Tax and public spending gap narrows in Wales

- Published

- comments

Wales’ total deficit is projected to continue to fall as a share of the economy

The gap between the amount people pay in taxes in Wales and what they get back in public spending has narrowed in the last three years, largely due to spending cuts, a new study says.

Wales generates less money in taxes than it gets back from the UK Treasury.

Capital spending per person in Wales was 4.8% lower than the UK average, according to analysis by Cardiff University's Wales Governance Centre.

Spending on transport, science and technology has been particularly low.

The research for the Wales Fiscal Analysis project, analysing Office for National Statistics (ONS) data, shows public spending in Wales was £14.7bn more than the total amount of taxes collected in 2016 - whereas this year the gap was £13.7bn.

The narrowing of that gap is not because people in Wales are earning more and paying more taxes, rather because public spending has declined and is 10% lower than in 2009-10.

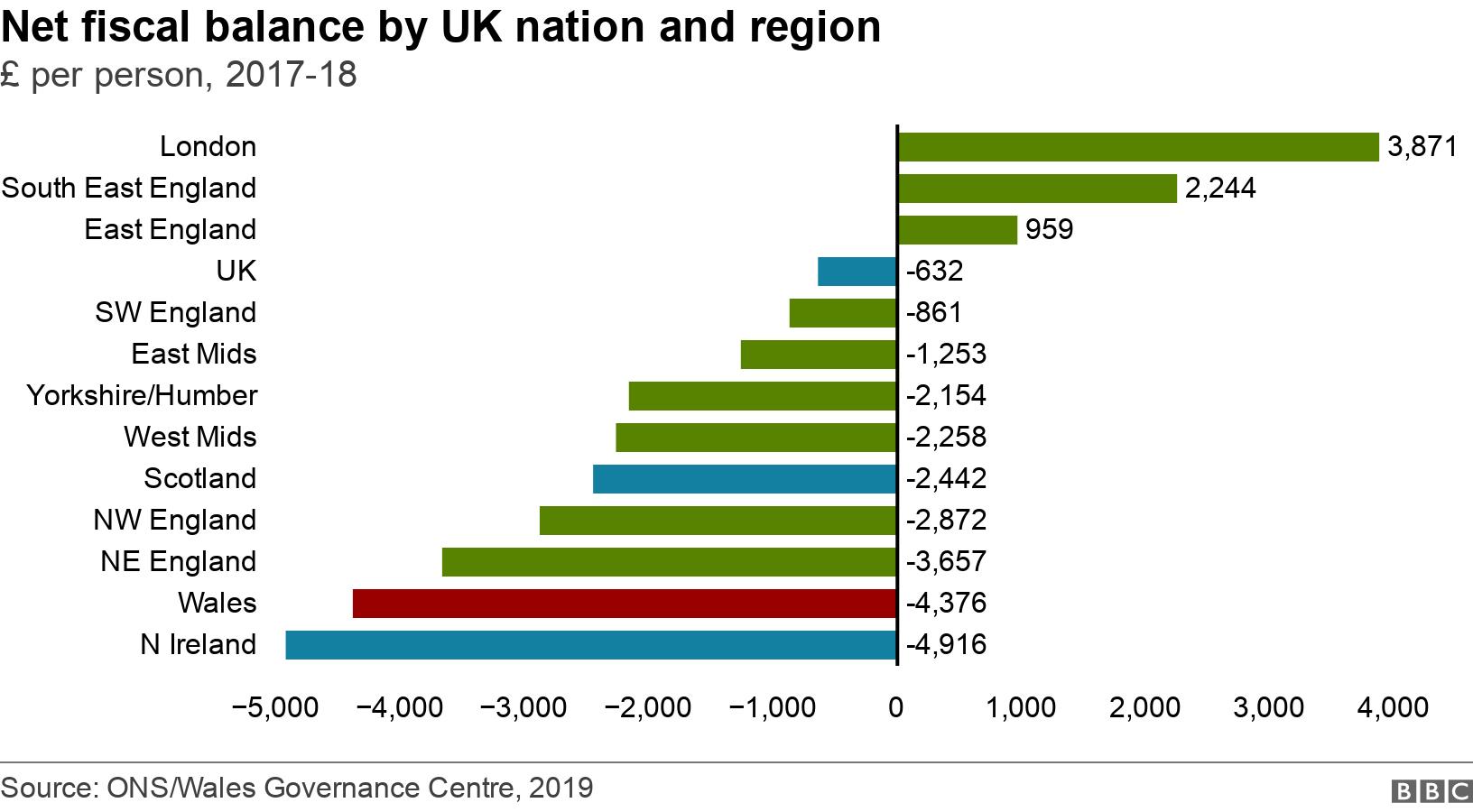

All UK nations and regions, except London and the south east, pay less into the Treasury than they get out because the UK economy is very centralised.

They therefore have a gap or deficit. The widest gap is found in Northern Ireland, with Wales coming second.

"While these results are based on ONS estimates, there is no escaping the fact that historic factors have led to the Welsh economy and tax base being far weaker than that of the UK as a whole," said Dr Ed Gareth Poole, academic lead of the Wales Fiscal Analysis project.

Public spending per person in Wales reached a peak in 2011-12.

The report forecasts it will return to that level in 2023-24 but it must be noted that is uncertain because we do not yet know the new Chancellor Sajid Javid's plans for public finances nor the outcome of Brexit.

The Welsh Government now raises its own taxes too but not as much as it spends.

The report says that this financial year, of the expected £29bn raised in revenues, 17.5% will come from taxes collected by Welsh and local governments. However they spend 55% of all the public spending in Wales.

Dr Poole believes the research could be "invaluable" in playing into debates about how Wales should be funded after Brexit and also into discussions about independence.

- Published4 April 2016

- Published21 July 2019

- Published21 July 2019