Bank closures affecting OAPs, says Age Cymru

- Published

Twenty eight communities across Wales have lost their last bank in the past two years, figures show.

Age Cymru said it was having a serious impact on the lives of elderly people living in the areas.

In March, the British Bankers Association, which represents the UK banking sector, pledged to try to minimise the effect of branch closures.

The union Unite said the industry-wide agreement was just "paying lip service" to the problem.

They said some impact assessments about closures were only being published less than a week before a branch closed.

'Financial abuse'

The figures from Campaign for Community Banking, external shows 28 town and villages are now without any banks, with some people having to drive up to eight miles to their nearest branch.

Age Cymru said having a local bank that was convenient for older people was "vital" for ensuring they did not become socially isolated.

Graeme Francis, the charity's head of policy and public affairs, said older people were at increased risk of financial abuse because of the branch closures.

"We know that around one in five older people regularly give their bank card and pin number to someone else they know, often a family member or a domiciliary care worker, to get money for them," he said.

"And whilst most people would be very trustworthy in that situation, it does clearly open a risk of financial abuse up for people.

"So there are real safety concerns that go along with a reduction in services."

Banks said the different ways of banking meant visits to branches had fallen massively.

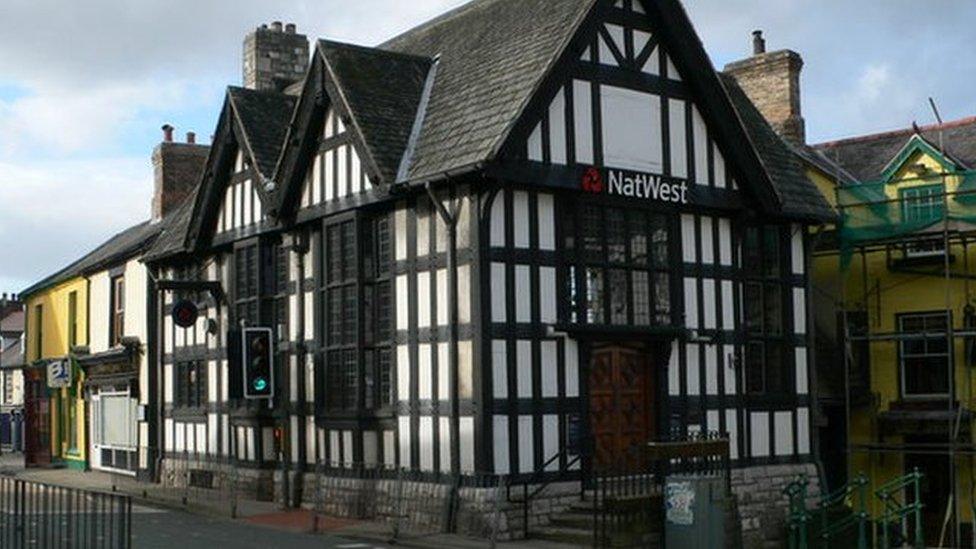

Natwest said online and mobile transactions had grown by more than 300% since 2010, while only 9% of its total transactions now take place in its branches, compared to 25% in 2010.

Mark Douglas, of the bank's Wales office, said they always tried to minimise the impact on communities, in particular through the use of mobile banking vans.

"We're certainly not in a rush to get out of any community," he said.

"It's a difficult and sometimes emotional decision to have to make. We're not in a rush and we always go through making sure we have a very robust and considered leave behind plan before we close any branch."

'Latest technology'

A British Bankers Association (BBA) spokesman said the decision to close bank branches was "never taken lightly".

"The protocol we have developed with the support of government, consumer and business groups ensure that provisions are put in place so that customers are able to access banking services in their local area," he said.

"High street banks are determined to leave no one behind and they have invested millions in refurbishing their branches to install the latest technology to make them easy and accessible."

- Published9 June 2015

- Published3 June 2015

- Published9 March 2012