Crash for cash: Police used 'Facebook stalking' to nail gang

- Published

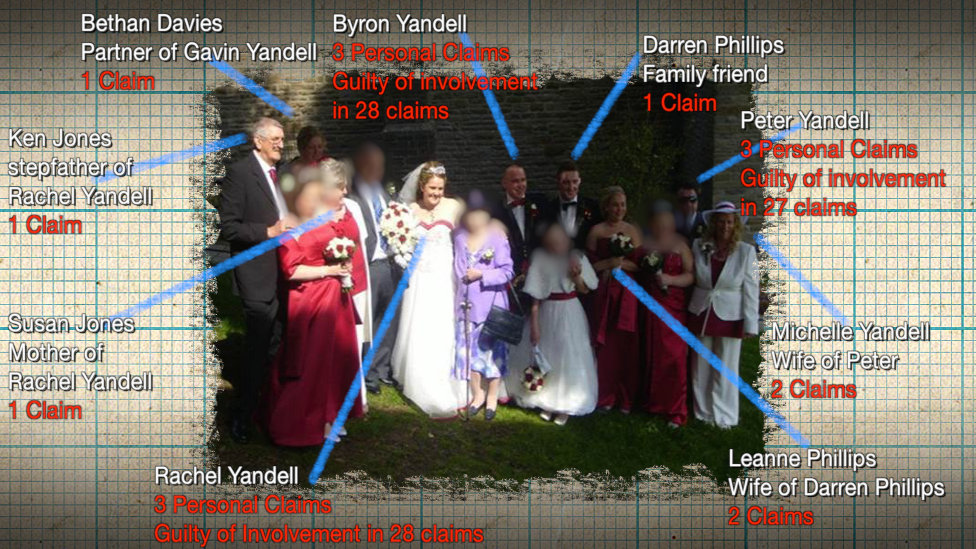

(l-r top): Peter Yandell jailed for six years, Michelle Yandell two years, Byron Yandell six years, Rachel Yandell five years, Gavin Yandell (l-r bottom): Anthony Callaghan 27 months, his partner Jennifer Cosh three years

The phrase crash for cash first emerged around 10 years ago and has now taken its place in common parlance.

For the Yandell family from south Wales it became a career choice, a way of life.

Running a crash for cash swindle as a business, police say they made up to £2m with staged crashes, whiplash injuries, courtesy cars and repairs that simply never happened.

They went undetected for years due to the sheer number of people they roped into the scam, a wide range of names and addresses ensuring they stayed under the radar of insurance companies.

And had it not been for Facebook - along with some good old fashioned stupidity - the chances are they would have got away with it.

For the past three years BBC Wales' Week In Week Out current affairs programme has followed the investigation securing exclusive access to those leading it.

Here is a glimpse at the tenacity which exposed the size, audacity and at times blatant stupidity of Wales' great car crash con.

Facebook can be a minefield. One inappropriate post, one compromising photo could so easily spell the end of a career or leave a relationship in turmoil.

Facebook, as the Yandell family found out, can even land you in jail.

On the face of it, the Yandells were a fairly regular family living in Blackwood, a fairly regular former mining town in south Wales, most famous for being the home of rock band Manic Street Preachers.

In a time before social media, Peter Yandell, now 53, set up a legitimate business - a back street garage called St David's Crash Repair.

In 2010, the younger of his two sons, Byron, 32, took it over. He gave it a new name - Easifix.

Easifix comprised a large workshop and spray bay inside a fenced compound strewn with vehicles in various states of disrepair. As back street garages go, again, pretty unremarkable.

But the Yandells had diversified their business.

In precisely what way would only be discovered by pure chance.

How police exposed Wales' great 'crash for cash' scam

Acting on a tip-off that a stolen car was being kept there, Gwent Police arrived at Easifix on the evening of 2 August 2011.

They found the remains of the stolen car - a Renault Megane. It had been stripped down to its bare shell.

So the Yandells were involved in car theft. That much was clear.

Byron Yandell was arrested and the case passed on to a small team of officers investigating a criminal gang stealing quad, mountain and off-road bikes.

A search of Easifix ensued and 20-or-so other stolen vehicles were identified. All that remained of some were registration plates and tax discs.

That was likely to have been the extent of the inquiry until, that was, an officer spotted a single sheet of paper among mounds of Easifix paperwork.

