Scottish budget: What's going to happen?

- Published

Derek Mackay will set out his draft budget on Wednesday afternoon

Scottish Finance Secretary Derek Mackay is to set out his plans for tax and spending for the year ahead at Holyrood. What are the big issues going to be, and will he get the budget through parliament?

Income tax

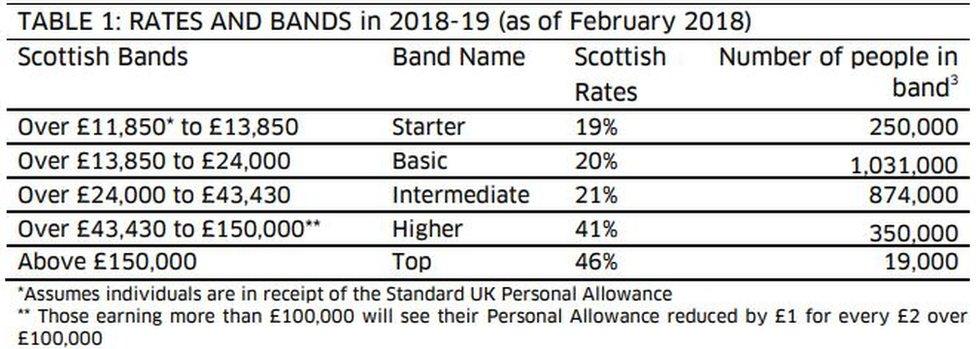

This was really the big issue of last year's budget, when a new five-band income tax regime was set up. But prepare to hear more about it.

The new system saw some low earners pay less tax, via a 19% "starter" rate, while higher earners were taxed a bit more, courtesy of a 21% intermediate rate and an extra penny on the higher and top tax rates.

It's not just the rates themselves that are different in Scotland, though - it's the thresholds where they kick in too. And that's where there's likely to be change this year.

Here's the Scottish government's estimate, external of how many people paid tax in each of the bands last year.

So, what's going to happen this year?

Well, to start with, in his UK Budget in October, the chancellor announced that the tax-free allowance (and thus the point at which people start paying income tax) was rising to £12,500. That applies in Scotland, too.

What doesn't apply though was his move to raise the higher-rate threshold (HRT) to £50,000. And Mr Mackay has previously indicated that he has no intention of passing on such a tax break for higher earners.

The Fraser of Allander Institute has modelled a number of potential approaches, external, and suggest that matching the UK HRT would cost about £280m, while freezing it in place would raise an extra £60m for spending - with that money coming out of the pay cheques of higher earners.

At present, it seems like Mr Mackay will raise the thresholds by the current rate of inflation, at the most. It's a sort of "steady as she goes" approach when you look just at the Scottish budget, but in the wider context it does mean the gap between the regimes north and south of the border is growing.

This means the government in Edinburgh brings in more money to be spent on public services, but it also means those earning more money are stumping up more than they would if they lived in England or Wales.

The Fraser of Allander Institute calculates that raising the Scottish higher rate threshold by the rate of inflation only will see people earning £50,000 in Scotland pay £1,350 more than they would if they lived south of the border.

And that's just income tax - there are also National Insurance Contributions (NICs) to think of, which drop from 12% to 2% at the UK higher rate threshold. That means any earnings that fall into the gap in between the Scottish and rUK HRTs have an overall (or marginal) tax rate of 53%.

Spending

Health spending is likely to be a key feature of the announcement and subsequent debate

That's how the money is raised - how is it going to be spent?

Health is likely to feature in Mr Mackay's speech in a big way, with the government keen to underline its commitment to funding the NHS. Expect a row over the amount of money being passed on in "Barnett consequentials" from Westminster as a result of spending south of the border.

Education will also get a look in, oft quoted as it is as the government's "top priority". Will there be extra money going direct to schools, like the Pupil Equity Fund?

Support for business will feature - but how? The government's latest economic plan in October put emphasis on technology, manufacturing and attracting inward investment, which is a pretty good clue. Mr Mackay's comments ahead of the big day also point towards backing for long-term infrastructure projects.

Also expect to see some talk about business rates, especially around protecting small and medium-sized enterprises (SMEs) from overly heavy tax burdens.

Local government has been crying out for some extra funding - the government insists it has been fair to councils in previous years, but umbrella body Cosla says councillors have "no options left" for savings and need some extra cash.

To ease this, there might be some movement towards a tourist tax - a local levy on hotels and overnight accommodation in tourist-heavy areas to help pay for local services. The government has thus far been edgy about whether this could hurt businesses and visitor numbers, but haven't ruled anything out.

One thing that we probably won't be hearing much about is Air Departure Tax, which the government wants to chop in half and eventually scrap. The process of devolving the levy is bogged down in state-aid rules around an exemption for remote airports in the highlands and islands - which might ultimately help Mr Mackay out, as it will save him some cash and make a deal with the likes of the Greens a little easier.

Fiscal forecasting

One other thing to look out for on budget day is the latest figures from the Scottish Fiscal Commission, external (SFC), Scotland's own financial forecaster.

The SFC will come up with projections for how much cash will be coming in over the next few years from all devolved taxes - so the likes of landfill tax and land and buildings transaction tax (LBTT) as well as income tax.

And here's the rub - previous fiscal forecasts turned out to be somewhat wide of the mark, when the actual totals were totted up.

The "outturn data" for 2016-17 showed that there were actually fewer higher and additional rate taxpayers in Scotland than had been assumed, and the overall tax take came in £550m short.

This doesn't have an immediate knock-on effect on the cash the government has to spend, thanks to various adjustments, but it will ensure extra scrutiny and potentially controversy around these figures this time round.

Will it get through parliament?

Will the budget get through a vote of MSPs?

And, finally, to the politics. As Theresa May would tell you, it's all very well coming up with a deal - you have to get it through parliament too.

The SNP is a minority administration, so Mr Mackay needs some help to get his plans through the final vote, which should take place next February.

The Greens have been his partners for the last two years, but they are making threatening noises this year by saying they won't even enter formal negotiations until they see movement towards major reform of local government funding.

The Lib Dems, who are normally at least in the conversation, have pulled out of talks altogether after their demand that the SNP step away from any plans for a new independence referendum. For similar constitutional reasons, a deal with Labour or the Conservatives looks vanishingly unlikely.

This leaves the Greens in a strong position to make demands - and they have set their sights on scrapping the council tax in favour of "a fairer system that protects services and cuts inequality".

What can Mr Mackay do to provide the "meaningful progress" on this front that Patrick Harvie is looking for? Will the tourist tax be enough, or is he going to have to move further?

Expect the real horse-trading to begin in earnest between this announcement and the first votes on the budget bill in the new year.

- Published12 December 2018