Welsh councils' 'large shortfall' as tax and budgets set

- Published

Councils have had to make "incredibly difficult decisions" to balance the books in setting their budgets and council tax, a senior leader has said.

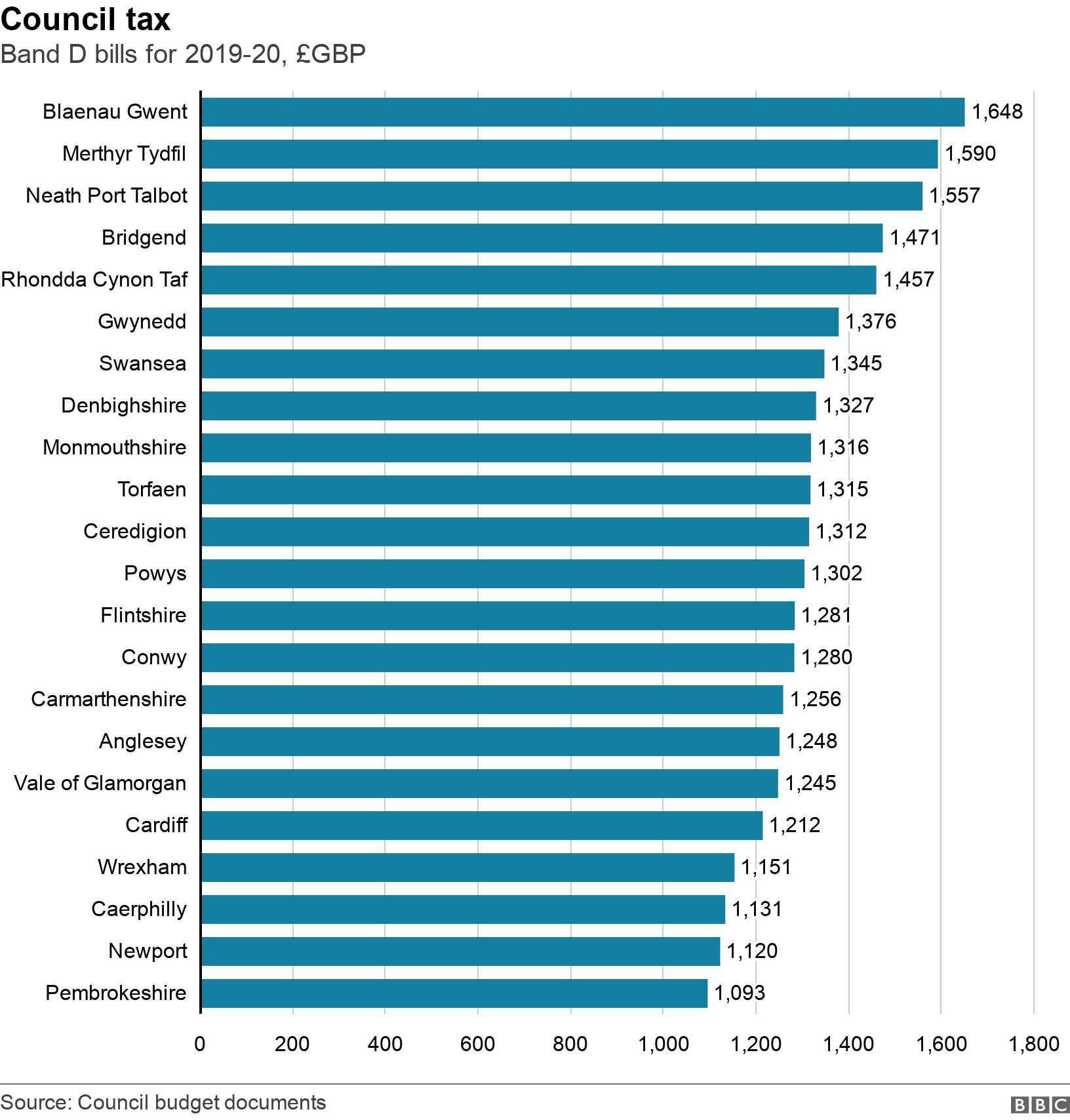

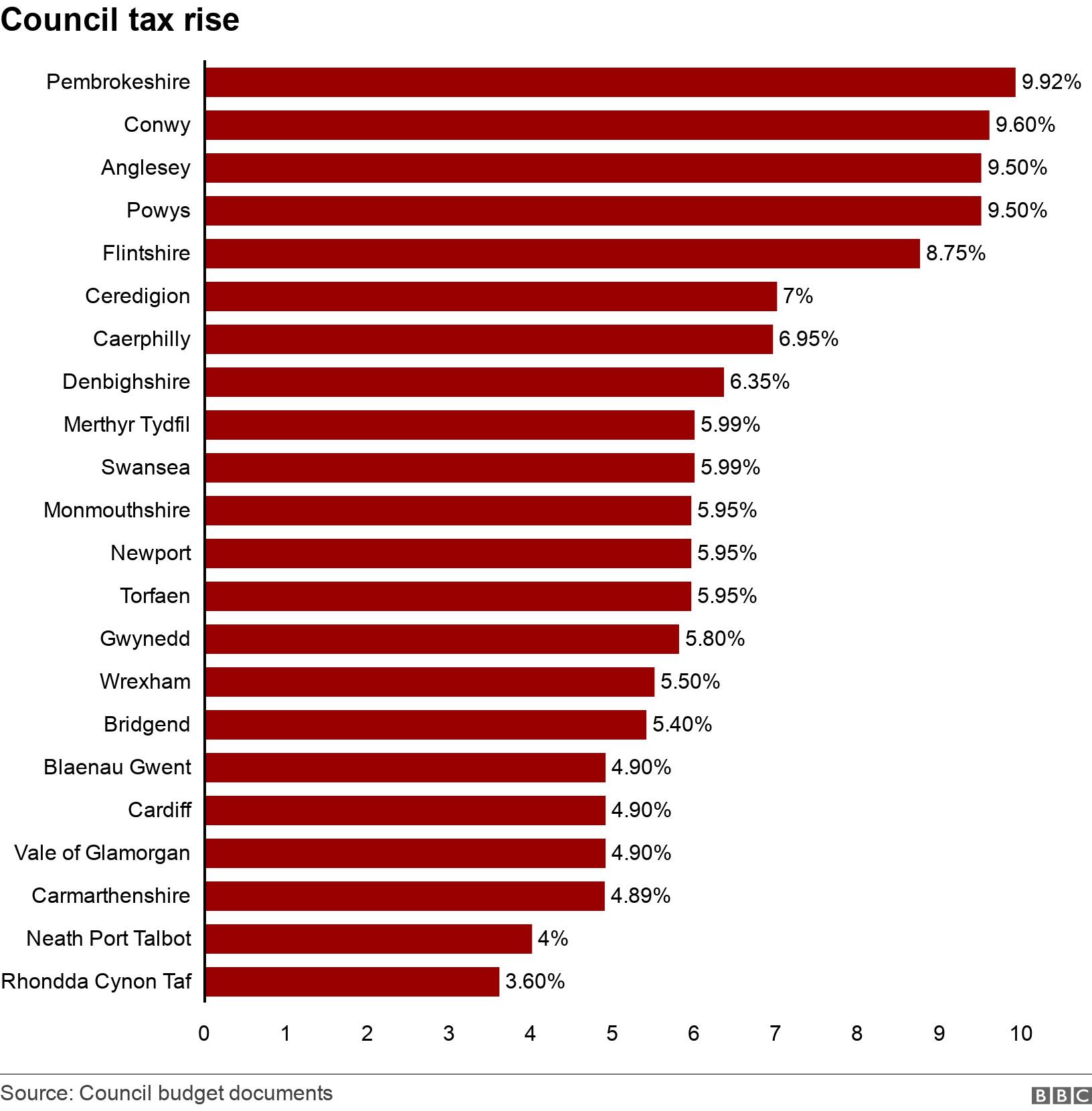

Residents face tax increases ranging from 3.6% in Rhondda Cynon Taff to almost 10% in Pembrokeshire, although the county charges less than others.

Torfaen council leader Anthony Hunt said savings could only go so far to ensure vital services were maintained.

The Welsh Government said councils were given "the best settlement possible".

Core funding from the Welsh Government, external covers between two-thirds and three-quarters of each council's budget.

No council will see their core funding rise enough to cover inflation - Cardiff council will have the biggest increase of 0.9% while five others will see a 0.3% cut.

With statutory services such as schools and social care taking up the lion's share of spending, local authority leaders have had to look to other services to bear the brunt of cuts.

Proposed savings overturned in the face of public opposition include threats to libraries in Powys, free Christmas parking in Gwynedd, and school crossing patrols in Blaenau Gwent.

Councils fund schools, care services, waste collections and some local transport

Mr Hunt, who speaks on finance and resources for the Welsh Local Government Association, said: "Local authorities are having to make incredibly difficult decisions in order to set balanced budgets and council tax for 2019-20.

"Thanks to continuing austerity, councils have been left with a large shortfall for next financial year, as funding is not rising in line with the pressures faced by services like social care."

