Teams line up in the battle for Tata Steel UK

- Published

Two rival bids to take over Tata Steel UK have unveiled their teams.

It came as Tata said seven interested parties have gone forward to the next stage of the sale process.

But of the two we know about, who are they - and what are the differences?

Excalibur is fronted by a combination of former senior managers at Tata, Corus and British Steel - with the team at Wesley Clover, technology tycoon Sir Terry Matthews's investment company.

Three Tata Steel executives have taken a leave of absence to join the bid.

Stuart Wilkie, the bid's co-chief executive, was the first to emerge three weeks ago.

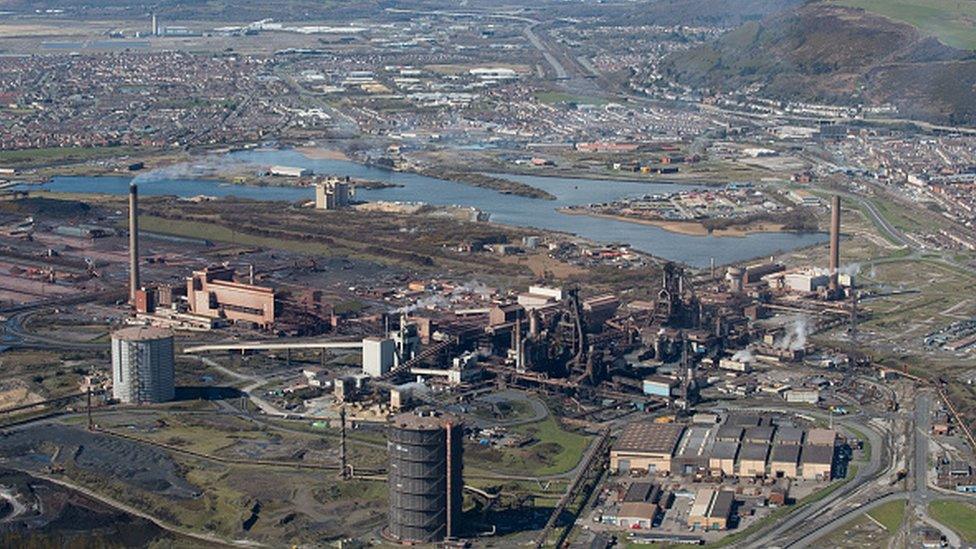

As Tata Steel UK's director at Port Talbot and Llanwern, he played a leading role in drawing up the survival plan in January, which was rejected by Tata bosses in India. He has years of experience in the industry, including with Corus before Tata at Ebbw Vale and at Trostre.

His buy-out team has now been joined by Neil Davies and Martin Driscoll.

Mr Davies, a chartered accountant, is group controller with Tata Steel Europe and had previous experience with Corus. Mr Driscoll is HR director for Tata at Port Talbot, with 25 years experience in the steel industry.

Mr Wilkie called their decision "an endorsement of Excalibur's ability to design and execute plans to transform Tata's United Kingdom operations into a profitable business."

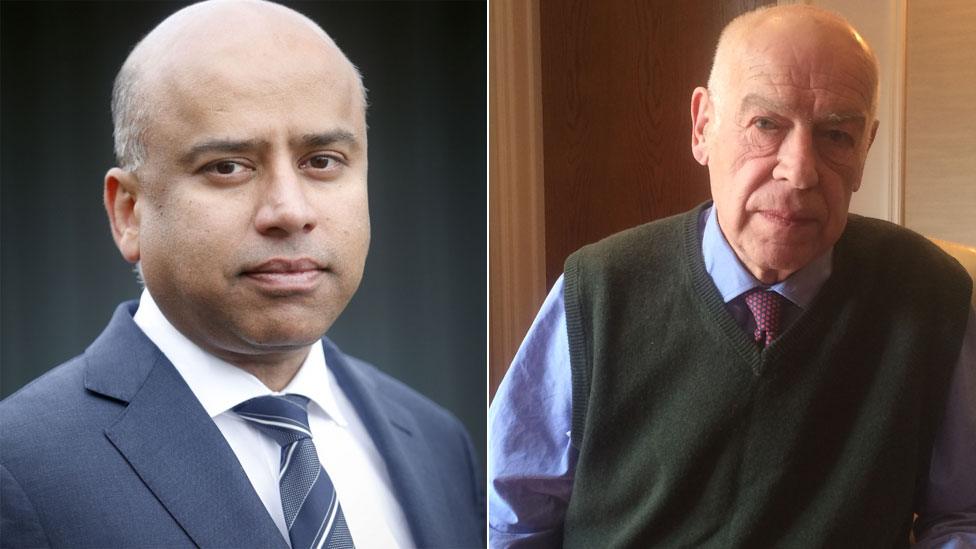

Chairing the bid is Roger Maggs, 70, who has nearly three decades experience in the metals business. He told BBC Wales last month he believed the original rescue plan was viable.

Mr Maggs, who is also the chair of the Port Talbot Enterprise zone, worked for Alcan Aluminium globally and is the founder, along with Sir Terry, of investment firm Celtic House Venture.

They are up against the Liberty team, which brings together the heads of a number of companies that are part of the Liberty House group and others with wide experience in international banking.

Liberty House chairman Sanjeev Gupta was the first to be linked with a bid and the first to outline initial thoughts on saving the Tata Steel UK operations.

His vision is around making steel from recycled scrap and "ultimately powered by renewable energy sources".

