Scotland's poverty adviser calls for tax increases to tackle inequality

- Published

Naomi Eisenstadt said much had been done to cut poverty but the gap between rich and poor has widened

The Scottish government's adviser on poverty said taxes need to rise if the gap between rich and poor is to end.

Naomi Eisenstadt was speaking on the final day of BBC Scotland's week-long Unequal Scotland? series.

She wants inheritance tax to go up, councils given flexibility to raise taxes and increased tax on the wealthy.

In response, the UK government said it had given the "lowest paid a pay rise" and the Scottish government said it was "making taxation fairer".

Ms Eisenstadt has spoken in the past about putting up taxes.

'Eye on the next election'

In January this year she published a report, external which contained 15 recommendations, including calling for an end to Scotland's council tax freeze. That is set to happen in April next year when local authorities will be able to increase tax by up to 3% a year.

In an interview with BBC Scotland's business and economy editor Douglas Fraser, Ms Eisenstadt proposed that higher taxation was the key to producing a more equal society.

She said: "When people say they want a really wonderful NHS they don't say I want to pay more taxes for it. Well, I'm afraid you cannot have a really wonderful NHS unless you are willing to pay more taxes for it."

However, she was not convinced governments would raise taxes to the levels needed. She said: "You [governments] can always go further but you'll always have your eye on the next election and what people can expect."

This Friday at 14:00, BBC Scotland's business and economy editor Douglas Fraser will be hosting a Facebook Live in which he'll be answering your questions on his Unequal Scotland? series. Take part by going to the BBC Scotland News Facebook page, external.

Throughout this week BBC Scotland has been looking at inequality and has examined issues including income, wealth, education and health.

Ms Eisenstadt said much had been done to reduce poverty, particularly among pensioners and families with young children, but inequality had increased.

She added: "What I would say is that inequality is bad for everybody.

"Societies that have much higher levels of inequality have much higher levels of crime, they don't have as good public services. So inequality is not just bad for the bottom, it's bad for the top as well."

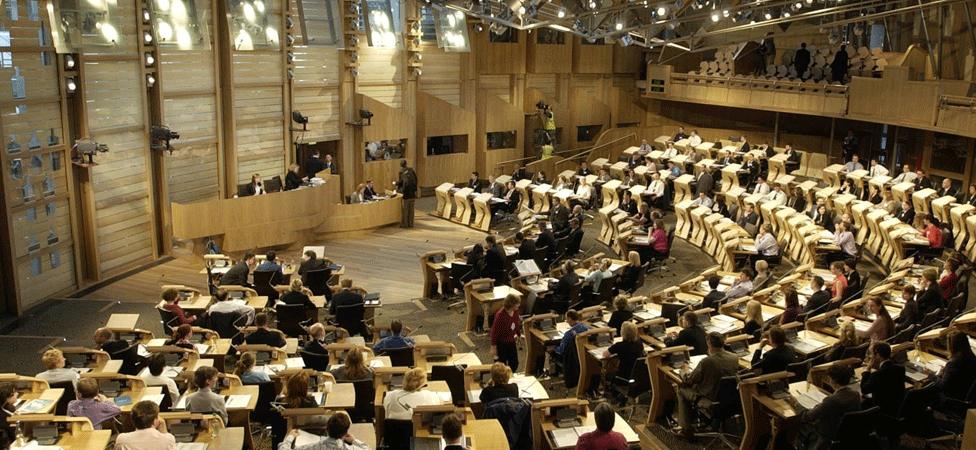

Naomi Eisenstadt believed changing taxes would help end inequality

The Oxford University research fellow has advocated changes to a number of taxes at both Westminster and Holyrood.

They include;

Inheritance tax (rate set by Westminster) - "I do believe in a higher inheritance tax - and I know that's toxic for politicians. But even the idea of taking a very small amount of what would be inherited, say 1-2% - and pool it for elderly social care, you would have a pooled sum that all elderly people would have access to, rather than just rich people relying on it."

VAT (rate set by Westminster) - Ms Eisenstadt wants to see more progressive taxation and one area where she believes there is room for change is on VAT. She said: "One of the things that Scotland doesn't have power over and I am surprised nobody is arguing about is VAT. 20% VAT is very regressive. Because it's a flat tax - and poor people have to buy stuff."

Income tax (more control heading to Holyrood) - "The answers to inequality are about taxing the rich. There are lots of other answers - but that is one of the key issues."

Local taxes (Holyrood and local councils) - "No matter where you are, you blame the next level up. Local government in Scotland is going to blame Edinburgh, Edinburgh is going to blame Westminster. At the end of the day, at every level there is a role to play. And I think giving local authorities greater discretion over taxation would be a good thing."

What are the two governments saying?

Scottish government

A spokesman said: "Our income tax proposals for 2017/18 and beyond will ensure Scotland continues to be an attractive place to live, work and do business. They protect those on low and middle incomes - but generate extra revenue of around £1.2bn in cumulative additional revenues by 2021/22 which we will invest in key public services, by asking higher rate (40p) taxpayers to forego a tax cut.

"Where we have the powers to do so, we are making taxation fairer and more proportionate to the ability to pay, while also raising additional revenue. That is why we are proposing progressive reforms to local taxation which will, over the lifetime of this Parliament, raise an additional £500 million to invest in raising educational attainment.

"Our Fairer Scotland Action Plan includes commitments which will help families to maximise their incomes and a new £29m fund, with £12.5m of European money, will support communities and the third sector in tackling poverty."

The Scottish government added that it would be setting up a Poverty and Inequalities Commission next year to tackling a number of issues including child poverty.

UK government

A spokesman said: "Many people today are just about managing, but would like a little extra help. That is why the UK government is taking action to build a country that works for everyone.

"To help those struggling to manage we've cut income tax so people keep more of the money they earn, given the lowest paid a pay rise through our National Living Wage, increased the State Pension to give people greater security in retirement and are helping parents with childcare.

"The Scottish Parliament is also getting unprecedented new tax and welfare powers which will mean, for the first time, Holyrood will be able to shape the welfare system in Scotland.

"There is still much more to do though, with housing costs too high, too many households stuck on the most expensive energy tariff and not enough parents having access to good-quality childcare. We're going to act in their interests and deliver a better deal for them."