All eyes on the Scottish budget

- Published

Scotland's Finance Secretary Derek Mackay presents his budget to parliament on Thursday

Much delayed - owing to circumstances beyond Holyrood's control - but today sees the beginning of an intense programme of Scottish budgetary scrutiny.

Actually, belay that. Holyrood's committees - rash, impetuous brutes that they are - have already begun the process of examining the underlying state of Scottish public spending, prior to looking at the details when they emerge.

The delay, of course, was occasioned by the fact that the Treasury's Autumn Statement was, itself, somewhat late in the term. Apparently, the slackers justify this by the intervention of an apocalyptic referendum and a change in Prime Minister/Chancellor.

Unaccountably, Scotland's Finance Secretary Derek Mackay was reluctant to guess what Scotland might be allocated in terms of the Westminster block grant. Hence the delay in the Scottish Budget.

But we are there now. We get the Budget details tomorrow and this afternoon, as a toothsome prelude, there is a Holyrood debate on taxation.

Not in generic terms. Not as an exercise in ideological discourse - although there may be a concomitant dose of that too. No, Holyrood now sets Scotland's rates and bands for tax on earned income. This means you. (If, of course, you live and work in Scotland.)

Scottish taxpayers

For many decades, indeed centuries, there has been a debate, illuminating or otherwise, as to what constituted a Scot. Was it origin? Was it sporting affiliation? Was it choice? Now we have another delineation. Scottish - for tax purposes.

There will be some, it is anticipated, who will decline such a status. Scottish government briefings talk coyly of "behavioural effects" from Holyrood tax decisions.

By that, they mean some individuals might choose to become other than Scottish, for tax purposes, if the bill for higher rate taxpayers ends up higher than in England, as is intended by Scottish Ministers.

But before that prospect arises - or doesn't - there is the small matter of getting the SG plans endorsed by parliament. Or, indeed, otherwise.

Ministers are quite determined to get their budget through - and to do so without conceding on the fundamentals of their tax plans. However, the SNP is in a minority at Holyrood and needs another party to back them or abstain. Just one party.

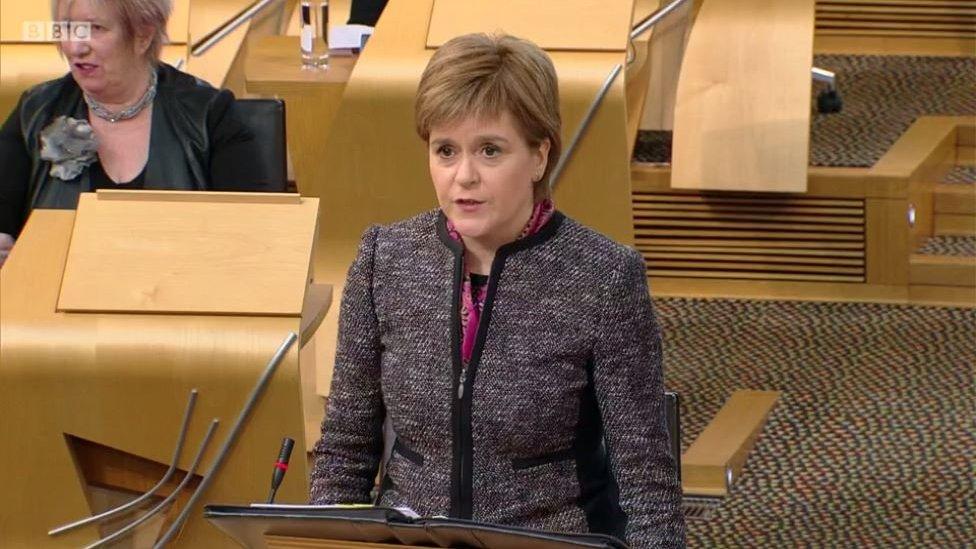

FM Nicola Sturgeon was critical of UK Chancellor George Osborne's tax cut plans

Why the resolute determination to adhere to the tax plans? Because they have been carefully calibrated. Because they formed a defining element in the Holyrood elections. And because the SNP won by far the most seats in that election. Big parties have rights too.

But, mostly, it is that careful calculation. To recap, Derek Mackay intends no change to the basic, higher or additional rates of income tax. But he will not replicate what he regards as an unwarranted cut in the tax bill of higher earners.

The Chancellor has announced that, from 2017, the threshold for the 40p higher rate will be increased to £45,000 - en route to an eventual £50,000 figure.

By contrast, Mr Mackay says that, from 2017, the Scottish threshold for 40p tax should only rise by CPI inflation. After that, the CPI increase will be the maximum. It may be less.

To be clear, you won't pay more tax here in Scotland than you do at the moment. Indeed, your bill may well go down because bands are changing, including a UK-wide increase in the basic starting point for income tax.

But, if you're one of the 356,000 people in Scotland who pay tax at the 40 pence higher rate, then you'll pay around three hundred pounds a year more - than you would in England.

What are the arguments?

That is the basis of the Conservative complaint in the debate they have instigated for this afternoon. They say it is fundamentally wrong that folk in Scotland should pay more than in England. They say, further, that it leaves Scotland potentially uncompetitive: that Scottish employers might have to pay higher salaries to compensate.

Mr Mackay disagrees - vehemently. He says the tax plans have been designed to achieve balance. Indeed, the SNP drew considerable flak from the other side of politics for declining to increase income tax to protect spending.

The Minister argues, further, that the Tories are "showing their true colours". He says that they are inherently opposed to the wielding of devolved tax powers. The Tories dissent.

As I have noted here previously, it will be difficult to secure a budget deal in the current atmosphere at Holyrood - where opposition parties are feeling decidedly oppositional and the governing party is keen to preserve as much of its programme as feasible.

Scotland's 40p tax payers

372,000

Approximate total number

10%

Working population

-

£190m Value of 40p tax cut plan

-

14,000 Workers removed if cut adopted in Scotland

Tories? Think not. This afternoon is designed to highlight their profound opposition to a core element of the budget, tax.

Labour? Ditto. Expect them to demand increased taxation this afternoon, echoing their mantra from the election.

Both the Greens and the Liberal Democrats have proposals on taxation which depart substantially from the SG plans. But it may be - it may be - that they could be attracted by spending offers in line with certain of their core pledges.

However, right now, with the tax debate and the Budget pending, there is no deal. Plenty of talks but little overt movement. That is because the governing and opposition parties know they do not need to move, seriously, until spring next year.

Which leaves the atmosphere a little febrile. There is even talk in SNP circles of identifying the rival party "which fears an early election the most".

There is talk of identifying, precisely, what it would mean if Parliament declines to carry the tax resolution which is scheduled for one week before the Stage Three vote on the Budget Bill, again in the spring.

With the passage of time and the expenditure of effort, I expect there will be a deal - with one or another party agreeing, reluctantly, to abstain in return for a key concession. But, as things stand, the pre-Christmas spirit at Holyrood is less than festive.

- Published8 December 2016

- Published8 December 2016