Budget 2021: Welsh businesses share their reaction

- Published

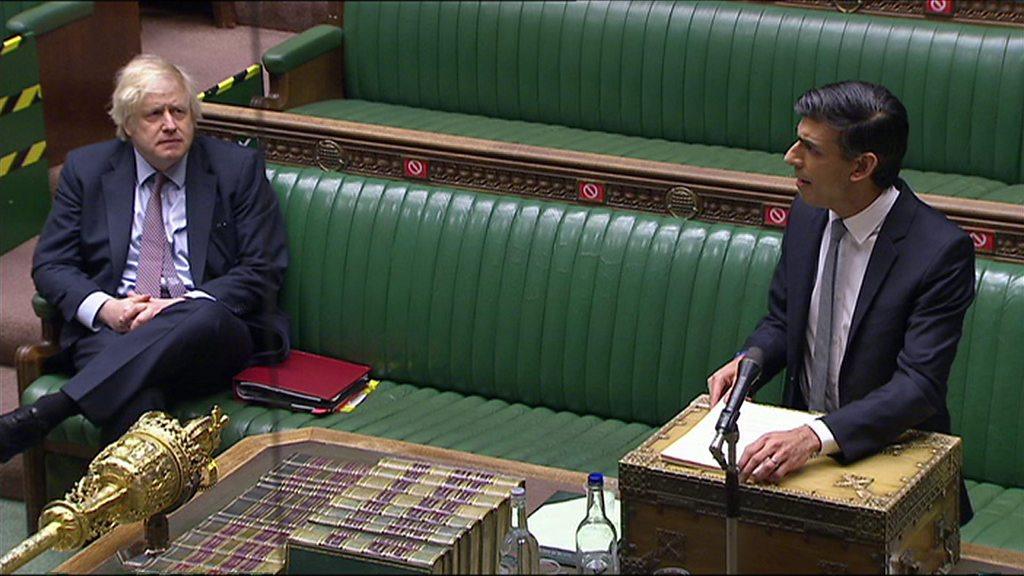

Chancellor Rishi Sunak has promised extra funding for Welsh public services

Many Welsh businesses keep a close eye on UK government Budgets.

But this year they have been watching even more closely at how the chancellor plans to navigate the UK economy out of the coronavirus pandemic - and how the Welsh government will respond.

Rishi Sunak announced he would raise corporation tax in April 2023 from 19% to 25%, except for smaller companies with profits of less than £50,000.

There will be no changes to rates of income tax, national insurance or VAT. On the latter, the rate of 5% remains in place for the hospitality sector until September and then rises to 12.5% for six months.

Business rates holiday for firms in England will continue until June with 75% discount after that. The Welsh government said hospitality, retail, leisure and tourism would get full rates relief in Wales for another 12 months.

Here's what some businesses in Wales wanted and their reactions to what they got.

'Reasonable'

Karen Matthews, chairwoman of the Cardiff Hoteliers Association, said it was well-documented the hospitality industry had been "severely hit" over the past year.

"We employ 15,000 people within the city in the tourism industry and we have seen some job losses across that, but with the support of the government schemes we've had so far, thankfully we've been able to retain most of them.

What she hoped for:

Furlough scheme extended until September

Repeat of business rate holidays

What she got:

Furlough scheme extended until September

Repeat of business rates holidays until the end of June in England, with Wales opting for a further 12 months

Verdict: "I think it was reasonable.

"I think it was good to see the extension of furlough until September, however, there is still a worry with the employer contributions increasing in August and September because as well as having those contributions, we've also got employer's national insurance contribution on top of that.

"There'll be some businesses who won't be back on their feet, so there's a bit of a worry there and it's not quite as generous as we'd have hoped.

"For the VAT cut to remain at 5% until the end of September and then not as generous as we'd hoped to see continue through to the rest of the financial year, 12.5% is still a reduction for us so once business starts to trade again then we'll see a benefit from that."

