Student finance: Getting the balance right

- Published

These Cardiff University housemates say living costs are their biggest headache

How should the cost of university education be divided between an individual student and the taxpayer?

It is the question at the heart of the debate about student finance, which has led to the Diamond review.

In Wales, there has been a growing feeling that the balance is wrong - that the taxpayer is bearing too much of the cost at the moment and that is mainly due to the tuition fee grant.

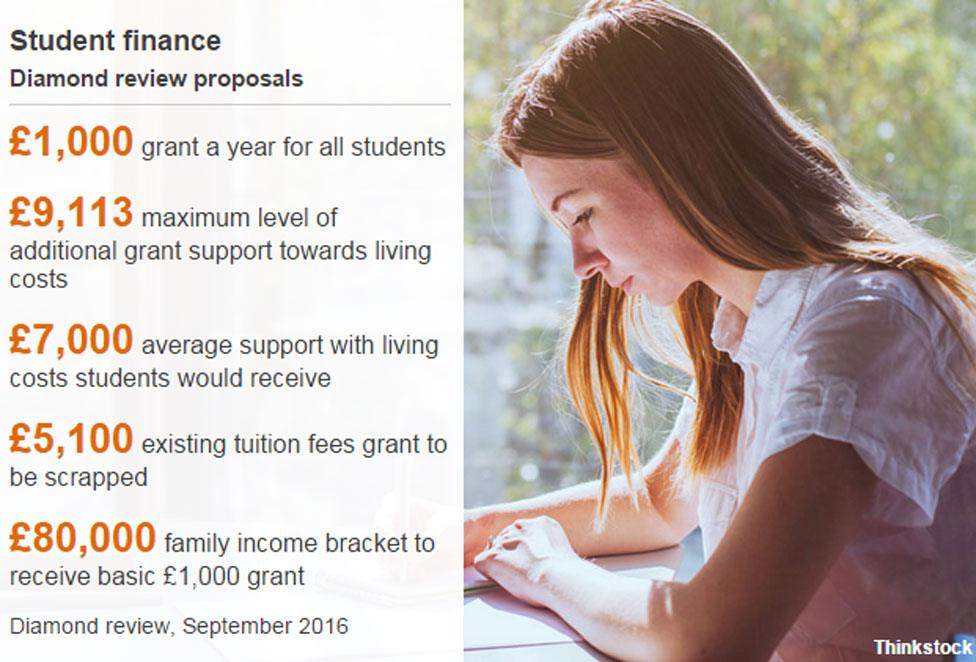

HOW STUDENT FINANCE COULD LOOK

Prof Sir Ian Diamond, in his review, external, said he wanted to see the funding of higher education as "a partnership between wider society and the individual."

The review sets out a re-balance - students getting more help with their day-to-day living costs up front in terms of grants, while borrowing to cover their tuition fees which would be repayable only after they start earning a certain amount.

The education secretary, who is to examine the detail of the findings, said it would mean Wales would have the only UK system that was "consistent, progressive and fair across all levels and modes of study".

HOW THE SYSTEM WORKS NOW FOR STUDENTS

Students pay up to £9,000 a year for their courses and the Welsh Government pays up to £5,100 of that for Welsh undergraduates wherever they study in the UK.

In 2014-15 it cost £237.6m - equivalent to two thirds of the total bill of running Wales' GP surgeries.

Students can be charged a maximum of £9,000 for their tuition fees but a tuition fee loan can be taken out to cover the first £3,900.

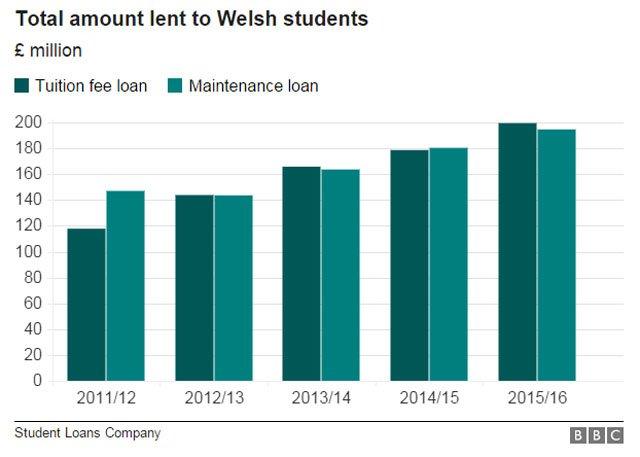

The chart above shows how in 2015/16, students from Wales borrowed a total of £199.5m to cover this.

If the university or college charges more than £3,900 in fees, Welsh students can apply for a tuition fee grant of up to £5,100 to cover the difference.

That grant is now set to be scrapped, under the proposals.

To deal with living costs, maintenance loans are currently available - a maximum of £4,637 a year if students are living away from home studying outside London or £6,497 for studying in London. They can borrow more if their parents are on a lower income.

The chart above also shows a total of £194.6m was borrowed by Welsh students in maintenance loans last year.

Students can also apply for a Welsh Government Learning Grant if their taxable household income is £50,020 or below. They qualify for the maximum of £5,161 if the household income is £18,370 or less.

It operates on a sliding scale so coming from a family with a £30,000 household income qualifies for a £2,099 grant. For students who qualify for this, it will affect the amount they can borrow through a maintenance loan.

