What are Scotland's income tax options?

- Published

Derek Mackay and Nicola Sturgeon set out the discussion paper

Nicola Sturgeon has set out a discussion paper on income tax as her government prepares for budget talks with opposition parties. What are the options on the table, and where might we end up?

The Scottish government paper, external examines the positions of each political party, before setting out a series of potential "alternative approaches" which might well resemble the final deal.

It's complex stuff, but this is not just a chin-stroking exercise - it could potentially affect the pay that every Scot takes home in their pocket every month.

The four tests

How should we weigh up the plans?

Before we dive into the nitty-gritty of the proposals themselves, how do we know the good ones from the bad? How are they to be judged?

Well, Ms Sturgeon has set out four tests by which her government will be evaluating the proposals. Whatever the final deal is, it's going to have to adhere quite closely to the following points:

tax policy should help maintain and protect the level of public services - so no cuts

the lowest earners should not see their taxes increase - so no blanket rises

tax changes should make the system "more progressive" and reduce inequality - so middle and higher earners will shoulder more of the burden

changes should support the economy - so don't whack rates up so high as to ruin businesses

These priorities are not universally accepted by all parties, of course - the Conservatives in particular have some rather different ideas about taxation - but Ms Sturgeon has been clear that they must form the foundation of any deal her administration does.

Current position

One more prelude to the proposals - what is the current position?

In a way, this is option one - to do nothing at all. Some might like that to be the approach, but it's already fairly clear that it's not one the government are seriously considering, thanks to the four tests up there.

Scotland currently has a mild variance from the tax position in the rest of the UK, via the thresholds at which rates kick in. In last year's budget the point at which the higher rate kicks in was frozen in Scotland, whereas it rose UK-wide.

The no-change scenario isn't completely changeless; it includes an assumed increase in the brackets in line with inflation and the personal allowance.

If this stands, then in 2018-19 the vast majority of Scots will remain in the 20p standard bracket - more than 2m people who earn up to £44,290.

Earnings above that, and up to £150,000, would be taxed at the higher rate of 40p in the pound, and those above £150,000 at the additional rate of 45p.

Party proposals

The SNP's minority government will need backing for its budget from at least one opposition party

Each of Holyrood's parties were invited to submit tax proposals for analysis in the paper - although only the Greens and Lib Dems actually sent in detailed figures.

Helpfully though, there have been quite a few elections in the last few years, each of which featured party manifestos resplendent with tax proposals.

The SNP's most recent proposals were to more or less keep things the same, but to raise the higher rate threshold by a maximum of inflation until 2021-22. They have toyed with the idea of a 50p top rate, but have only firmly supported this UK-wide.

The Tories have also largely proposed keeping things the same, but would raise that 40p threshold to match the rest of the UK.

Labour, meanwhile, have suggested an extra penny on the basic and higher rates, with a 50p top rate - going slightly further than the Lib Dem proposal, which would add a penny to all bands.

The Greens have been the only party to propose a more radical redesign, seeking a four-band system with cuts for lower earners and a big jump in the additional rate to 60p.

We could go into more detail here, but there might not be much point - the paper acknowledges that each party has some "interesting" ideas, but none of them fully satisfies the "four tests" set out above. In fact, only the Greens come close.

Ms Sturgeon was also very clear that parties must be willing to compromise, and can't stick "rigidly" to their current position. At FMQs, she said that if everyone doggedly maintains their manifesto positions, there will be no deal and no budget.

Her message is that if the SNP is to abandon the position it set out in what proved the most popular manifesto at the 2016 election, then others will have to move too.

Alternative proposals

If none of the party proposals completely fit the bill, what might we end up with?

The paper sketches out "alternative approaches", with options featuring three, four, five or even six tax bands.

Let's look at them in detail...

Option one: a three-band approach, with the basic rate untouched, and the higher and additional rates knocked up by a penny.

This would raise between £80m and £90m, with potential behavioural changes factored in (i.e. people cutting the number of hours they work, or at the more extreme end of the scale just leaving the country altogether).

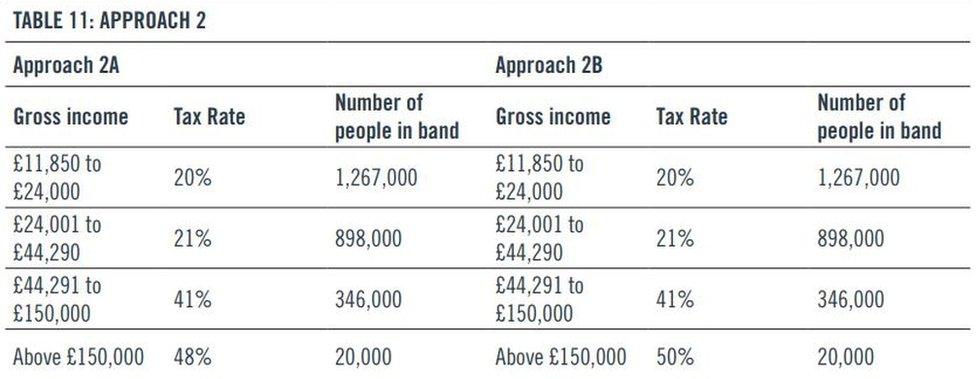

Just in case you thought you had a handle on this from a complexity perspective, option two is divided in two.

This plan adds an extra band, by effectively splitting the lower end of the spectrum in two. Earnings below the £24k median salary would stay in a 20p band, but there would be a extra 21p band for those earning between the median and the higher rate.

