'Loophole' in second home council tax hike plans for Wales

- Published

It is hoped the move will help control house prices and bring empty properties back into use.

Seven Welsh councils with holiday home hotspots are considering increasing council tax on second homes.

Ceredigion, Pembrokeshire, Anglesey, Conwy, Powys, Carmarthenshire and Gwynedd are exploring new powers to charge up to 100% extra.

The Welsh Local Government Association said it meant second homes could make a "fair contribution" to the community.

However, Gwynedd said a potential loophole could mean councils were worse off.

An estimated 23,000 homes in Wales are empty or used as second homes and the seven authorities currently consulting have about 16,000 between them.

Changes to the Housing (Wales) Act 2014 mean councils have the ability to charge a premium on top of the existing council tax payments for second homes from the 2017-18 financial year.

It is hoped it will help control house prices and bring empty properties back into use.

Gwynedd has almost 5,000 second homes and is exploring the possibility of a tax hike, but a report to go before council on 3 March warns of a trend of properties transferring from the council tax regime to being "self-catering units", which are commercially let for holidays, and pay business rates.

It warns: "The council must be aware that many of these properties would be subject to attempts to avoid paying the additional tax, and there are "exceptions" in the regulations where the premium cannot be raised.

"This tendency could accelerate if the premium is introduced and before resolving on introducing a premium, it is prudent to fully investigate its probable consequences on the council's income."

If second home owners decide to let out to customers for more than 70 days a year, then they would be eligible to apply for small business rate relief of 50% and the council is worried it could end up with less in tax from that sector.

Reinvested

A report to Pembrokeshire council estimated there were 3,000 second homes in the county and said charging up to 100% extra could raise "at least" an extra £2-£2.5m a year.

Ceredigion, which has around 2,000 second homes, is also consulting on the plans, while Powys will consider a holiday home tax of either 30% or 50% at a meeting in March.

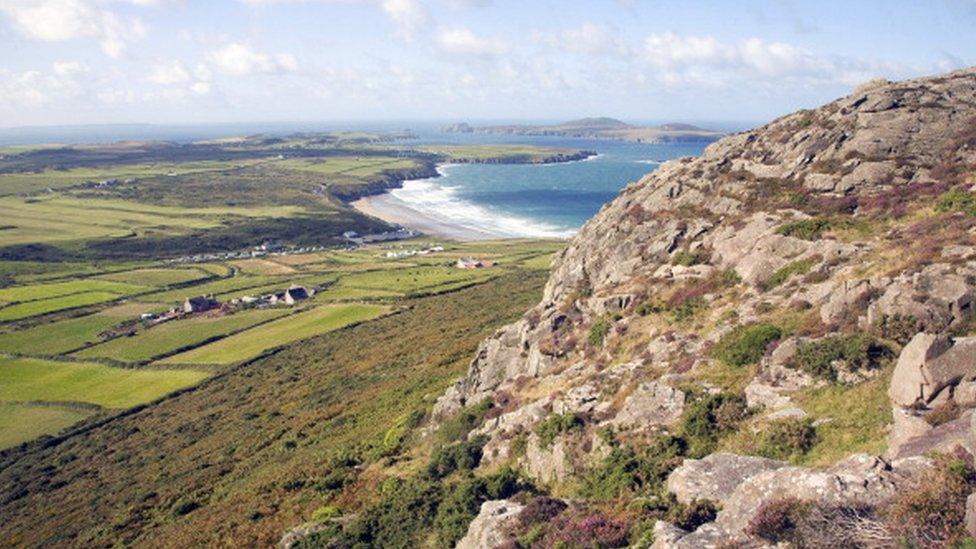

Ceredigion is among the councils with a large number of holiday homes considering the hike

A premium will also be considered by Gwynedd, Anglesey, Conwy, Powys and Carmarthenshire.

A Welsh Local Government Association spokesperson said: "The ability to increase charges on second homes offers councils a much needed and practical way of using the local taxation system to ensure second homes make a fair contribution to the provision of local services and affordable housing, especially in rural areas of Wales.

"The need for additional charges will be evaluated on a location specific basis, and any additional income raised through these levies will be reinvested into local services."

- Published26 January 2016

- Published25 November 2015

- Published13 March 2015

- Published4 December 2014

- Published3 April 2014

- Published23 October 2012