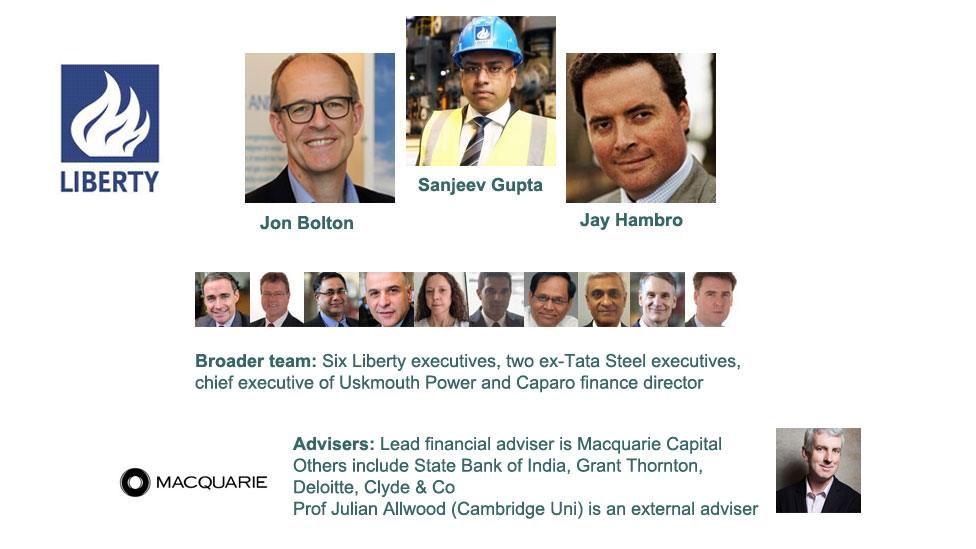

Mr Gupta has now revealed his bid team and advisers; and a name - Project Greensteel Pluto.

He leads a three-man steering committee. The others are close associates Jay Hambro and Jon Bolton.

Mr Hambro started his career at Rothschild's before moving into HSBC's investment banking division. He is group chief investment officer of the GFG Alliance, external and chief executive of the SIMEC Group - both owned by the Gupta family.

Mr Bolton is chief executive of Liberty Steel's UK plates division and with a track record including senior roles at Tata and Corus. He is also chairman of the industry body UK Steel.

Mr Gupta is also calling on previous experience at Tata in VB Garg - his chief executive at Liberty Steel in Newport - and Hridayeshwar Jha and Udai Chaturvedi.

Others on the team include James Busche, who is chief executive of the Gupta family-owned Uskmouth power station.

How do they compare?

Both teams have brought together a wealth of experience in investments and the steel industry to make sure that they are the winners.

What they are offering is very different. Liberty favours an electric arc system of recycling steel scrap and giving it another life. At the moment we export steel scrap around the world and import foreign steel. Instead, Liberty would use much of that steel scrap in the UK to make steel here.

In contrast, Excalibur is adamant that the UK needs to continue what it calls primary steelmaking. In other words, making steel in a blast furnace from coking coal and iron core.

Sanjeev Gupta and Roger Maggs

This team say that they would initially work with the rescue plan that Tata UK put forward to its Mumbai headquarters and was rejected. Working with a team of researchers, it would then aim to develop Port Talbot into making "the greenest and most efficient " steel in the world while still making steel from raw materials.

The Liberty Group has been expanding recently. It runs the former Alpha steelworks in Newport and also the nearby Uskmouth power station This is coal-fired at the moment but the plans are to change to biomass and in time supply the steelworks, which in future would use an electric arc furnace to recycle steel. At the moment, the plant processes steel made abroad.

On top of that Liberty, has already bought two small steel processing mills in Lanarkshire in Scotland, at Dalzell and Clydebridge, where 270 people worked. It has also taken on parts of the Caparo steel company, including in Wales.

What happens next?

In April, Tata said that there was no fixed timeline for the sale. Whoever buys Tata UK will have many processes to go through, both financial and legal.

It would be fascinating to be a fly on the wall at Tata HQ.

Ironically if Excalibur wins, Port Talbot will be a direct competitor with what will become Tata Europe's main plant, in Holland.

Liberty House, planning to make steel from scrap in an electric arc furnace, would be less directly in competition.

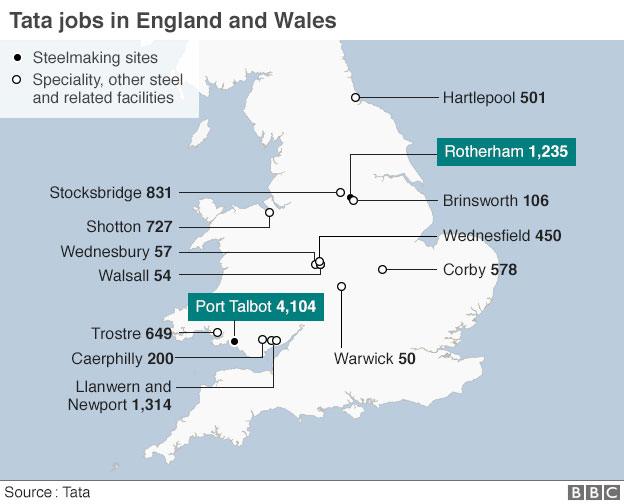

Port Talbot employs more than 4,000 workers

- Published9 May 2016

- Published21 April 2016

- Published25 April 2016

- Published12 April 2016