Principality Building Society unveils record profits

- Published

As more customers switch online, saver Mel Powell says he still likes the personal touch of his branch in Blackwood

The Principality Building Society has unveiled record pre-tax profits of £53.5m.

The society said it had helped 2,300 first-time buyers in 2014, up by 500 on the previous year.

The Cardiff-based Principality is the largest in Wales and the sixth biggest UK-wide, with 53 branches and 18 agencies.

Last summer it sold its estate agency Peter Alan to the owners of the Allen and Harris chain for £16.5m.

The profits are a jump on the £28.2m last year but include £10.1m one-off credit for a pension adjustment for inflation. They do not include the profits from the Peter Alan sale.

"The last 12 months has been a story of strong growth for the society," said group chief executive Graeme Yorston.

He said they recognised the plight of savers in an environment of continuing low interest rates and had implemented a number of initiatives to help.

Mr Yorston added: "Competition in the mortgage market has meant that interest rates for borrowers have been forced downwards and as a direct result of this savings rates have also been reducing.

Chief executive Graeme Yorston tells Brian Meechan of the road ahead in 2015

"Lenders, including Principality, have had to remain competitive and ensure that their businesses remain profitable."

THE HIGHLIGHTS

£218m growth in Welsh savings balances in 2014

Assets have risen to £7.3bn (from £7.1bn)

Net retail mortgage balances have risen to £4.8bn (up from £4.5bn)

Nemo Finance profits are down to £13.9m (from £16.4m) with secured loan market facing increased competition and a downward pressure on pricing

Principality Commercial has returned to profit

"Unfortunately for savers I don't think that savings rates will grow as fast as they might hope" - Graeme Yorston

On changes in branch transactions and more online finance in the industry: "A substantial further investment will need to be made in our business to remain relevant and meet the needs of future generations"

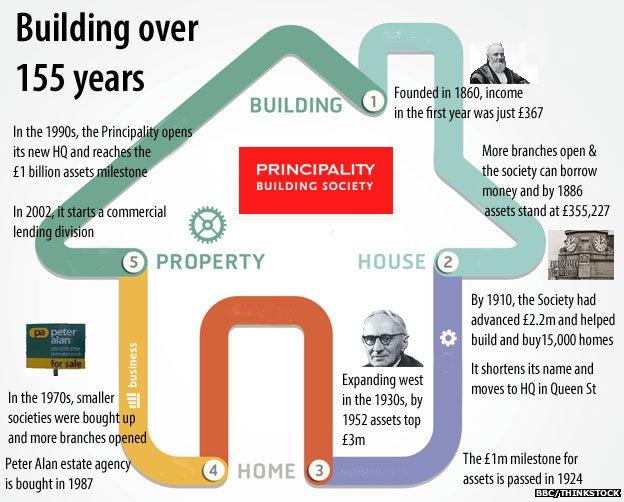

Timeline showing the society's landmarks

The changing face of the Principality

The first office in Church Street in Cardiff opened in 1860 as the Principality Permanent Investment Building Society

By the end of the 1960s, the Principality's assets had more than trebled to £33.7m.

Inside the head office in the 1970s - the society grew by expanding its branch network and buying a number of smaller Welsh building societies

Leonard Boyle, who was general manager of the Principality for more than two decades, is interviewed in 1973

The society now has 71 outlets across Wales and the borders and says it is 'not immune to the decline in branch transactions'

A royal visit to mark the opening of the new headquarters building in 1992

Analysis: BBC Wales business correspondent Brian Meechan:

It is an impressive set of figures from Wales' biggest building society.

With or without one-offs like the sale of Peter Alan and the changes to the company pension scheme, the Principality is seeing the sort of growth it aimed for in its 2012 strategy.

That's good news for the company and its 1,000 employees.

It is increasing its assets, loaning more to first-time buyers and growing in size not just in Wales but in England too.

Additional profits mean the Principality can conform to the regulations- toughened since the near-financial meltdown - about the cash levels banks and building societies are required to hold and have access to.

It also means the company can invest in new technology to be more competitive in a world where customers are increasingly using online, smart phones and tablets for their banking requirements.

The performance is also interesting in what it tells us about the economy.

Increased lending including to first-time buyers shows a housing market that is moving- a boost that has been provided by growing confidence, low interest rates, Help to Buy and 95% mortgages.

One other aspect to note is the Principality's commercial wing, which lends to businesses for property development, turned a profit in 2014 for the first time in a few years.

It is a sign of optimism returning as firms become more willing to invest in building and construction projects, many of which were difficult to finance during the downturn.

- Published5 February 2014