Scottish Conservatives call for house-buying tax change

- Published

Scottish ministers have announced plans to replace stamp duty with a new property tax

The Scottish Conservatives have said the "eye-watering" new tax rate for people buying homes between £250,000 and £500,000 should be halved.

The Tories have outlined proposals for a property tax scale which they said would be fairer than those being introduced by the Scottish government.

The new Land and Building Transactions Tax will replace stamp duty on houses purchased in Scotland from 1 April.

Ministers claim tax will be reduced on houses costing up to £254,000.

Finance Secretary John Swinney announced, as part of the Scottish government's budget plans in October, that homebuyers in Scotland would pay no tax on properties costing less than £135,000.

Under the Land and Building Transactions Tax, a marginal tax of 2% will apply to the proportion of a transaction between £135,000 and £250,000, while a 10% rate will be levied between £250,000 and £1m.

A 12% marginal rate for houses costing more than £1m will also come into force.

The Conservatives have called for the starting rate to be raised to £140,000, making 46% of house purchases tax-free.

And they said the 10% rate for homes between £250,000 and £500,000 should be cut to 5%, in line with the changes recently announced in England.

Conservative finance spokesman Gavin Brown said: "The SNP has to act now.

"Scottish families are in danger of having to pay a heavy tax on home-buying purely because this left-wing SNP government thinks it knows best about how to spend our money."

The Tories said their plans amounted to a £90m tax cut, which they said could be paid for from extra cash earmarked for Scotland in the chancellor's autumn statement.

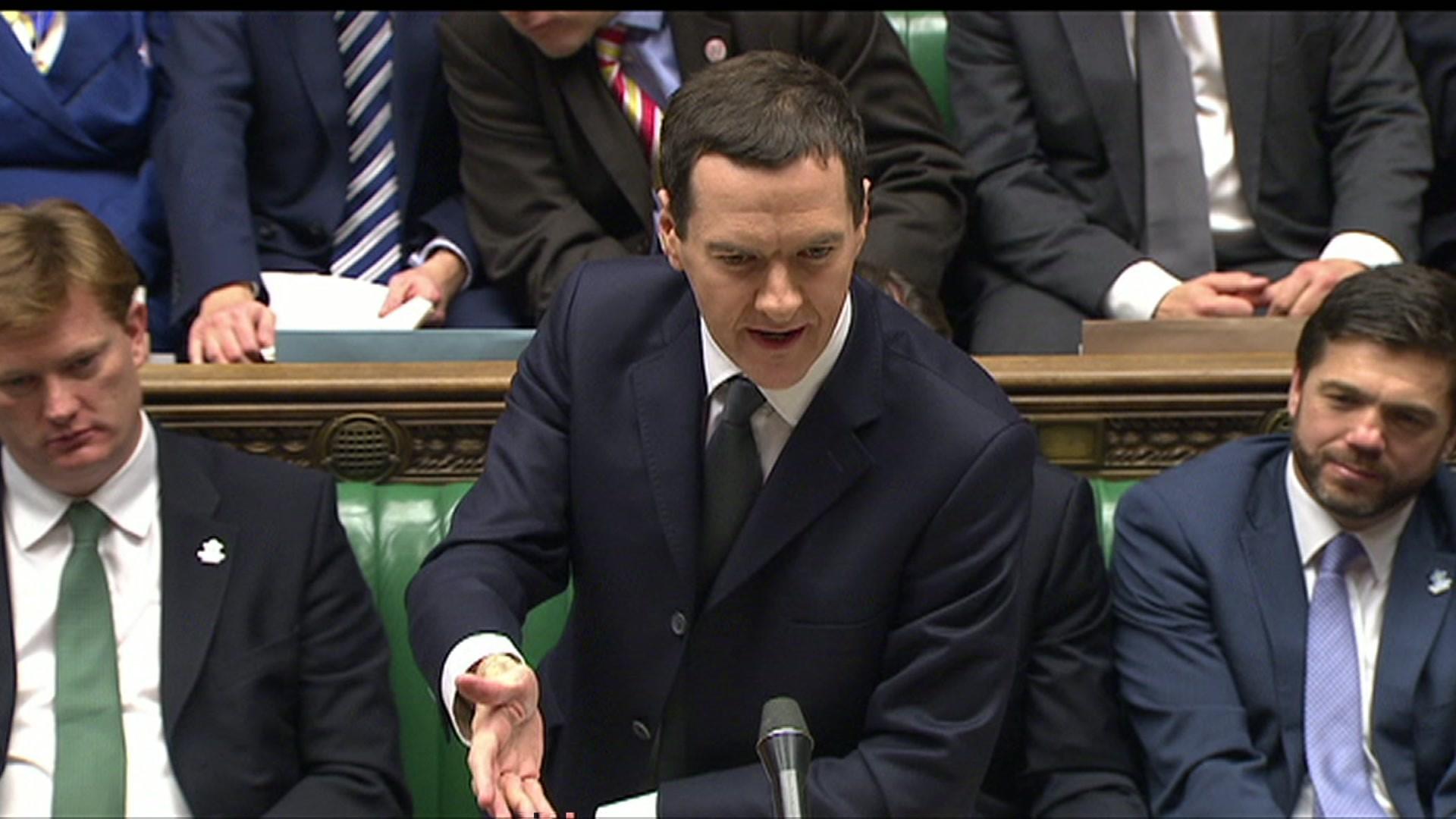

Earlier this month, UK chancellor George Osborne unveiled his own reforms to stamp duty for England and Wales.

Under the new rules, no tax will be paid on the first £125,000 of a property, followed by 2% on the portion up to £250,000, 5% on the portion between £250,000 and £925,000, 10% on the next bit up to £1.5 million and 12% on everything over that.

A Scottish Government spokesman said: "Our plans - which have brought reform to the whole of the UK system - are specifically designed for the Scottish housing market and prices, and will ensure that more than 80% of buyers in Scotland will pay less than they would under the UK government's plans, or will pay no tax at all.

"Our plans will also remove tax from an additional 5,000 house purchases a year compared to the UK system, which will be a particular boost to first-time buyers.

"As we have said before, we are willing to consider alternative rate proposals, but those bringing them forward must be able to demonstrate that they are affordable in light of changes to Scotland's block grant."

- Published9 October 2014

- Published3 December 2014