'Fears recognised'

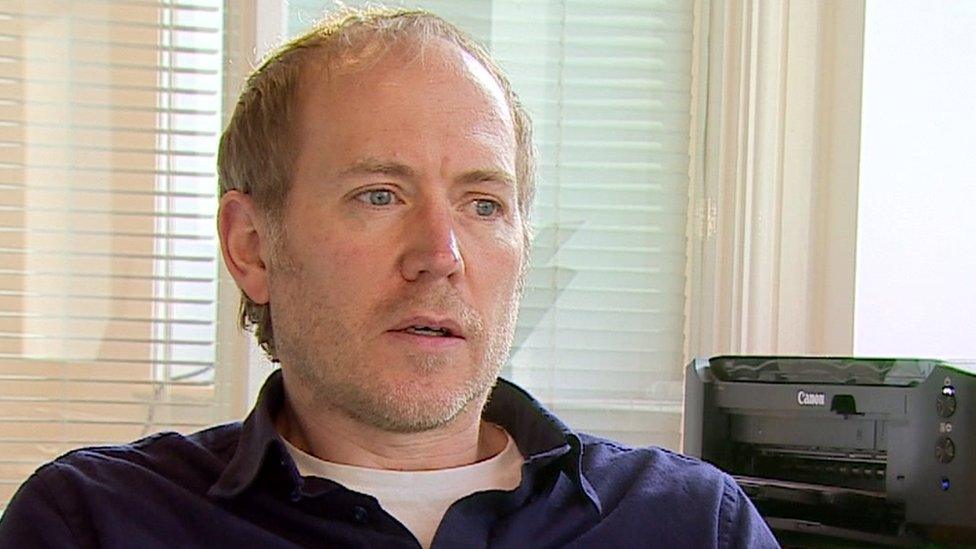

Richard Selby is director of steel manufacturer Pro-Steel Engineering.

"We've got to move from a point where the chancellor has been helping people to survive and get by, into opportunities for businesses to actually start moving forward, contributing to society and earning the money that's available from government contracts rather than just being given a handout," he said.

"We're in a key point where businesses like ours are looking to reinvest in our equipment and in our people so we can be more sustainable going forward."

What he hoped for:

No tax rises in the short term

More support for young people, education and training

What he got:

No tax rises in the short term

"Super deduction" on tax for companies when they invest

Verdict: "I think the chancellor has listened to business and has come up with a Budget as we expected which raises taxes but he's done it in a considered manner which businesses can prepare for.

"I think he's recognised the fears people like myself had for reinvesting money in our business is catered for within the Budget."

On the super deduction, he added: "That's the one thing that pricked my ears up - what can we do with that?

"Certainly digesting the details over the next few days, we'll be looking at our future investment plans of perhaps how we can become more productive in the business and that might help our sustainable growth going forward."

'No surprises'

Colin Cuthbertson, manging director of Data Messaging & Communications, expects some changes will not have too much of an impact.

"Being in the telecoms industry we've not been as badly affected as some businesses have been, and the support we've had is mainly from the small business rates relief," he said.

"We've been quite busy so we've needed all hands on deck. We're a small team anyway so we've been able to keep going as normal."

What he hoped for:

Support for small businesses affected by the pandemic, such as leisure or retail

What he got:

Furlough scheme extended until September, business rates relief and VAT remaining at 5% for hospitality

Verdict: "Nothing has really come as a surprise to me.

"I think the support for businesses most affected by the pandemic is welcome - things like the extension to the furlough scheme is going to help a lot of our customers who are affected.

"I think the restart grants are going to help businesses which have had to close down during the pandemic, and the business rate holidays.

"The corporation tax rise over time is something that I felt was inevitable. It's not necessarily going to affect my company as much as it will affect larger companies, but I think it's probably a fair increase and plan."

- Published3 March 2021

- Published3 March 2021

- Published3 March 2021

- Published3 March 2021

- Published3 March 2021