"Someone came up to me and said 'Sarge, have a look at this'," said Det Sgt Andy Cullen who led a team of five detectives on the case.

"He handed me a piece of paper. On it were written words to the effect of 'what to say to the insurance company'."

Alarm bells started ringing.

What started with a call about a stolen car, began spiralling into a highly-complex investigation - entitled Operation Dino - which would expose Wales' biggest and "highly organised" motor insurance fraud.

Next week the final five people involved are due to be sentenced.

In total over the past five years, 83 people have been found guilty - 81 on conspiracy to defraud and two for theft - and have received sentences ranging from six years in jail to suspended prison terms.

"There's such a variety of people involved in this from nans to unemployed people to those with professional, decent jobs and an awful lot to lose," said Det Con Jon Parkinson.

"There's a core of people who are pushing it - the Yandells mainly. For quite a lot of them it's greed, easy money, a tried-and-tested scam, nothing to worry about.

"On the flip-side there are some people who were talked into it by greedy family members.

"They told their nan or aunty, 'You don't even have to say anything, just sign here and there's a little bit of money in it for you'.

"Some of these people are previously of good character and I think some of them have stupidly got dragged into it."

So, how did it all begin? It is unclear exactly when the Yandells's fraud activities date back to but police are certain it goes back many years.

Police say Michelle and Peter Yandell paid £1,900 for this holiday - the exact amount Michelle had just won in damages for a crash that never happened

"Originally they'd tried a couple of collisions to get a bit of extra cash," said DC Jon Parkinson. "They realised there was a lot of money to be made."

The Yandells also realised that insurance companies would soon become suspicious if the same names kept cropping up on claims.

To get around this, they began roping in friends and other family members.

The more names and addresses involved, the less risk there was of insurance company fraud investigators smelling a rat.

It worked something like this:

1) The Yandells and their associates would invent car accidents in which one party would pose as the non-fault driver

2) The at-fault vehicle would either have high mileage or be mechanically problematic. No loss as it was worth more as a write-off and money could be made by removing parts, headlamps, gearboxes

3) The non-fault party then submits an insurance claim for damage to their car, personal injury, courtesy car, crash repairs and so on

4) The Yandells would submit fraudulent courtesy car and repair invoices to insurers

5) Other family members and friends or friends-of-friends would then be roped into the deal. They agreed to lie and say they were in the car at the time

6) A flurry of cheques follow ranging from £10,000 to £40,000 per accident - new cars, personal injury payouts, courtesy car charges and bogus repair bills

But the accident had never happened. So, before any inspectors arrived from insurance companies, the Yandells had to make sure the cars looked suitably smashed up.

The gang would damage cars with hammers, or drive cars into one another just outside Easifix compound.

On another occasion, one of the gang is seen deliberately driving a Land Rover into a forklift truck, having remembered to remove light fittings and other working parts beforehand.

When a convincing amount of damage is done to the 4x4, Peter and his son can be seen manually deploying the air bags, which automatically writes off a vehicle, no questions asked.

If the vehicle had a pre-accident value of £5,000, in its damaged state that would fall to just £1,000. The insurance company would pay out £4,000 and the crash "victim" would get to keep the car to sell as salvage.

But the Yandells would fix the car up themselves, sometimes using the parts they took off the vehicle before it was damaged, sometimes using parts from stolen cars. The car would be sold on, as good as new.

'Tip of iceberg'

Another detective on the team, Sara Morris, said they made around £750,000 purely from the cases which reached court.

"This is not including the stolen vehicles. Even then I think that was the tip of the iceberg," Det Con Morris said.

"We think this group of people, the Yandell family, incurred losses from insurers of up to £2m."

But back in August 2011, this was all yet to be discovered.

The paper entitled "What to tell the insurance company" was a big clue for the police that the Yandells's criminality extended beyond car theft. But how would they prove it?

The first port of call for detectives was the two accident management companies Easifix used.

Accident management companies (AMCs) are legitimate intermediaries who can be contacted by a driver who is not at fault. They will handle the insurance claim, repairs, personal injury assistance and provide a like-for-like courtesy car.

The scam was caught on CCTV

These firms came about in the 1980s to address the problem of innocent motorists having to pay upfront for a replacement car after a collision, and wait weeks or even months to be reimbursed by the at-fault party's insurer.

