Analysis: Why this is such a big day for Wales and your tax

- Published

You won't notice this on your pay slip but things are changing for tax-payers in Wales.

Today marks a turning point in where the Welsh Government gets its money from.

It has unveiled its £18bn draft budget - and a bigger slice of money raised from our income taxes to pay for it next year will go directly to Cardiff Bay.

While in material terms that may not seem significant, it marks an important change because it opens the doors for Wales to start to discuss options for income tax in the future.

It also more closely links Welsh Government to how policies perform on the ground.

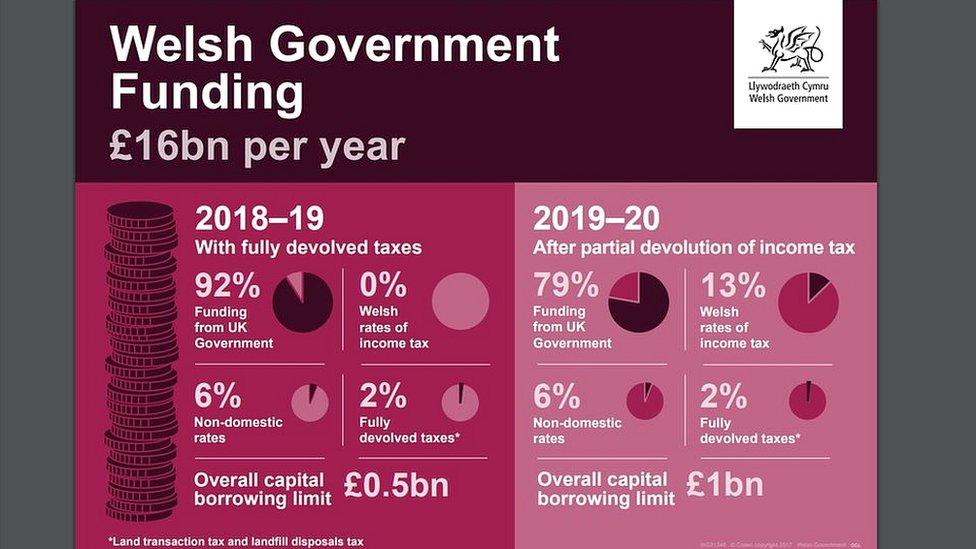

At the moment, 92% of the Welsh Government's income comes from the UK Treasury.

But from next April that will fall to 79%.

That does not mean that the Welsh Government will have less income, rather that 10% of the income tax paid by residents in Wales will go directly to the devolved government and not through the Treasury.

We will all still pay our tax to HMRC. But from there it will be divided between the two treasuries in Cardiff and London.

From April, 10p in every pound of income tax you pay will go to the Welsh Government. The rest will go to the UK government. That will be the same whatever tax band you are in.

Wales has the same proportion of basic rate tax payers as England but only two thirds the proportion of higher rate tax payers and only a quarter of additional rate

The Welsh Government has said that it will not change how much taxpayers pay in income tax before the next election in 2021.

Drakeford explains 'bread and butter' budget

Could taxes change our behaviour?

Minister backs 1p in £ income tax rise

But what this change will do is kick start a debate about income tax in Wales.

In particular, are taxpayers so concerned about the NHS or the level of services that they get from their local council that they would be prepared to pay a little more income tax to the Welsh Government to fund it?

Or could the Welsh Government lift the economy by cutting income tax? Since income tax is paid where you live, not where you work, would lower income tax attract high earners who hopefully would spend in local communities?

Income tax could become one of the main discussion points in the run up to that election in 2021.

You could argue that debate has already started.

That's a radical suggestion in itself but he added that the tax would need to vary depending on age and income to make sure it was fair.

From today we can expect that discussion of the link between public services and what we pay in taxes to intensify and become a main topic of debate in the Welsh election of 2021.

- Published3 October 2018

- Published2 October 2018

- Published27 September 2018

- Published5 June 2018

- Published3 October 2017

- Published19 December 2016