Scot accused of £1m US fraud to pay £171

- Published

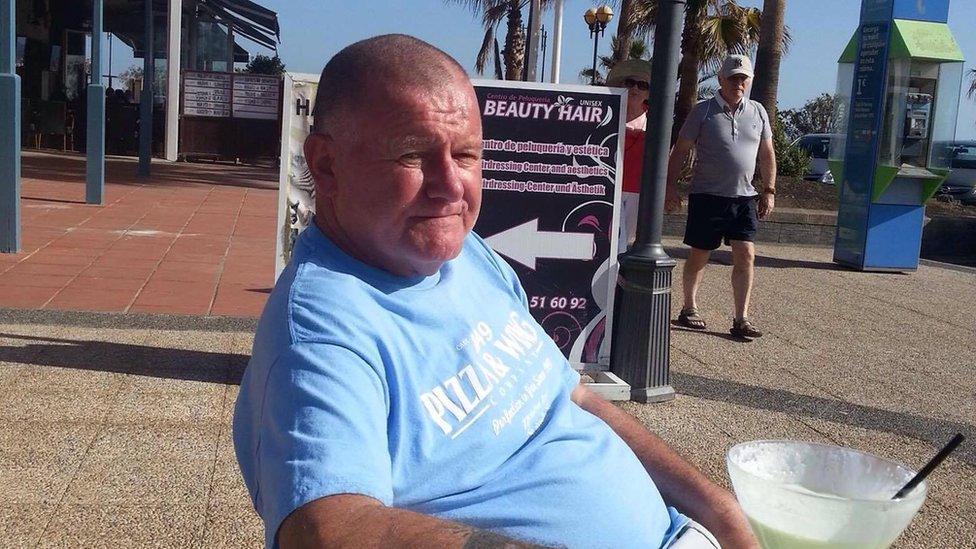

James Craig, of Dunragit, is facing extradition to the US

A Scottish trader accused of a £1m American stock market fraud has agreed to pay £171 to the US authorities.

BBC Scotland has learned that the civil case against James Craig, of Dunragit near Stranraer, has been settled.

Court documents reveal that Mr Craig has agreed to pay $217 to the Securities and Exchange Commission (SEC).

But the 65-year-old is still facing extradition to the US to answer criminal charges.

He is accused of using Twitter to publish false news designed to make share prices fall so he could buy and resell shares for profit.

Federal prosecutors claim his alleged actions in January 2013 caused shareholder losses of more than $1.6m.

The SEC said Mr Craig's first false tweets caused one company's share price to fall 28% before Nasdaq temporarily halted trading.

The following day, false tweets about a different firm caused a 16% decline in its share price, it alleged.

In the final judgement on the matter issued by a court in San Francisco, Mr Craig does not admit or deny the allegations.

It says he will pay $97 (about £76) "representing profits gained as a result of the conduct alleged in the complaint" to the SEC.

He will also pay $120 (£95) in interest.

Mr Craig has been ordered to pay £171 to the US authorities

Last year Mr Craig successfully challenged a decision by the UK government to delay the introduction of a possible defence to his extradition to the US.

The so-called "forum bar" can prevent extradition in cases where the alleged criminal conduct takes place in the UK and extradition is not in the interests of justice.

It was introduced by then-Home Secretary Theresa May following the Gary McKinnon case and tested in the high-profile Lauri Love case.

At the Court of Session a judge ruled that the government acted "unlawfully", external in failing to introduce the safeguard into Scots law.

A Scottish judge is expected to rule on Mr Craig's extradition later this year.

- Published9 November 2015