The companies used by the Yandells confirmed to police that they had processed 71 separate claims.

That is maybe not that surprising, given the Yandells were in the crash repair business.

Should a legitimate accident victim bring their damaged car to them, why would they not refer them to an AMC?

It was in the driver's interest and more to the point the Yandells were paid up to £500 for each referral they made to the AMCs.

"On one hand maybe the number of collisions wasn't surprising but then looking at the number of vehicles in the garage, I thought that may be a bit low," said former Det Sgt Andy Cullen, who led the investigation before he retired in 2011.

The books did not add up either.

"There was something strange about Easifix," Mr Cullen adds.

"It appeared to be processing an awful lot of work for friends and family, the accounts showed very little money going through them but there were an awful lot of damaged vehicles and crash parts around the premises. It looked like it was a very busy garage but not making any money. Something wasn't adding up.

"They literally appeared to be a business based on family and friends, a totally unsustainable business, you would think."

Police soon established that the Yandells were not working alone. Another name - Callaghan - kept cropping up in the paperwork.

"It was clear the Callaghans, two brothers and one of their girlfriends, were bringing in people from Cardiff and Caerphilly and the Yandells were bringing in people from the Blackwood area," says Det Con Jon Parkinson.

"If you widen the associates, make the pool a little bigger, it looks less suspect."

Everyone involved in the "accidents" insisted they were random events; that they did not know the people in the other vehicle.

The key to the police inquiry was to prove they were lying. And this is where Facebook came in.

"I don't think they ever expected us to go to into the depth that we did by researching all of the social media," Det Con Sara Morris said.

Any Facebook user, if they are honest, will be familiar with the practice of so-called "Facebook stalking".

Michelle Yandell claimed she was so ill after a crash she took to her bed for two days. Facebook revealed she was in fact at her son's wedding

Det Con Morris set about doing exactly the same thing. Examining public information from photographs, posts, likes, comments and dates to establish links between the suspects and build a robust case.

"I found pictures on people's accounts who weren't obviously connected," Det Con Morris explained.

"But they had posted photographs of weddings, nights out and christenings which showed many of these individuals knew each other.

"One claim involved Byron Yandell and a woman in one vehicle and they claimed to have a collision with three other people. They said they didn't know each other.

"By researching Facebook and finding pictures of Byron's wedding, we have photos which show quite clearly that they all attended Byron's wedding.

"Another claim involved Patrick Callaghan and a woman. She tried to state they didn't know each other.

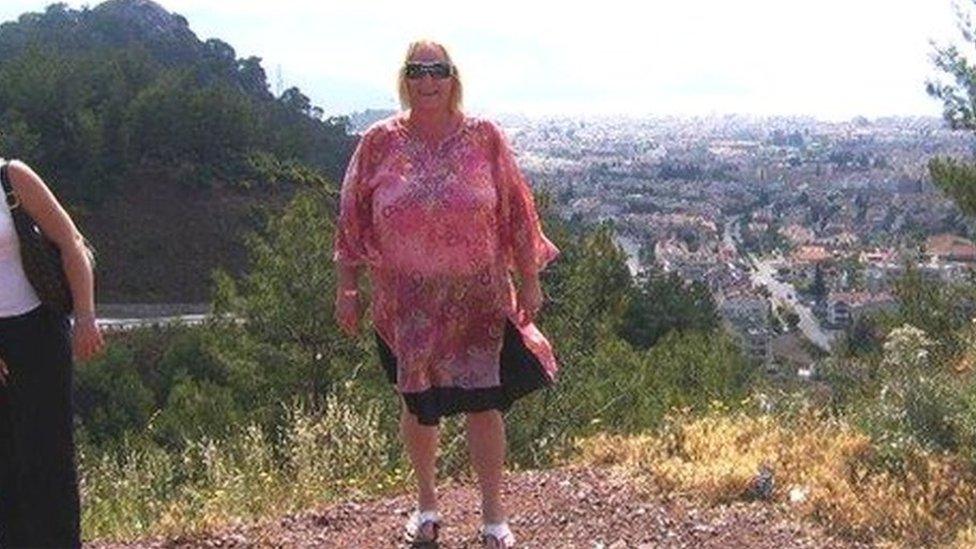

Michelle Yandell on holiday with Peter just after claiming she was badly hurt in an "accident"

"But we found an image showing they had attended the same christening. You could see Patrick outside the church and in the background was the woman."

