Coronavirus: What is changing with land transaction tax in Wales?

- Published

No tax will be due on sales of homes costing under £250,000 in Wales

Buyers of homes in Wales costing less than £250,000 will not pay land transaction tax.

The temporary cut applies from 27 July to the end of March 2021.

The tax will still apply to more expensive properties, and to all second or buy-to-let house purchases.

It means there are now holidays on property sales taxes in each part of the UK.

The chancellor announced a stamp duty holiday for England and Northern Ireland in his Summer Statement on 8 July, which came into immediate effect.

Scotland announced plans for a similar scheme the following day.

Do we pay stamp duty in Wales?

Stamp duty is a tax paid by people buying properties, although it varies slightly across the UK.

In Wales, stamp duty is devolved. It is known as the land transaction tax (LTT).

The new system was announced by the Welsh Government in October 2017 and came into force in April 2018.

How much do we pay in Wales?

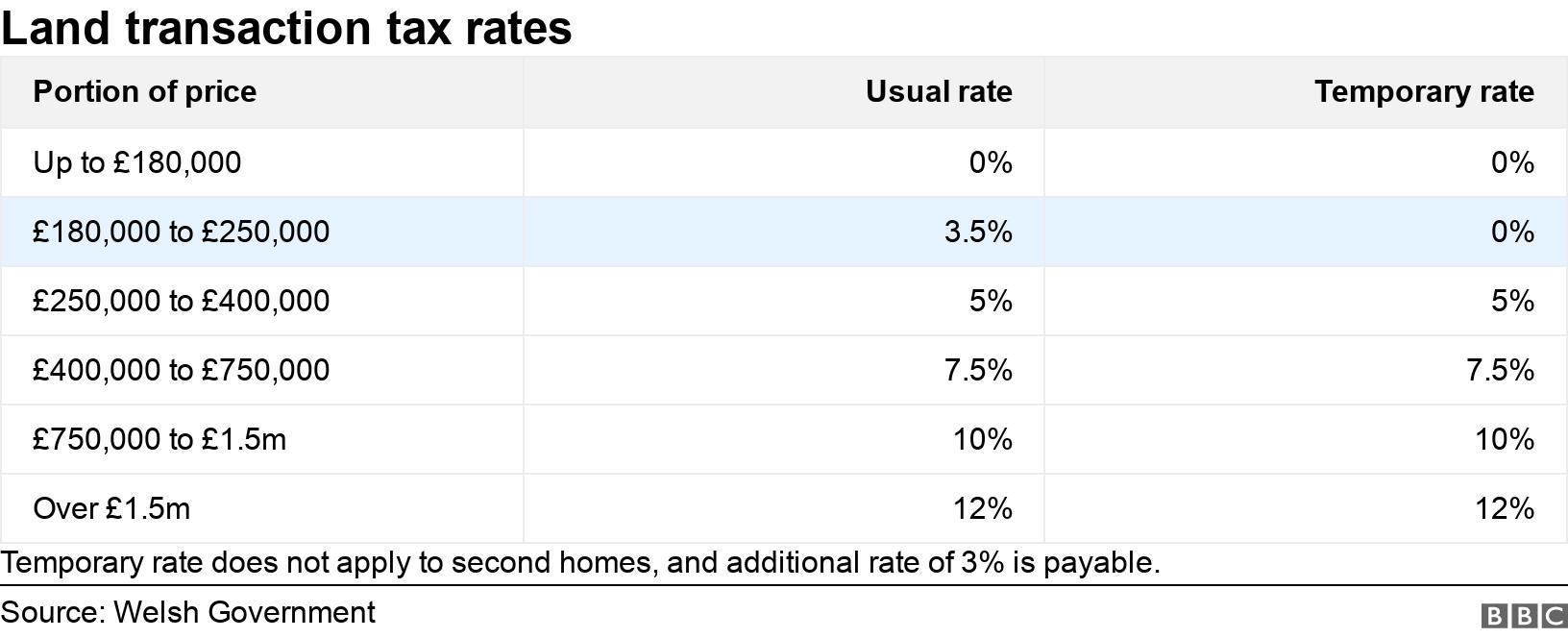

No tax is paid on the first £180,000 of a property.

Until 14 July, it had increased to 3.5% up to £250,000 and 5% up to £400,000.

However payment of tax on properties up to £250,000 has now been waived until 31 March 2021.

First-time buyers in Wales don't get any discounts or exemptions on LTT.

Under the system before the payment holiday was announced, in Cardiff, where the average property price is £216,063, the buyer would have paid £1,262.21 in tax.

In Monmouthshire, which has the highest average house prices in Wales at £275,656, buyers would have paid £3,732.80.

But on Anglesey, where the average house price only just eclipsed the previous threshold at £180,505, the LTT would have amounted to only £17.68.

What about buy-to-let and second homes?

Those looking to buy second homes or buy-to-let properties in Wales have to pay an extra 3% in LTT on top of the tax payable for their band, external. There is no exemption being made for these properties.

What are the house prices like across Wales?

The average property price in Wales falls under the threshold for Land Transaction Tax

The average price of a property in Wales is £161,719, which falls under the pre-holiday threshold for LTT.

The cheapest properties can be found in Blaenau Gwent, at an average of £87,977.

Monmouthshire house prices are the highest across Wales, at an average of £275,656. As the county borders England, the changes to stamp duty announced for England could have the biggest impact here.

- Published14 July 2020

- Published2 April

- Published9 July 2020

- Published10 June 2020

- Published3 January 2020

- Published13 May 2020

- Published2 June 2020