He said budget planning had also been made more difficult by uncertainty over who would foot the bill for nationally-agreed pay and pension increases for groups such as teachers and firefighters.

NB Figures for council element only - excluding charges for police and town or community councils

A Welsh Government spokesman said: "We have offered local government the best settlement possible in this ninth year of austerity, reducing the cuts councils had been expecting.

"As a result, the 1% reduction announced at the 2018-19 final budget has turned into a 0.2% increase in general funding for local government.

"This includes £3.5m for a settlement floor so no local authority faces a reduction of more than 0.3% in its core funding."

The spokesman said £4.2bn core funding was shared out according to an agreed formula, taking into account "a wealth of information about the demographic, physical, economic and social characteristics of authorities, some of which can change from year to year".

Residents in Pembrokeshire towns such as Tenby face the biggest increase in council tax

Despite setting the biggest council tax increase once again, Pembrokeshire still has the lowest bills for for each type of property - £1,093 this year for Band D.

While Rhondda Cynon Taf and Neath Port Talbot will see the smallest increases, they are among the councils charging the most.

Charges for the police and - in areas that have them - town and community councils can add about £300 a year to a household's bill.

Leaders of two councils - Powys and Vale of Glamorgan - faced rebellions from within the ranks of their own groups and only saw their budgets passed at the second time of asking.

Report collated in conjunction with the Local Democracy Reporting Service.

- Published7 March 2019

- Published21 February 2019

- Published24 October 2018