How do the property tax systems add up?

- Published

The Scottish Finance Secretary John Swinney has revised his planned property tax changes, due to come into effect on 1 April.

His original scheme, announced in October last year, proposed new bands, plus a gradual tax, similar to income tax.

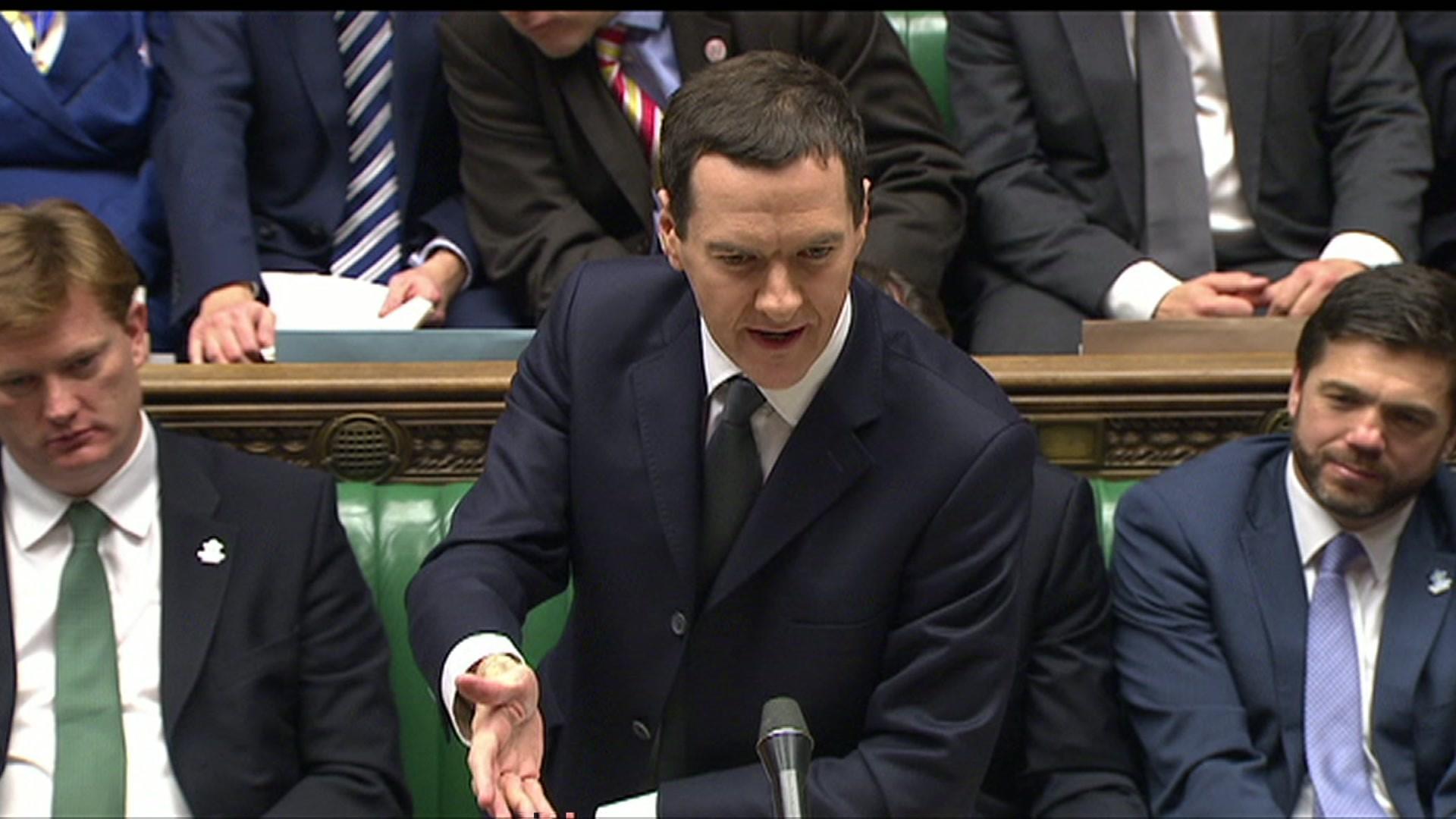

Two months later, UK Chancellor George Osborne adopted the same gradual approach to stamp duty, but with different bands and rates. That move prompted a re-think by Mr Swinney who has now changed his proposal.

Here are some random purchase prices showing the tax under the old stamp duty system; the new UK property tax; the draft Scottish system and the revised Scottish system......

Note: Pictures used are for illustrative purposes

What's the tax for a £135,000 house?

Stamp duty system (now abolished) - £1,300 tax

New system (UK) - £200 tax

Draft Scottish system - No tax to pay

Revised Scottish system - No tax to pay

What's the tax for a £233,000 house?

Stamp duty system (now abolished) - £2,330 tax

New system (UK) - £2,160 tax

Draft Scottish system - £1,960 tax

Revised Scottish system - £1,760 tax

What's the tax for a £325,000 house?

Stamp duty system (now abolished) - £9,750 tax

New system (UK) - £6,250 tax

Draft Scottish system - £9,800 tax

Revised Scottish system - £5,850 tax

What's the tax for a £490,000 house?

Stamp duty system (now abolished) - £14,700 tax

New system (UK) - £14,500 tax

Draft Scottish system - £26,300 tax

Revised Scottish system - £22,350 tax

What's the tax for a £560,000 house?

Stamp duty system (now abolished) - £22,400 tax

New system (UK) - £18,000 tax

Draft Scottish system - £33,300 tax

Revised Scottish system - £29,350 tax

What's the tax for a £1m house?

Stamp duty system (now abolished) - £40,000 tax

New system (UK) - £43,750 tax

Draft Scottish system - £77,300 tax

Revised Scottish system - £78,350 tax

- Published21 January 2015

- Published21 January 2015

- Published3 December 2014