Scottish budget plans passed by Holyrood

- Published

- comments

Derek Mackay and Nicola Sturgeon struck a deal with the Scottish Greens to ensure their budget will pass

The Scottish government's budget plans for the coming year have been formally approved by the Scottish Parliament.

The budget will widen the gap between how much income tax higher earners in Scotland pay compared to the rest of the UK.

But it will also provide extra funding for education, the health service and infrastructure.

MSPs voted by 66 to 58 to approve the plans, after the SNP government struck a deal with the Scottish Greens.

As part of the agreement, councils could be given new powers to introduce taxes on workplace car parking spaces and tourism - with the government also agreeing to increase core local government funding by £90m and to hold cross-party talks on replacing the council tax.

Local authorities will also be able to increase council tax by up to 4.79% rather than 3%, with the government also committing in principle to introducing a charge on disposable drinks cups - a so-called "latte levy".

The Scottish Conservatives are strongly opposed to the workplace parking tax, which the party has claimed will hit low-paid workers hardest.

And Scottish Labour has insisted that councils were still facing a real-terms cut in core funding, which will lead to cuts to local services.

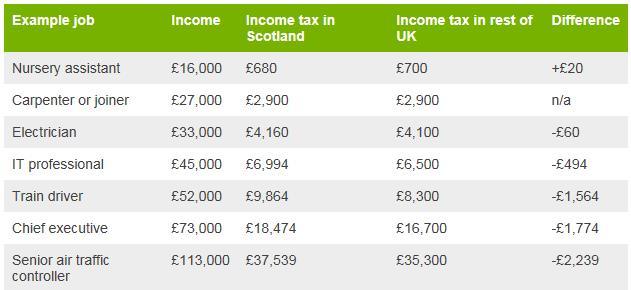

How much income tax will you pay?

Source: Fraser of Allander Institute

When he first unveiled his budget proposals, Finance Secretary Derek Mackay confirmed he would not pass on a tax break for higher earners that was announced by UK Chancellor Philip Hammond in October.

Mr Mackay has done this by freezing the higher rate threshold at £43,430 in Scotland - while it will go up to £50,000 in the rest of the UK from April.

It means people earning £40,000 in Scotland will be £130 a year worse off than their equivalents elsewhere in the UK, increasing to a gap of nearly £500 a year for those on £45,000.

The proposals also mean that everyone earning under £27,000 in Scotland - about 55% of taxpayers - will pay less income tax than those on the same salary elsewhere in the UK.

But they will only be a maximum of just over £20 a year better off, according to economists at the Fraser of Allander Institute.

Mr Mackay has also said everyone earning under about £124,000 in Scotland will pay less tax than they did last year.

What else is in the budget?

Among Mr Mackay's key pledges in his £34bn budget are:

A real-terms increase in the education budget, including £180m to close the attainment gap

An extra £730m for health and care services

£5bn of infrastructure investment over the coming year, including £1.7bn for transport

Finance Secretary Derek Mackay has warned that a no-deal Brexit could force him to change his budget plans

What does Mr Mackay say about his budget?

The finance secretary said his budget "prepares our economy for the opportunity of the future, enables the transformation of essential public services, and builds a more inclusive and just society".

He has also insisted that "now is not the time to cut tax for the highest earners at the expense of our public services" - arguing that not passing on the tax break given to higher earners elsewhere in the UK will raise an additional £68m for Scottish public services.

But he has warned that he may have to change his budget plans if the UK leaves the EU on 29 March without a deal.

Ahead of the budget vote, the Scottish government repeated its warnings about the potential impact of a no-deal Brexit on Scotland, which it has claimed could push the country's economy into recession.

In an analysis paper, external, it suggests Scotland's Gross Domestic Product (GDP) could fall by up to 7%. Trade with the EU could also be "significantly impaired", with a forecast for a potential drop in Scottish exports of between 10% and 20%.

Mr Mackay has previously said he may have to introduce new budget measures if the UK leaves the EU on 29 March without a deal in place.

The UK government has argued that the best way to avoid no-deal is for MPs to back the prime minister's proposed deal with the EU - which the SNP has voted against.

What about the opposition parties?

The budget passed with the support of the Scottish Greens for the third year in a row.

The party says its agreement with the government "provides councils with longer-term stability through multi-year funding deals, greater autonomy with plans to devolve powers over local taxes, and a commitment to work on a replacement for the outdated and unfair council tax".

Co-convener Patrick Harvie said the budget was "not perfect", but had been improved by the deal with his party, and criticised other parties for not engaging constructively in talks.

However, the Scottish Conservatives have described the budget as a "triple tax bombshell" which will do nothing for the competitiveness of the Scottish economy.

Finance spokesman Murdo Fraser said it was an "omnishambles budget" which would see people pay more for fewer services.

The Tories have also accused Mr Mackay of breaking promises to voters not to bring in a tourist tax or raise council taxes by more than 3%.

Labour's James Kelly said the SNP was "kidding itself on" if it thought there wouldn't be cuts to council services, saying: "The reality of this budget it that you've got cuts, cuts and cuts all over the country."

And Scottish Lib Dem leader Willie Rennie said the Greens had been "bought very cheaply", and said his party could not back a budget which the government was using as a "stepping stone" to independence.