Anyone could have viewed these pictures - the Yandells' friends and associates had unwittingly joined the dots for the police by posting photos on public Facebook pages.

But for one individual, it was a case of what was not posted on Facebook that set alarm bells ringing.

"One woman lived her entire life on social media," added Det Con Morris.

"She put down what she was having to eat, what she was doing on a daily basis and I would have thought that if she had smashed up her £11,000 BMW, she would have put it on her social media account.

Hill-walking on holiday at a time she told doctors she was suffering from crash-induced injuries

"She didn't. This raised suspicion that these collisions hadn't actually occurred."

Facebook also shed light on the motives behind these crimes.

"By looking at social media, it became quite significant that collisions occurred more frequently when there was a major event coming up, such as Byron and Rachel Yandell's wedding," added Det Con Morris.

The gang, it seems, was faking crashes to order and using the payouts to fund family parties, christenings and holidays.

As well as posting incriminating evidence online, the Yandells and their associates also gave police a helping hand by filming themselves smashing up cars. Criminal masterminds they were not.

"They were clever and stupid in equal measure," said Andy Cullen.

"You're clever if you stay under the radar but you're extremely stupid if you film the criminality you're involved in. They had CCTV at their garage which has been an incredibly effective investigation tool for us."

Ironically, the security cameras the Yandells had installed were to protect their business from other criminals.

Det Con Mike Adams was assigned the arduous role of sitting through 2,600 files of footage, each around one hour long.

He identified two collisions which had been deliberately staged, which proved that the "accidents" later claimed for through an AMC were utterly fraudulent.

"Collisions were alleged to have happened on particular dates but CCTV shows two Audis in questions being damaged two days later," says Det Con Adams.

"The fraud is not just about the collisions. There are extra layers of deceit by claiming for storing and recovery of vehicles and for a hire vehicle.

"One car is on paper as being rented out as a courtesy car but it never leaves the Easifix compound. There is a question over whether it can even be driven as it's moved around on a trolley jack."

The CCTV also shows the Yandells and their cohorts repeatedly driving a Land Rover into a forklift truck. They later claimed it had been involved in a crash a couple of miles away.

The operation could go on to investigate further motor insurance claims

"During interviews after their arrest we asked them to give an account of their involvement in collisions, their work at the premises, why they visited so often, their relationship to one another, what they knew about Easifix, if they'd been involved in stealing any vehicles, " Mr Cullen said.

"The vast majority said, 'no comment'.

"It was actually very helpful because we now knew which way we had to go as a team and how much depth we had to go into to prove them wrong.

"They were very confident that we wouldn't get there. But that gave us the incentive to move forward."

The first trial - of Peter, Byron, Michelle, Rachel and Gavin Yandell and Jennifer Cosh, partner of Anthony Callaghan - began in October 2014.

"Before the trial, I was quite nervous," said Det Con Sara Morris.

"I knew we had a lot of overwhelming evidence against them but you can never read a jury."

Only two of the Yandells - Byron and his wife Rachel - gave evidence in their own defence. It turned out to be a disastrous move.

"It was embarrassing to watch," said Det Con Morris.

"The prosecuting barrister tied them up in knots. The lies that were coming out, they were tripping themselves up constantly."

It sealed the deal for the prosecution. All were found guilty of conspiracy to defraud and sentenced between two and six years in prison.

'100 more'

A further 75 convictions followed. The sentencing of the final five, due next week, closes a five-year chapter for the investigative team.

But that is not the end of the story.

Gwent Police are pretty sure around 100 more people are involved.

Phase two of Operation Dino has been given the go ahead so they say there is going to be a few people who thought they had got away with it, looking over their shoulders once more.

It was the biggest insurance fraud Wales has ever seen. But if that was not enough, BBC Wales can reveal Michelle and Peter Yandell were also indicted for benefit fraud.

They had both falsely claimed tens of thousands of pounds for care and mobility allowances.

The case against them was not pursued because they were going to prison anyway.

Week In Week Out: Wales' Great Car Crash Con - Friday, 22 January, at 21:00 GMT on BBC One Wales

Video editing: Philip John

Additional reporting: Delyth Lloyd

- Published3 October 2013

- Published17 December 2015

- Published17 December 2015