Coronavirus: Alistair Darling warns economic impact 'far worse than banking crisis'

- Published

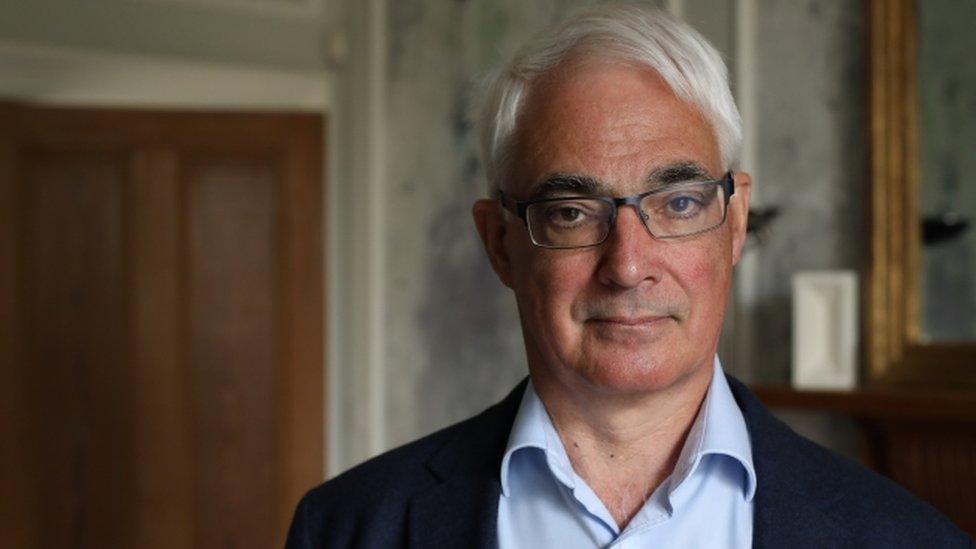

Mr Darling was chancellor during the 2008 financial crisis

The economic impact of the coronavirus pandemic will be "far, far worse" than the banking crisis in 2008, a former chancellor has warned.

Alistair Darling said the country was already in a "very deep recession".

He predicted that unemployment would start to rise in August despite the UK government's furlough scheme.

And he said the government had to start planning now to prevent people being "simply dumped on the dole" when furlough ends.

Mr Darling was Chancellor of the Exchequer in Gordon Brown's Labour government during the 2008 financial meltdown, which was widely seen as being the world's worst financial crisis since the Great Depression in the 1930s.

He was involved in bailing out some of the UK's major banks by taking multi-billion-pound stakes in them. But without access to state support, many companies folded.

Mr Darling told BBC Radio Scotland's Good Morning Scotland programme that the collapse in 2008 had been caused by a "fracture to the banking system that could be fixed, albeit at huge cost and political controversy at the time".

The former chancellor said the current crisis would be considerably worse because it would be some time yet before the virus was brought under control and the economy could begin to recover.

And he said there was "no doubt" that the country was facing a very deep recession that would take some time to come out of.

Furlough scheme

Mr Darling said the furlough scheme - which has been extended until October by current Chancellor Rishi Sunak - had been excellent for keeping people in work so far.

But he warned: "What will happen in August, when the government moves to a situation where employers begin to share the cost, is you will find that employers will say 'is this job really going to be around'?

"That is when when you will start to see unemployment rise, which is why I think the government needs to plan for that now.

"We can't go back to what it was like in the 1980s when people were simply dumped on the dole - the government has got a role to play here."

Mr Sunak has extended the furlough scheme for a further four months

Mr Darling said the UK had managed to deal with levels of debt after the Second World War and could do so again.

He added: "We are a big economy, we have got our own central bank, so I think the government should concentrate on making sure that the economy is intact so that when we get the recovery, we can start to grow."

Mr Sunak said on Wednesday that it was "very likely" the UK was in a "significant recession", as figures showed the economy contracted at its fastest pace since the financial crisis in the first three months of the year.

Economists expect an even bigger slump in the current quarter, which has seen the full economic impact of the lockdown.

Austerity measures

Mr Darling praised Mr Sunak for focusing on keeping as many people in work as possible - but warned against a return to austerity measures as a way of dealing with the current economic crisis.

He said: "One thing big governments - which is what we've got because we are a big economy - can do is spread the risk over generations so you don't end up clobbering people unnecessarily.

"If you start imposing tax rises now and cuts you will suppress the economy even more, which is the very last thing you want at the moment."

Andrew Wilson, an economist and former SNP MSP, had earlier told the Good Morning Scotland programme that the UK and Scottish governments should discuss the idea of changing the devolution settlement to allow the Scottish government to issue its own bonds as a way of helping to fund universities and other devolved areas.

Mr Wilson, the author of the SNP's Growth Commission report on the finances of a future independent Scotland, said there was "no reason" why this could not happen.

Mr Darling, who led the Better Together campaign ahead of the 2014 independence referendum, said he had no problem with this in principle.

But he said the reality was that the UK would be able to secure better rates for its bonds than Scotland could, because it has its own central bank which can keep interest rates low and therefore cut the borrowing cost.

He added: "I am practical about this. I want to make sure that wherever you are in the UK, we can benefit from those low cost borrowing bonds.

"And that is what you can do if you are part of a large economy. It has got its own central bank and we've got a record where people can have absolute confidence that if they lend us money, they will get it back."