Q&A: Swansea Bay tidal lagoon - the sticking points

- Published

The tidal lagoon would have an operational life of 120 years

The Welsh Government's offer to kick-start the tidal lagoon in Swansea is about helping to get the long-awaited project over the line.

The cost of the electricity after it gets up and running has proved to be the major sticking point in discussions between the developer and UK ministers.

BBC Wales economics correspondent Sarah Dickins and environment correspondent Steffan Messenger run through some of the issues.

Q What is the lagoon's cost and who is paying for it?

The cost of building Swansea Bay's lagoon is expected to be £1.3bn over four years.

Developer Tidal Lagoon Power (TLP) has already been granted a £1.25m loan from the Welsh Government but the project is largely privately financed. The main backers are Infracapital, the investment arm of insurance giant Prudential and the global investment firm InfraRed which is already investing in four onshore wind farms in Wales.

Two years ago, the Gupta family behind Liberty Steel and Simec, which owns Uskmouth Power station in Newport, invested more than £10m in TLP in return for a 16% stake.

Other investors include renewable energy company Good Energy and Admiral co-founders David and Heather Stevens. There are another 350 individual investors.

The challenge for those running TLP has been to keep investors on board while waiting for the UK Government's response to the independent review into the whole industry.

This latest involvement by the Welsh Government will please investors and reduce underlying concern that the UK government may conclude that it is too expensive to go ahead.

Q What is a strike price and how does it work?

In order to get the investment to cover the upfront costs for building large energy schemes, developers usually look to agree with ministers a guaranteed price for the electricity generated. It is known as a strike price. It gives them the certainty that the investment will be worthwhile and they will be able to make a profit.

It is often referred to as a subsidy - but works a bit differently in practice. If the market price of electricity falls below the agreed strike price, the government will make sure the developer receives the difference between the two prices. It works the other way though too - and if the market price of electricity rises above the agreed strike price, then the developer refunds the difference. As the money comes from a levy on our energy bills it goes back to taxpayers, not the government.

Q So what are the developers of the Swansea lagoon asking for?

TLP has asked for a 90-year contract with the government with an average strike price of £89.90 per megawatt hour - so for every megawatt hour of electricity it generates, it would receive this amount. But it would start at £123/MWh for the first year and will then reduce over time. By the end of the 90 years, it would be just £43/MWh. Given that the lagoon's developers predict it could keep going for 120 years - for the last three decades it would be generating free power.

A decision on the Swansea tidal lagoon is still awaited, a year after an independent review reported back

Q Is the size of the Swansea project working against it?

The Swansea lagoon is seen as a pilot, a "pathfinder" project to test how the technology works. TLP acknowledges because the Swansea lagoon would be the smallest, the electricity generated would in effect be more expensive for every unit of electricity produced. But the company argues that its subsequent lagoons will be much larger and economies of scale will bring down the price per unit making the electricity generated cheaper.

Q How does tidal energy compare with other technologies, like nuclear?

A 90-year contract for the tidal lagoon would be very different to how other energy schemes have been dealt with. The new nuclear power station at Hinkley Point C in Somerset was given a strike price of £92.50/MWh for 35 years. The UK government has told the other new nuclear plants in the pipeline - including Wylfa Newydd on Anglesey - that they will need to be cheaper. And when you look at renewable energy technologies that are already established - like wind and solar - they are receiving much lower guarantees. Recently two offshore wind projects in England and Scotland won strike prices of £57.50/MWh for 15 years. Meanwhile, in September the UK's first solar farm to be built without any government subsidy at all started generating.

