occur to alleviate capacity constraints. In fact, although National Grid is investing in new capacity, there are current constraints across the Scottish-rUK border which limit Scottish exports.

"The wider is point is that the attempt to construct a European-wide market (including Norway) is to make it easier to balance the system at any point in time. This will increasingly be a problem - and already is in Germany - when there is significant amounts of electricity coming from wind and solar power. This is also why a capacity market is being introduced within the UK system. This is where new generating plants, which can react quickly when demand is very high, will be paid for simply by being available, i.e. when they are not producing."