Special support grants up to £5,161 are also available towards travel, books and equipment for students receiving benefits or who are single parents.

NUS Wales says student finance shake-up 'targets help to those who need it most'

Students' representatives have argued that greater help is needed with living costs but with a squeeze on public finances, no-one expected the current level of help with fees to be maintained as well as extra support for day-to-day costs.

Instead, under the Diamond proposals a maximum of £9,100 in a grant for living allowances would be available each year.

The student from an average earnings family can expect £7,000 a year and at a minimum - even students from high income families - can expect £1,000.

Education Secretary Kirsty Williams has argued that help with living costs is the bigger issue in making sure students from poorer backgrounds are not put off going to university.

"I am deeply committed to making sure access to higher education should be determined by academic ability and not social background," she said on Tuesday.

Rhian Floyd, 19, from Aberaeron, Ceredigion, a second year Welsh and English student at Cardiff University, welcomed any move which would see more help with living costs.

"They're probably more of a problem than the actual fees themselves," she said.

"You borrow those and pay them back in the long run. Living costs here in a city like Cardiff are expensive compared to home.

"We're paying our landlord three months at the start of one month and that's a lot of money to fork out."

House-mate Leah Williams, also 19 and from Cardigan, Ceredigion, studying politics and international relations, said poorer students should be prioritised.

"I think they need to look at the financial background of every student," she said. "I don't think families who can afford to pay their child's tuition fees should have a grant.

"There's not an option for poorer students for their parents to pay for them - and to not go to university is heartbreaking."

Student Bethan Elin Morgan says it is not easy making ends meet.

STUDENT FINANCE: CRIB SHEET

Name: Bethan Elin Morgan

Age: 20

Where are you from? Swansea

What year and what are you studying? Third year at Cardiff University, history and Welsh

How are your tuition fees paid for - do you get a grant and have you taken out a tuition fees loan too? Student loan

Do you receive a maintenance loan towards living costs? Yes, about £3,500 year

How much do you pay in rent a month? £325

Do you have a part-time job? Yes

What is it - and roughly how much does it pay? It's in retail - about £5.50 per hour

Have you received help from your family in the last 12 months? Yes

If so, is it a regular amount? No, whenever I go home I get help with a food shop and so on. I hate asking for help.

Do you run a car? Yes

Is there anything you can't afford but wish you could at the moment? I want to save for the future as I want to do another course afterwards but I don't have the money yet.

Have you an estimate at how much you think you will owe in student loans by the end of your course? Too much - about £23,000 maybe?

What career/job are you aiming for at the moment? Law, hopefully

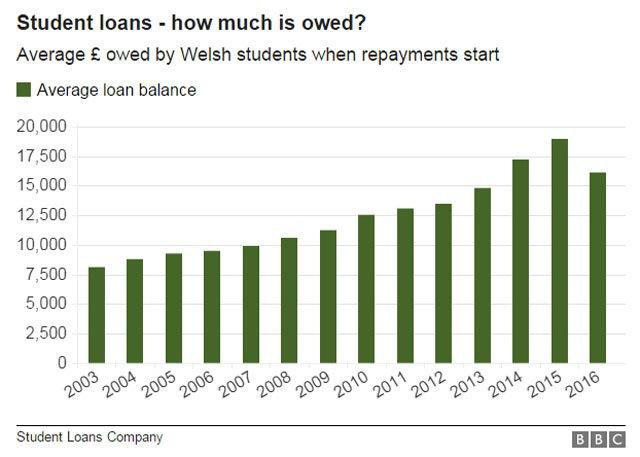

HOW MUCH DO STUDENTS OWE?

Students have to start paying back their loans once they start earning £21,000 or more.

On average, the loan balance for Welsh students who started repayments in 2015/16 was £16,120, according to the Student Loans Company.

The average loan balance in England is much higher - £24,640 - with students from here not getting grants towards their fees; it is on average £19,720 in Northern Ireland but only £10,500 in Scotland, where home students do not pay tuition fees and so borrow less.

For Welsh students who started paying back their loans in 2007, they started off repaying an average £350 a year, which had increased to £950 by the eighth year.

Cutting the grant would increase that debt, but some would argue that up front day-to-day cash in hand would compensate for that.

But on the balance sheet, it is highly likely that overall the average student will get less financial help as a result of any proposed changes to student finance.

STUDENT FINANCE: CRIB SHEET

Name Elin Lloyd

Age 20

Where are you from? Cardiff

What year and what are you studying? Third year Welsh at Cardiff University

How are your tuition fees paid for - do you get a grant and have you taken out a tuition fees loan too? A student loan

Do you receive a maintenance loan towards living costs? Yes, about £3,000 a year

How much do you pay in rent a month? About £300 a month

Do you have a part-time job? No

Have you received help from your family in the last 12 months? Yes

If so, is it a regular amount? Yes, monthly

Do you run a car? No

Is there anything you can't afford but wish you could at the moment? No, but I do get help from my parents so without them, yes. I know a lot of people who max-out their overdraft. You still need to have enough money to enjoy yourself.

Have you an estimate at how much you think you will owe in student loans by the end of your course? No

What career/job are you aiming for at the moment? Journalism

- Published27 September 2016

- Published27 September 2016

- Published27 September 2016

- Published15 August 2018

- Published19 April 2016

- Published18 December 2015

- Published29 November 2015

- Published16 February 2015