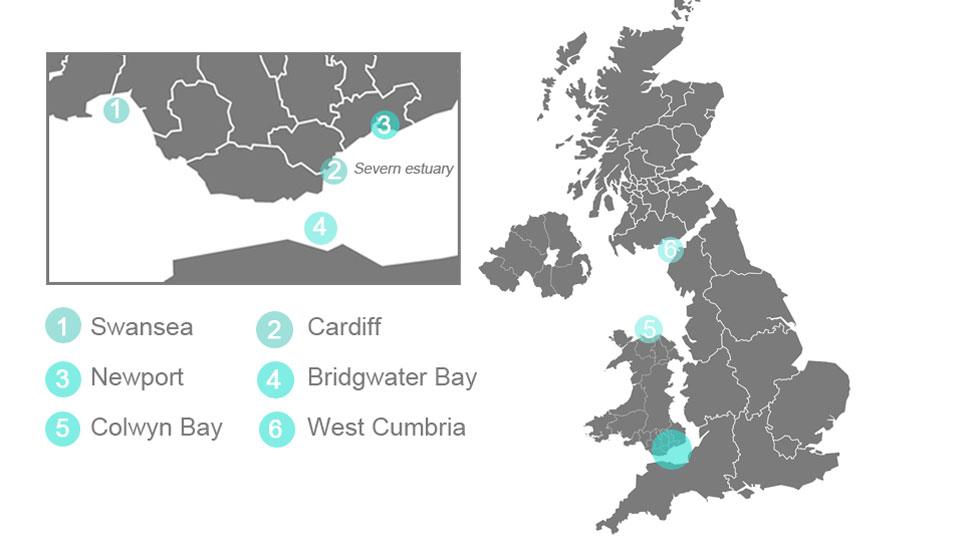

A map of how Tidal Lagoon Power's network of lagoons would look

Q Is the Swansea lagoon the only tidal option?

TLP has been the trailblazer and Swansea Bay would be the smallest of six around the coast of the UK. The others being at Cardiff, Newport, Colwyn Bay, Bridgwater, West Cumbria. Cardiff and Newport together are expected to involve £8bn of private capital.

Ecotricity boss Dale Vince questions the price for electricity Swansea Bay's tidal lagoon would charge.

There are other companies that are interested in tidal energy. Last summer, one of the UK's leading renewable energy companies Ecotricity wrote to the Energy Secretary Greg Clark arguing that it would be cheaper to produce tidal energy from offshore lagoons sitting in estuaries rather than being connected to the shore.

Another firm, Tidal Electric, is developing an offshore lagoon in Scotland and North Wales Tidal Energy is working on a £7bn tidal project that also aims to provide flood projection for Colwyn Bay, St Asaph and Rhyl.

Roger Harrabin looks at how lagoon power plants will work

Q So what are the lagoon's critics and supporters saying?

Critics argue that the figures prove the Swansea lagoon is too expensive, tying bill-payers into topping it up for almost a century, during which new much cheaper technologies would be likely to emerge.

But its supporters say the example of other renewable schemes shows exactly why the lagoon should go ahead - offshore wind farms required strike prices of £150/MWh to start with. The independent review into tidal lagoons by former energy minister Charles Hendry - published a year ago this week , external- concluded that they could play "a cost-effective role in the UK's energy mix".

Q Are there any other hurdles?

Even if the finances get sorted out the developers still require a marine licence to build out at sea. Local anglers are worried about the impact the lagoon's 16 large turbines will have on fish and other wildlife. TLP and the environmental regulator Natural Resources Wales have been involved in "exhaustive discussions" for years with no sign yet that a decision is imminent.

Q Why is it taking so long?

The Swansea Bay lagoon was included in the UK National Infrastructure Plan in 2014., external It was held up by the then Chancellor, George Osborne, as heralding a new industry for the UK with a long supply chain that would impact on a wide range of construction and manufacturing firms.

That government optimism along with the predictability of electricity generation - because tides are constant - made the project attractive to investors wanting a long term, low-risk return. But that was nearly four years ago and for the last 18 months, TLP has had to keep investors on board while waiting for the outcome of the Hendry review and now another year waiting for the UK government's response.

While Mr Osborne was clearly supportive, the political landscape has been dominated by two general elections and the Brexit vote and its aftermath.

We understand the project has been caught in a debate between different Whitehall departments - those looking to boost the economy, those looking to secure the UK's energy future in an affordable way and those responsible for environmental protection.

- Published10 January 2018

- Published19 December 2017

- Published12 January 2017

- Published7 November 2016

- Published7 November 2016