Scottish government U-turn over council tax schools plan

- Published

The Scottish government plans to give extra money to head teachers to raise attainment

The Scottish government has performed a U-turn over plans to use the council tax to raise money for head teachers.

Instead it plans to use its own resources to give £120m of extra money to schools - £20m more than originally planned.

Councils had been angry at plans to use changes to the bands to create a national fund for education.

The money raised from the changes will stay with councils - although many still expect to make cuts.

The government is committed to giving the extra money to head teachers to spend on schemes to raise attainment.

The money will be targeted at helping children from disadvantaged backgrounds - the more disadvantaged students at a school, the more money they will get.

The original plan was to put the money raised by changes to the bands into a national fund.

Finance Secretary Derek Mackay argued there would be no overall reduction in the amount local authorities were given from the Scottish government, with additional investment in social care.

He told MSPs councils would receive:

£120m from central government to fund shared ambitions to close the attainment gap

Money to maintain councils' share of capital spending with an increase of £150m compared with 2016-17

Further investment in social care

However, councils will be calculating how much money they will have at their own disposal to spend on local services.

For instance, the £120m for schools is going straight to head teachers and is expected to be an additional resource.

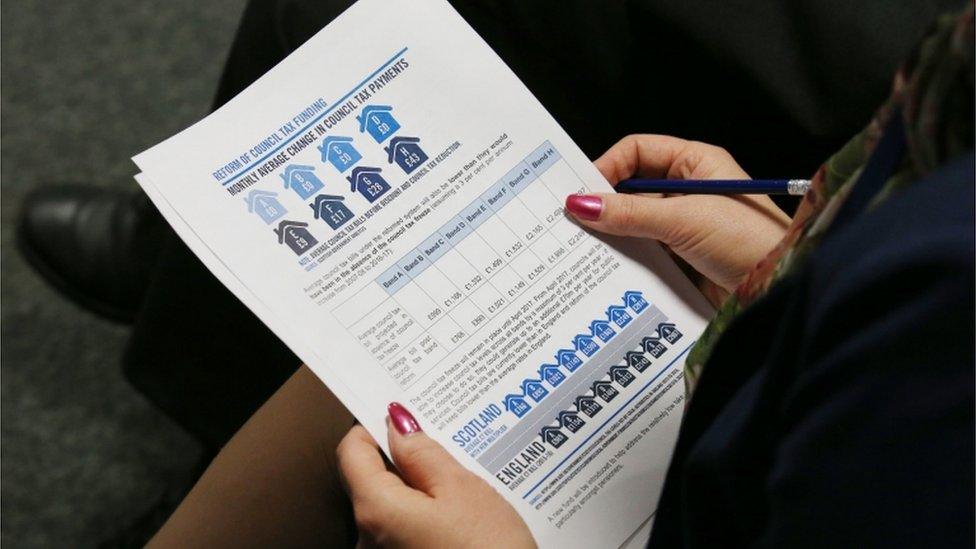

From next April, people in more highly-valued properties - Bands E, F, G and H - will pay more council tax even if their council does not put the charge up for everyone.

'Backdoor tax'

The multiple of the Band D charge that people in the higher-valued properties will pay is being increased.

Some council areas would have received more or less back than the amount raised locally.

Relatively prosperous council areas - with a larger number of high-band properties and relatively few disadvantaged youngsters - would have subsidised areas facing bigger problems.

It had proved controversial. Critics claimed it was undermining the link between the council tax and local services and turning the charge into a "backdoor national education tax".

Each of Scotland's 32 councils should learn by Friday just how much the government proposes to give each of them.

A total of £111m is expected to be raised from the changes to the bands. Councils will also be able to put the council tax up by as much as 3%.

Analysis: Local government funding

Local government is heavily dependent on the Scottish government for cash.

According to a breakdown of the figures, councils will receive less from the government to spend at their own discretion.

The revenue budget given to Scotland's 32 councils by the government will fall from £9,693m this year to £9,496m next year.

This figure includes the £120m which councils will have no choice but to give straight to head teachers.

However, other money could make up for the drop - though critics contend this is not comparing like with like.

£111m from changes to the council tax bands

£70m if all councils put up the council tax by 3%

£107m to ensure people working for the joint boards covering health and social care are paid the living wage

Local government organisation Cosla said the core local government settlement would fall, but recognised the government had improved on its previous offer.

Cosla president David O'Neill said: "Cosla can never endorse a reduction to the core local government settlement as announced as part of the budget statement today.

"It is our understanding that the Scottish government had significant additional cash for 2017-18 and therefore this decision will impact on services delivered by local government.

"We fully recognise that the Scottish government has made efforts to improve the settlement through their offer of a wider package including a major change on the council tax proposals. Cosla had lobbied the Scottish government on their previous proposal and we are pleased that the Scottish government has acknowledged this."

Mr O'Neill said councils would now consider the whole package as part of their budget considerations.

The impact on local budgets of the changes to council tax bands will vary from area to area. The more Band E, F, G and H properties in the area, the more the council will gain revenue.

As a broad rule, this means councils in relatively prosperous areas such as East Renfrewshire could benefit from these changes.

However, schools in less prosperous areas are likely to gain the greatest amount of the government cash for head teachers.

- Published15 December 2016

- Published3 November 2016