Glamorgan cricket club in debt write-off warning

- Published

Glamorgan held their photo-call ahead of the new season

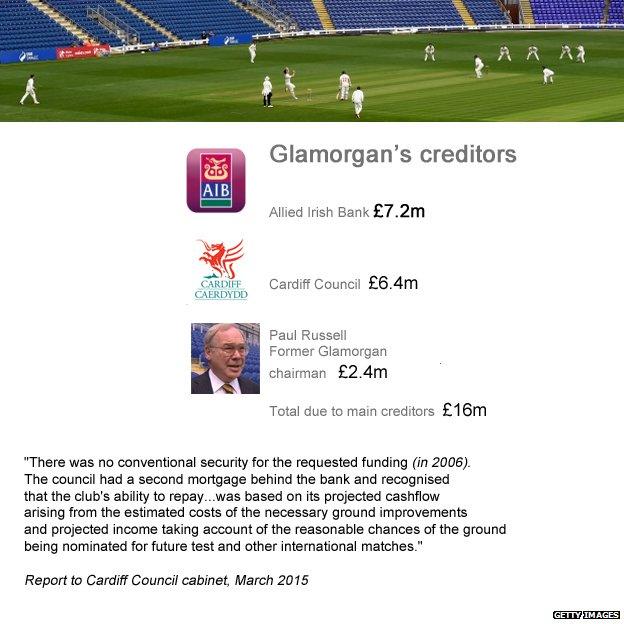

Glamorgan cricket club could go out of business and the local economy could lose out on millions of pounds if most of the club's £16m debts are not written off, it has warned.

Chief executive Hugh Morris said such a move was not something to be proud of but was essential to ensure its future.

Cardiff council has been challenged over its decision to write off £4.4m of the £6.4m it is owed.

But it could get almost nothing if the club goes into administration.

Glamorgan is due to host the first Ashes Test against Australia in July and has other international matches lined up.

But the cost of redeveloping its ground has left it with debts it has been unable to pay back.

The main creditor is Allied Irish Bank, with former club chairman Paul Russell also owed money. They have already agreed a 70% write-off deal, similar to the one put to the council.

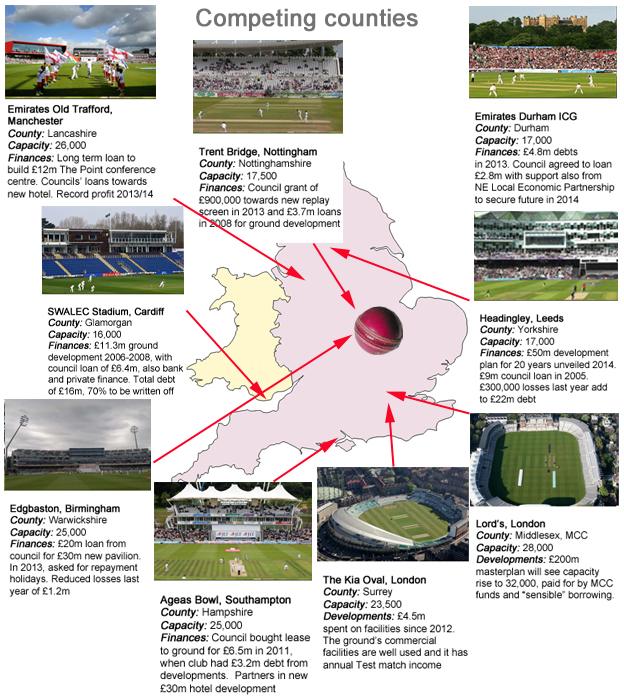

Nine venues bid to host the biggest matches, with two already guaranteed in London

Mr Morris, who took over at Glamorgan last year, said there was a "considerable debt" but it was vital to write it off.

"It's not something we necessarily want to do or are necessarily proud of but it's something we have to do to secure the future of this club," he said.

"To secure the economic impact that major matches bring to the city of Cardiff and the reputation that we will get as a country for hosting a Blue Riband event like the Ashes."

Forensic accountant Geoff Mesher said cricket was the poor relation to football

Geoff Mesher, a forensic accountant, said the council faced a stark choice if it tried to get all its money back.

"The risk for the council and for the cricket club is that they go into administration and effectively cease to trade. The council may well recover less than the 30% they get in this deal," he said.

"Also Cardiff and Wales is left without a cricket club and a stadium.

"I can understand why these questions are being asked but they should have been asked back in 2006 when the money was advanced. That was the time to look at whether the money was or could ever be repaid."

Hugh Morris said the club's future could only be secured if its debt was written off

Mr Mesher said the council should have been more aware of the risks.

"There are a number of established Test cricket grounds, but there are only so many test matches and international games in any particular year.

"When you're sharing the rest out through a number of grounds and then when you have the unpredictable British weather there's always a risk they wouldn't get the level of income they needed to service the debt they've taken."

On balance, he said the option of writing off £4m was potentially the best.

He added: "What Cardiff and Wales has got is a premier stadium, a club fostering cricket, so you can understand the political imperatives that led to Cardiff Council investing in the first place. To be able place the club on a secure financial footing is probably worth it."

How the debt breaks down

Chief executive Mr Morris admitted the club had experienced financial challenges, but said it had cut costs and the number of professional players.

As to the debt to the council, he added: "We're very aware of our responsibilities as far as the community is concerned.

"We have cricket programmes in many schools in Cardiff and have very close links with our 132 ambassador clubs across the whole of Wales, and are developing cricket in black minority ethnic communities around Cardiff.

"Also we have the Ashes in July and that's likely to bring in £5-8m for each day to the city, which is very considerable for Cardiff."

A Cardiff Council spokesperson said its decision to write-off 70% of the outstanding loans made to Glamorgan had been called in by a councillor and the matter would be considered by a committee on 12 May.

How the county's finances have fared

- Attribution

- Published10 April 2015

- Published19 March 2015

- Published13 March 2015

- Attribution

- Published31 January 2012

- Published17 February 2011