Will I pay more council tax?

- Published

Council tax makes up about 15% of the money councils receive for providing local services

Scottish councils will now find it much easier to put up the council tax but do not assume your bill will rise. BBC Scotland local government correspondent Jamie McIvor explains.

The council tax has not gone up in Scotland since 2007.

The council tax freeze was initially an interim measure but became a major Scottish government policy.

In recent years, many councils complained the freeze was adding to the pressure on their finances and leading to more cuts.

Meanwhile a more philosophical point was being debated too - whether councils should have more control over their finances, with a greater suite of financial powers.

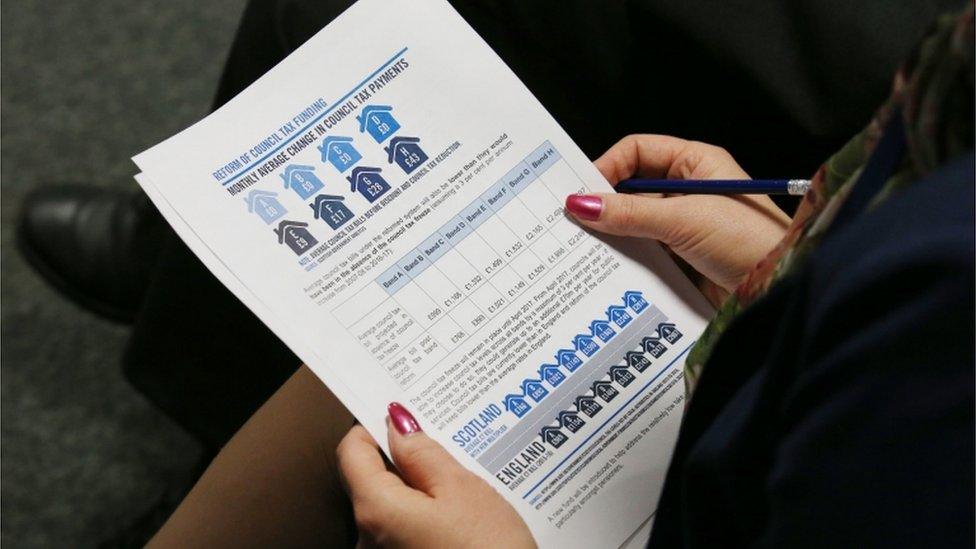

From next April councils will have the power to raise the council tax for everyone by up to 3% again. People in higher band homes - around a quarter of residents - will automatically see their bills rise because of changes to the band system. All Band E, F, G and H bills will rise but what about everyone else's?

Given how some councils have complained about the pressure on their budgets, you might imagine that it would go without saying that all 32 local authorities would put up council tax. Well think again.

So far only two have confirmed their intentions - Borders and South Lanarkshire. And in South Lanarkshire's case, the Labour-run council said they intended to keep the freeze for another year.

All people in the highest bands will pay more council tax from April

A number of factors will come into the equation as councillors work through their options .

For a start the council tax makes up a relatively small proportion of a typical council's finances - around 15%.

In some cases, even putting up the council tax by the full 3% would add a relatively modest amount to a council's budget. In the case of Scottish Borders, the rise will only put around £1.5m extra into the kitty. Nationally, about £70m would be raised if every council opted for a 3% rise.

After a 10 year freeze, only those on the tightest incomes would feel much of an impact from a 3% rise - in the Borders, a Band D bill will rise by barely £3.25 a month. But this rise - plus the changes to the bands - could mean a more significant increase for people in the more highly banded homes.

Yet, most councils are still facing up to cuts and savings. The overall amount of money they will be getting straight from the Scottish government to spend at their discretion is being cut although the government argues there will be more money available for local services overall.

The exact figures vary from area to area but the nightmare scenario for some councils is that they will be asking people to pay more in council tax but still offer them fewer local services. "Pay more, get less" is hardly a vote-winner, weeks before May's council elections.

A council which manages to hold the council tax freeze could present a number of arguments to justify the move:

They could argue that efficiencies and hard choices are getting results.

They might claim they are trying to help family budgets.

Or they could argue that keeping the council tax frozen, could give their area a competitive advantage over other areas. Five years ago Stirling cut council tax marginally in a controversial move - some supporters argued Stirling's council tax was too high compared to other similar local authorities.

But a further freeze is not without its risks too:

It would be hard for a non-SNP council to justify a freeze and still claim it is not receiving enough from the Scottish government.

And even if a rise in the council tax would not end the need for cuts and savings, a council could open itself up to criticism if it were making unpopular local choices and not trying to mitigate them with a council tax rise.

The council tax was a simple to administer replacement for the unpopular poll tax

The council tax was a hybrid of the old domestic rates system and the hugely controversial community charge or poll tax - the system used from 1989 until 1993.

Supporters of the poll tax or community charge argued that the flat rate charge made it easier for voters to weigh up how efficient their council was.

That principal of simple accountability was carried over into the council tax in a more subtle form - a bill payer can easily look at their bill and compare the local charge in their band to the fee levied by other councils. From that they may wish to conclude that their council was more or less efficiently run than another.

At a guess, the likelihood is only a minority of councils will freeze the council tax again - while some may opt for a rise of less than 3%.

But the fact that these options are even a realistic possibility for debate in some areas is hugely significant and will colour the debate on local services ahead of the council elections.

The power to put up council tax is one thing. Using that power is quite another.