Scottish independence: Rivals both say Scots 'better off with us'

- Published

- comments

The UK and Scottish governments are debating whether Scots would be better off under independence

Competing claims about the costs and benefits of Scottish independence have been set out to voters.

The Scottish government said everyone in Scotland would be £1,000 better off a year, in the event of a "Yes" vote in September's independence referendum.

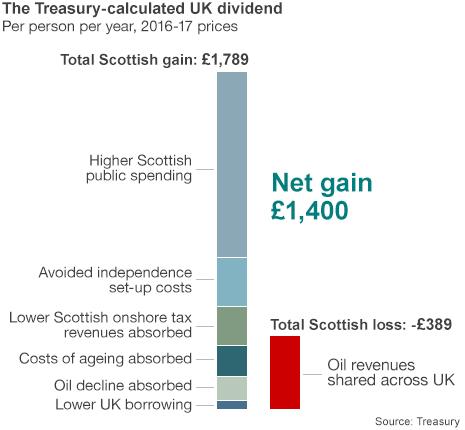

But UK ministers said in their analysis, external people would benefit from staying in the UK by £1,400 per person, per year.

Each side of the debate also sought to discredit the figures put forward by their opponents.

Scottish First Minister Alex Salmond said the Treasury's calculations had been "blown to smithereens", while Chief Secretary to the Treasury Danny Alexander accused SNP ministers of offering voters a "bogus bonus".

Independence: Treasury view

Each person in Scotland

£1,400

a year better off in UK

-

13% more tax needed to maintain independent Scotland public services, or...

-

11% cut in public services needed to keep current tax levels

-

£1.5bn-£2.7bn estimated cost of restructuring Scotland's institutions

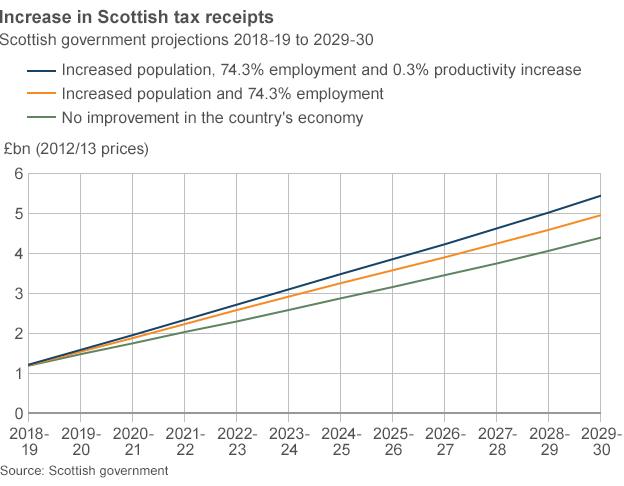

A new Scottish government paper, external said an independent Scotland would begin life with its public finances in a "strong" position, and could see its economy £5bn per year better off by 2029-30.

Mr Salmond said Scotland was one of the world's wealthiest countries, but needed the powers of independence to realise its full potential.

He told the BBC: "We put forward the benefit over a period of 15 years. We calculate that as each individual in Scotland being £1,000 better off - that's a £5bn bonus, or a family £2,000 better off a year."

The Scottish government paper said:

Scotland's finances in 2016-17 will be similar to, or stronger than, both the UK and the G7 industrialised countries as a whole.

Scotland's public finances show debt on a downward trajectory, enabling future Scottish governments to start an oil savings fund.

Scotland's estimated debt to GDP ratio in 2016-17 is forecast to be lower than the UK's under any potential outcome of negotiation with the UK over public sector assets and liabilities.

Scotland's fiscal position between 2008-09 and 2012-13 is estimated to have been worth £8.3bn, equivalent to £1,600 per person.

An independent Scotland could see tax income increase by £2,4bn a year by 2029-30, under a predicted 0.3% productivity increase.

A 3.3% increase in Scotland's employment rate would move it up to the level of the top five performing countries in the OECD and could increase revenues by £1.3bn a year, by 2029-30.

Independence: Scottish government view

Each person in Scotland

£1,000

a year better off out of UK

-

Onshore tax receipts will be up £5bn by 2030

-

14% increase in oil and gas production between 2013-18

-

Tax receipts currently 14% higher in Scotland than UK