Coal Exchange: Calls to save 'shamefully neglected' building

- Published

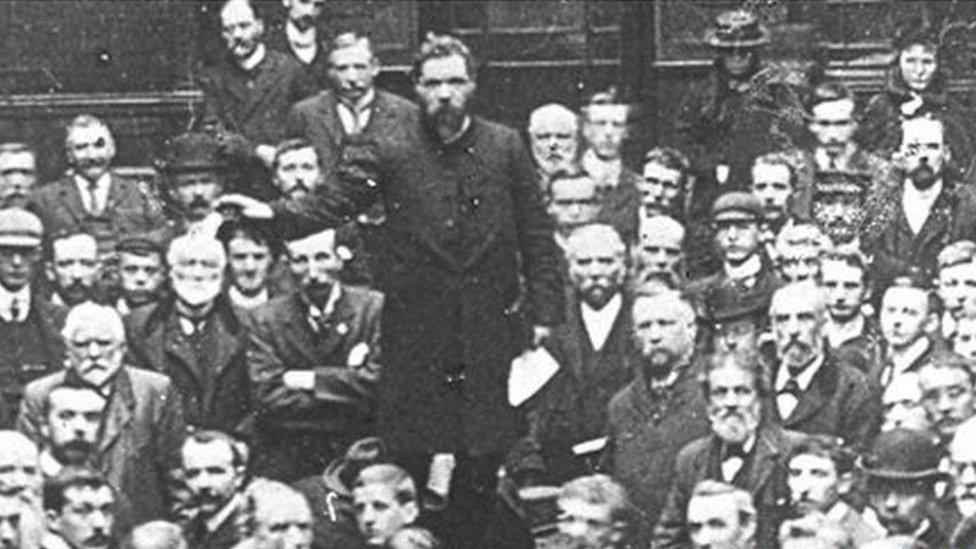

The 173-bed Exchange Hotel opened in 2017

Cardiff's Coal Exchange should be rescued by the Welsh Government, heritage campaigners have said.

After a £40m revamp the building, where the world price of coal was once set, reopened as the Exchange Hotel in 2017.

But the company that owns the building, Signature Living Coal Exchange, went into administration and has now been placed in compulsory liquidation.

Cardiff Civic Society and Save the Coal Exchange said the Grade II* listed building, external was "shamefully neglected".

In a letter to the first minister they said the building, on Mount Stuart Square in Cardiff Bay, had been "treated as a liability rather than a cultural asset".

The letter ends: "Its future once again hangs in the balance and there is now a unique opportunity to step in - please act to give the Coal Exchange the future it deserves."

Nick Russell of Save the Coal Exchange said: "We would like to see a coalition of Welsh Government, Cardiff council and community groups working together to find a solution for the future of the Coal Exchange.

"The next phase, whatever that might be, needs to be on a sound financial footing from the outset, with a sustainable business model, otherwise any solution may only be temporary."

Nerys Lloyd-Pierce, who chairs Cardiff Civic Society, said: "That the building has been treated so shabbily is a travesty.

"Practically anywhere else in the world, such a significant building would have been lovingly restored."

The first £1m cheque was signed at Cardiff's Coal Exchange

Signature Living Coal Exchange went under owing about £25m, including more than £1m to Cardiff council and about £12m to individual bedroom investors.

The largest creditor, Albendan Limited, is owed £10.6m.

Administrators Wilson Field wound up the company and placed it in compulsory liquidation, saying it was "onerous and unsaleable" and that they believe they could not recoup any money for creditors.

It is understood the matter will either pass to an official receiver or a private insolvency practitioner.

In their administrators' report released at the end of June, Wilson Field said the hotel was in "a poor condition" and insurers had identified "significant health and safety risks and potential structural issues" on the site.

Due to this, the report stated they had been unable to insure the building.

It said it was spending £70,000 a month to keep the building safe, including keeping security on site and paying for scaffolding which was "integral to the structure".

Any trading of the hotel would not be viable, according to the report, due to the costs it would incur.

A spokesperson for Wilson Field told BBC Wales: "The former joint administrators have made every endeavour to achieve a sale of the hotel and this is reflected in the huge amount of time they and their team have spent on the case.

"The decision to vacate office was not taken lightly and it is with regret that a better outcome could not be achieved for the company's creditors.

"That being said, we are hopeful the official receiver or any subsequent liquidator will be able to achieve a better result for the company's creditors."

The alcohol licence for the hotel lapsed when the company entered administration but application to renew it was made to Cardiff council in the name of Eden Grove Properties Limited on 3 August.

The director of the Cwmbran-based company is former Cardiff councillor Ashley Govier.

The Exchange Hotel's Facebook page has changed its name to The Coal Exchange Hotel and has posted that it will be reopening very soon, adding that it was no longer part of the Signature Living group.

A spokesperson for Cardiff council said: "We are aware of the ongoing developments in relation to the Coal Exchange and the decision of the existing administrator.

"We are also aware of the continuing interest in the building from investors which could potentially lead to the completion of the hotel.

"The council has only ever been interested in helping facilitate a sustainable future for this important and historic building."

- Published23 January 2020

- Published12 May 2020

- Published20 May 2017