Conmen steal £53k savings from man with terminally ill wife

- Published

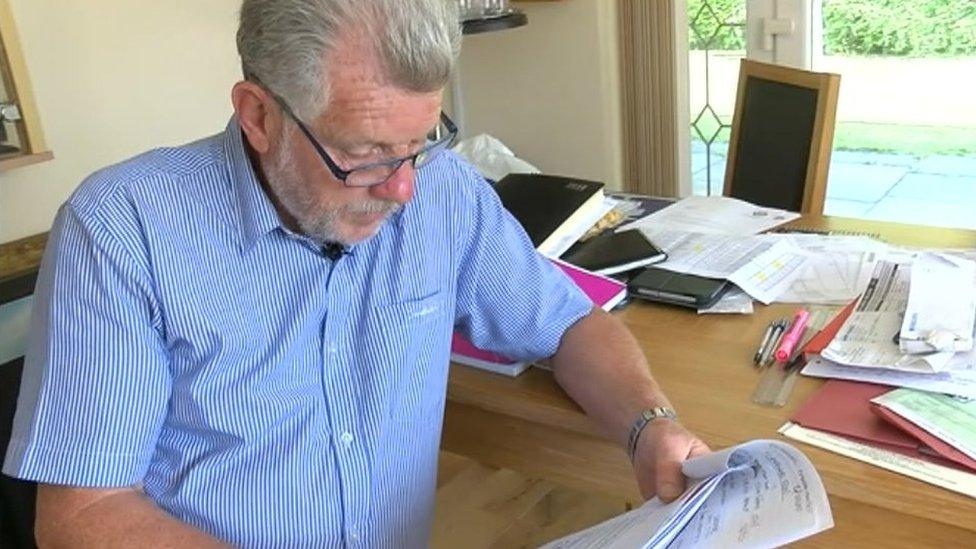

John Williams: 'I thought, no, it didn't seem right'

When retired phone engineer John Williams sold his holiday home in Tenerife he wanted to buy an apartment so his wife with terminal cancer could have a break.

But 65-year-old was tricked out of the £53,000 during a phone and online scam by professional conmen who claimed to be his bank.

Mr Williams, of Newbridge, Caerphilly, said the fraudsters managed to get remote access to his account via his laptop.

He said the criminals were so professional he had "no reason to believe it wasn't them".

His bank, Santander, said it was "sympathetic", but would never ask customers to transfer funds or divulge personal information and pass codes.

Mr Williams was using the money from the sale of a holiday home to buy an apartment in Weston-super-Mare as his wife Carol, 69, has terminal cancer and is unable to travel abroad.

He said the night he took the costly call in May, his phone's display showed his bank's name.

He said he was taken through what he thought were genuine security checks.

And, after querying a fictitious £15,000 payment that was supposedly due to leave his account, the conman advised Mr Williams to go online to check for himself as two others payments - taking the total to £53,000 - were due to be paid.

He offered to help by asking Mr Williams to give him remote access to his account via his laptop.

The conman accessed Mr Williams' bank account via remote access from his laptop

Mr Williams agreed but, seeking assurances, he called the bank's number on his computer screen from a second phone.

But he said it was only after the sting that he realised it was a fake number and he was speaking to the conman's accomplice who had tried to assure him everything was legitimate.

Still wary, Mr Williams said he made another call, this time to a correct number for the bank that he had on paperwork near to his laptop, but he rang off after the conman told him he was delaying things.

Mr Williams said his bank should have made further enquiries after his call to raise concerns that night and he has complained to the Financial Ombudsman Service seeking to be reimbursed.

But Santander said "despite clear warnings not to, Mr Williams gave away confidential security details to the fraudsters which enabled them access to his account".

John Williams: 'I'm supposed to be switched on... I wasn't switched on that night'

Mr Williams said: "I thought to myself 'this doesn't seem to be right'. So I looked at the screen... and I rung the other number of Santander on the screen which was on my laptop.

"I explained to them that he was taking money out and he said that Santander wouldn't do this and [asked] 'who was he?'

"I explained that he was from the investigation branch and he asked for his staff number and they said that they would get back to me within 10 minutes.

"Unbeknown to me that was a screen that was created by them [fraudsters] and it was his colleague that I was speaking to.

"So they [fraudsters] come back to me and said 'yes, it was OK' and if I didn't let them do what they were going to do the amounts of money would come out in the morning.

"After I've seen the first amount of money coming out, I gave the one time password. I didn't actually give it. I entered it myself and I thought, no, it didn't seem right.

"So I looked at my notepad by the side of the screen which had a Santander number, another one, and I rung them up. This was the, as it happened, the real Santander.

"And they said exactly the same as the previous call; 'Santander wouldn't do this'... and this guy [fraudster] said 'why are you going through all of this security again? It is only going to delay matters'.

"I'd rung them [real Santander] on my mobile number which is the number that is registered to Santander to receive the one time password, and I put the phone down as he [fraudster] instructed and let him carry on.

"Now it was another two hours after they took the other amounts of money. Santander didn't even ring me back to say 'is everything OK'?

"I phoned them on my mobile phone which was registered to them to receive the one time password.

"And when they were texting me, Santander was texting me, I was having texts off the fraudsters on the same thread.

"They [fraudsters] were very professional. There was two or three of them I think. At the time I was convinced it was Santander.

"When you think about it, a personal account, at 8 O'clock in an evening, when you have got £53,000 going out, surely that should be flagged up that it's suspicious. Santander should ring me and say 'is this OK?'

"The security questions they was asking me was the same as Santander. I couldn't believe it when it wasn't them.

Gwent Police said it was investigating Mr Williams' case

"I dare say they ring a hundred people a day and get two bites.

"I'm supposed to be switched on and I wasn't switched on that night, that's for sure. I had no reason to believe it wasn't them [Santander].

"But what I've got to ask myself is how did they know my phone number which is ex-directory, how they knew I banked with Santander, how they knew that amount of money was in there.

"Only because I sold an apartment in Tenerife was that sort of money in there.

"It makes you wonder how they know all these things."

'Clear warnings'

A Santander spokeswoman said it sent out "scam awareness" communications to make it clear it would never contact customers by phone, email or text to ask them to disclose one time pass codes, transfer funds or share passwords or personal details.

She said: "Unfortunately, despite clear warnings not to, Mr Williams gave away confidential security details to the fraudsters which enabled them access to his account."

A spokeswoman for the Financial Ombudsman Service said it could not comment on individual cases.

Gwent Police said it was investigating Mr Williams's case.

Mr Williams has still put in an offer to buy an apartment in Weston-super-Mare for his wife, but he said it was now being purchased with a mortgage.

- Published9 July 2018

- Published15 March 2018

- Published7 April 2018

- Published3 November 2017