Covid: 'I've relied on parents to keep my family afloat'

- Published

Andy Stonely is not eligible for the UK government Covid support scheme

A father who has lived on Universal Credit since the Covid-19 pandemic started has called on the UK government to be "more flexible" with its support.

Driving instructor and dad-of-three Andy Stonely is not eligible for the government's Covid support scheme.

The Federation of Small Businesses Wales has also asked for changes ahead of the next round of grants.

The Treasury said its Self-Employment Income Support Scheme, external was "one of the most generous in the world".

This scheme requires claimants to show accounts for the 2018-19 year as well as 2019-20.

However, Mr Stonely from Newport hasn't been self-employed for long enough to qualify - so the 35-year-old has had to rely on financial support from his parents.

"I count myself somewhat lucky because I have been able to claim for Universal Credit," he said.

"But obviously it's minimal and luckily through the help of parents I've been able to keep afloat.

"It's been tough. It would have been ideal if the government was just slightly more flexible."

Mr Stonely, who hasn't been able to work for much of the past year due to lockdown restrictions, said Universal Credit was worth "less than half" of his normal earnings.

Driving school firm owner Gareth Denny said almost a quarter of his drivers can't claim Covid help

The coronavirus crisis forced his wife to give up her job to look after their three children, aged three, six and 17, when Mr Stonely was able to work for a short period at the end of the initial lockdown period.

Asked how much longer his family could sustain itself if the current restrictions continue, Mr Stonely told the BBC's Politics Wales show: "Not too much longer… we're going to be in a very tough situation."

Mr Stonely is part of a local driving school franchise managed by Gareth Denny, who said 11 of his 43 instructors were in this position.

"If you imagine that somebody lives their life to their income and suddenly there's absolutely no income to pay their mortgage and their bills, Universal Credit simply doesn't pay most people's mortgage," Mr Denny said.

'Struggling'

Recent research, external commissioned by the Community and Prospect trade unions and the Federation of Small Businesses found 53% of self-employed people across the UK had lost more than 60% of their income since the pandemic began.

In addition, 64% of people said they were now either "unsure" or "less likely" to want to be self-employed or freelance in the future.

"These are normal people who have mortgages, families to support, who've just had to fund a Christmas for the families," said Ben Francis of Federation of Small Businesses Wales.

"All those bills are now mounting up the other side of Christmas, and after having an already extremely difficult 12 months, they've now got to see how they manage through the months ahead.

"We would ask UK government to be flexible in their approach to verifying the statuses of these newly self-employed businesses."

The Community union warns with small businesses "struggling to get back on their feet", more people will leave self-employment.

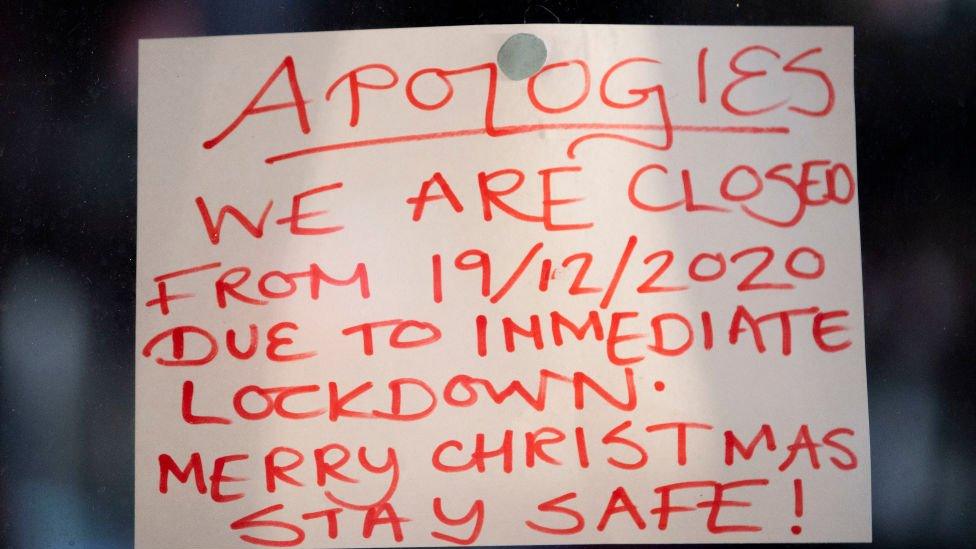

All non-essential businesses shut in Wales just before Christmas

"That will be a disaster for our economy, for local economies, for their livelihoods and their families," said Kate Dearden of Community.

"This section of the UK workforce plays a fundamental role and should be properly supported to continue to do so."

The Treasury has already committed to extending the Self-Employment Income Support Scheme until April 2021, although the eligibility criteria for the next round of grants is yet to be published.

A spokesman said the scheme had "helped more than 2.7 million people so far, claiming over £13.7bn".

He added: "Funding is designed to target those who need it most and protect the taxpayer against fraud and abuse.

"Those not eligible may still be able to access our loans schemes, tax deferrals, mortgage holidays and business support grants."

Watch Politics Wales on BBC One Wales at 10:15 GMT on Sunday 10 January or catch-up on iPlayer

- Published3 March 2021

- Published2 November 2020