UK minister warns of risk over high Scottish taxes

- Published

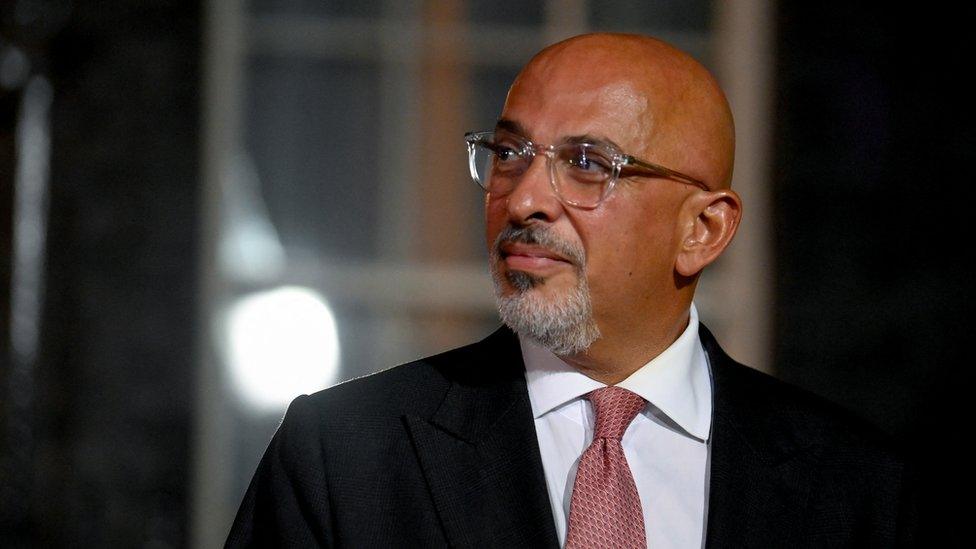

Mr Zahawi was speaking ahead of the first meeting of the new Islands Forum on Orkney on Wednesday

Scotland could risk losing highly paid jobs if its tax rates are higher than other parts of the country, a senior UK government minister has warned.

Nadhim Zahawi said the Scottish government should be encouraging businesses to invest in the country.

And he said no one should want to see a "flight of talent" from Scotland because of higher taxes.

The UK government announced last week that it would be cutting income tax rates for higher earners.

The changes do not apply in Scotland, where income tax rates and bands are decided by the Scottish government.

It has not yet said what it will do when it sets out its own budget plans later in the year.

But First Minister Nicola Sturgeon has described the tax cuts elsewhere in the UK as "morally abhorrent" and said it would be a "serious error" to do the same in Scotland.

There have been suggestions that taxing high earners more in Scotland could potentially lead to the country raising less money than it would otherwise do.

This is because it may become harder to attract highly-paid people to move to Scotland, and because it could lead to "tax flight" - where the highest earners either physically move out of Scotland or find ways of being taxed under the English system rather than the Scottish one.

Mr Zahawi, the Chancellor of the Duchy of Lancaster, told BBC Scotland that he believed the Scottish government should focus on maximising how much it raises in tax rather than on the rates of tax that people pay.

He stressed that it was a decision for the Scottish government to take, but said nobody wanted to see a "flight of talent" from Scotland and that the government should be encouraging businesses to invest in the country.

He added: "There are 2.3 million people who work across the United Kingdom in financial services and it's not all about London and the City of London - that only has about 175,000 people.

"If those people come to Scotland because they are able to work in the financial services sector their bonuses are taxed at 50%.

"That means we could spend on police officers and nurses and doctors and teachers for the education system and dealing with the scourge of the drugs epidemic in Scotland.

"That happens by investing and investment can only happen if you grow the economy, which is why we need the growth plan."

Mr Zahawi briefly served as Chancellor of the Exchequer before being replaced by Kwasi Kwarteng when Liz Truss became prime minister earlier this month.

The chancellor and prime minister have suggested that they want to cut more taxes in the future

Mr Kwarteng announced in last week's mini-budget that the basic rate of income tax will be cut from 20% to 19% from April of next year.

He also pledged to abolish the 45% additional rate of tax, which is paid by people who earn more than £150,000 a year - a tax saving of nearly £3,000 a year for somebody with an annual income of £200,000.

It means the 40% higher rate, for earnings of over £50,270, will be the top rate elsewhere in the UK.

But in Scotland everyone earning between £43,663 and £150,000 currently pays 41%, external, with those earning more than £150,000 paying 46%.

House buying changes

Changes to stamp duty in England also mean that people buying properties worth up to £250,000 will no longer need to pay stamp duty.

House buyers in Scotland currently have to pay the Scottish equivalent of stamp duty - Land and Buildings Transactions Tax - on properties worth over £140,000.

However, Scottish businesses will benefit from the scrapping of a planned rise in corporation tax from 19% to 25%.

And a 1.25% rise in National Insurance will also be reversed across the UK from 6 November - which the UK government said would save 2.3 million Scottish workers an average of £285 a year.

The UK government has also said it will work with the Scottish government to set up Investment Zones in Scotland, which will offer tax cuts for businesses and more relaxed planning rules to release more land for housing and commercial development.

The chancellor has said he wants to kickstart a "new era" for the UK economy that would be focused on growth, and that there are more tax cuts to come.

Nicola Sturgeon has said it would be a mistake for Scotland to follow all of the tax cuts announced for elsewhere in the UK

Speaking on Monday, Ms Sturgeon predicted that the strategy would not work, and would instead do "deep and very serious" damage to the economy and living standards.

She added: "It would be a serious error for the Scottish government to replicate in every sense that strategic economic mistake that the chancellor made, but we will take decisions that are right for Scotland.

"We live in a situation right now where growing numbers can't afford to heat their homes, can't afford to feed their children, are going without basic essentials.

"I don't think many people would think this is the right time to give massive tax cuts to a tiny number of already rich people."