So instead of 2.1m people on the basic rate, there would be 1.2m on a 20p rate and 900,000 on a 21p rate.

Option two also adds a penny to the higher rate, and - here's where it diverges into 2A and 2B - either 3p or 5p to the additional rate.

This is where behavioural change really comes into play. The government reckon that option 2A could potentially raise more money than 2B - despite featuring a lower top rate of tax.

The forecast for 2A is between £210m and £250m, adjusted for behaviour, while 2B is £190m and £270m. So there are higher potential returns for the higher-tax option - but equally it could end up bringing in less money if it pushes higher earners either into cutting their hours or moving house.

This underlines that it's not as simple as just putting taxes up to raise more money - there can be knock-on effects which could actually have the opposite effect.

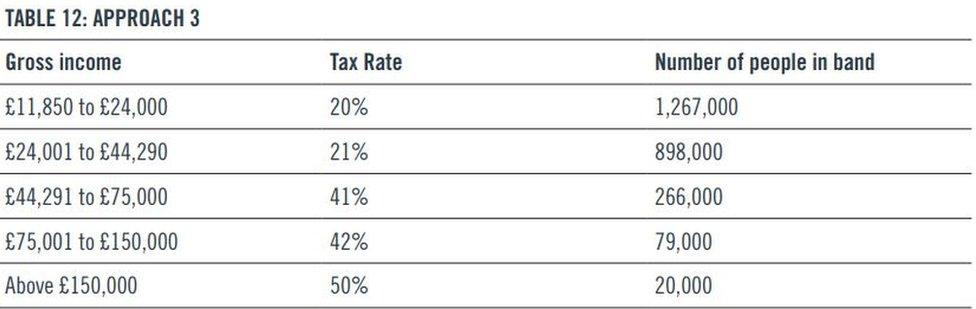

Option two introduced the idea of splitting the basic rate band in two. Option three carries this further by doing the same for the higher rate band.

This would see five different rates, of 20%, 21%, 41%, 42% and 50% - so basically, chipping off an extra penny in the pound at various increments.

By again leaving the basic rate untouched for those earning below the median wage - as all the proposals do - this would see about half of taxpayers pay no extra than under the current system.

The government reckons this plan would raise between £220m and £290m, again adjusted for potential behavioural change.

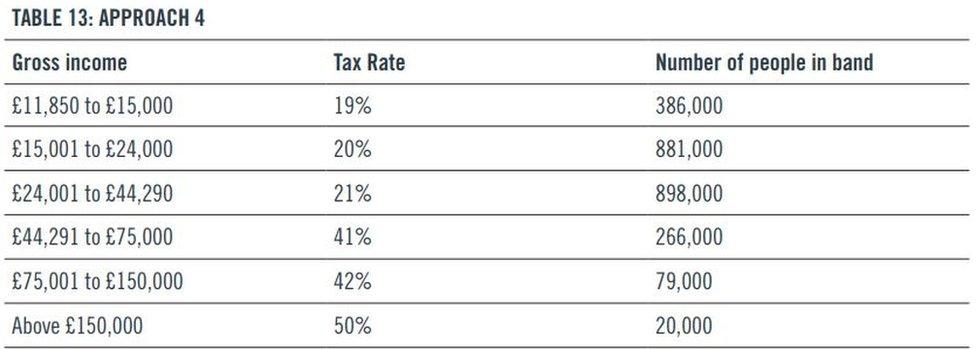

Here's the big one: option four, with six different bands.

Yes, that's double what we have right now, and Tory leader Ruth Davidson has already warned of "unintended consequences" of such complexity. But it's by no means unprecedented; Japan and the USA have seven bands. Ms Sturgeon argues that there is some evidence that more bands means more progressive.

This is option three - dividing the standard and higher rate cohorts in two, with 1p increments - with the addition of a new lower rate in the form of a 19p band for those at the lower end of the earnings scale.

This is not in fact a negligible group; some 386,000 taxpayers are on a gross income which is more than the tax-free allowance, but below £15,000 - so quite a few people would end up taking home more money at the end of the month.

This means this model might not raise quite as much money as options two and three - between £150m and £220m, adjusted for behavioural change - but it does tick that "more progressive" box in Ms Sturgeon's four tests.

However, this comes at the cost of added complexity - lowering taxes for those on low incomes could cause complications with social security payments, for those who receive them.

What's actually going to happen?

We will find out which plan has won out when Derek Mackay presents his draft budget next month

After all that, the big question everyone will be asking remains - what's going to happen to my pay packet?

This hinges on how the budget talks pan out, but the direction of travel very much seems to be towards rises for higher earners. This paper and the four tests in particular provide a hint of where we might end up.

The existing ideas put forward by Labour and the Lib Dems are out, straight away, because they involve a blanket increase which would see lower earners pay more. The Conservative proposals are also out, as they wouldn't raise extra funds.

The Green ideas are closer to the ballpark drawn out by Ms Sturgeon, but they also go very hard after the highest earners - their existing proposals might not quite fit the bill, but they are by far the most likely partners for the SNP as things stand.

Of the alternative options laid out, the six-band behemoth might be considered too complicated, given the complexity and potential impacts on social security payments, while the three-band limited proposal might not go far enough. Something along the lines of options two and three, with four or five bands, is probably the most likely.

One thing seems pretty sure from all of this - if you earn more than £24,000, your taxes are likely to be going up. We just have to wait for the draft budget in December to find out how, and by how much.

- Published2 November 2017