Second homes: Tax hikes make holiday lets in Wales unviable, owners say

- Published

Holiday let business owners say tax rises will make their businesses unviable

Holiday-let businesses in Wales will become unviable if planned law changes go ahead, owners have said.

The Welsh government plans include a 300% council tax premium on second homes and making it harder for those properties to be eligible for business rates instead of council tax.

Some holiday home owners said they face losing their livelihoods.

The Welsh government said the changes would ensure properties were being let regularly as holiday accommodation.

Currently, second home owners can avoid council tax by registering their properties as a business, as long as those properties are let for 70 days per year.

Following the proposed changes, this number would increase to 182 days per year to qualify for business rates.

The Welsh government has been under pressure to act following protests in holiday hotspots, and it plans to introduce the new legislation in April 2023.

Julia and Peter Hindley run a B&B and holiday let business near Crickhowell

'There isn't a scenario where we can survive'

Peter and Julia Hindley have run a holiday let business with six cottages and a B&B at their home in Llangattock, near Crickhowell, Powys, for 10 years.

They said the cottages are currently occupied for about 105 nights a year because they close for winter maintenance and because they want to lower their carbon footprint.

Mr Hindley added: "We run a profitable business here, it's not about how many nights you book, it's about how much profit you make."

He said increasing their occupancy to 182 nights a year would lead to higher VAT and business rates.

"We've looked at all the options and we've taken advice and there isn't a scenario where we can survive- it doesn't exist- and that's because of the taxes.

"As soon as we start to grow beyond this current size we're clobbered by taxes and it becomes unviable."

'It makes me want to cry'

Ms Hindley said: "It makes me want to cry. We're losing our home and all that we've worked for.

"At the moment our next 15 to 20 years is all in jeopardy.

"We've been through all the pandemic and coped with that and done everything right and then just as we're coming out of that this has been announced. It makes you feel awful."

Mr Hindley said he was "angry and disappointed" with the Welsh government, saying they "said that genuine businesses won't be included, well that's completely untrue. We're a genuine business and yet we will be affected."

There were 24,873 registered second homes in Wales at the start of 2021

Councils in Wales are allowed to double the cost of council tax on second homes.

Under the new scheme, councils would be allowed to make second home owners pay four times as much council tax as other residents.

Powys council does not currently charge the full 100% premium on second homes, instead charging a 75% additional levy.

'I'll have to close down'

Paul Martin, who runs a similar business in Powys, said the 182 day occupancy threshold was unachievable outside the most popular holiday spots.

He said: "182 days is not half a year, the actual season runs from March to October so 182 days represents 75-80% of possible occupancy which is absolutely impossible to achieve anywhere apart from in the very very best locations.

"Normally tax is paid on profit so you pay a percentage of your profit but this council tax is a fixed charge just for opening for business so before you even start the year you're already in debt that you cannot recover from so it's not viable. You'd have to close. I'll have to close down."

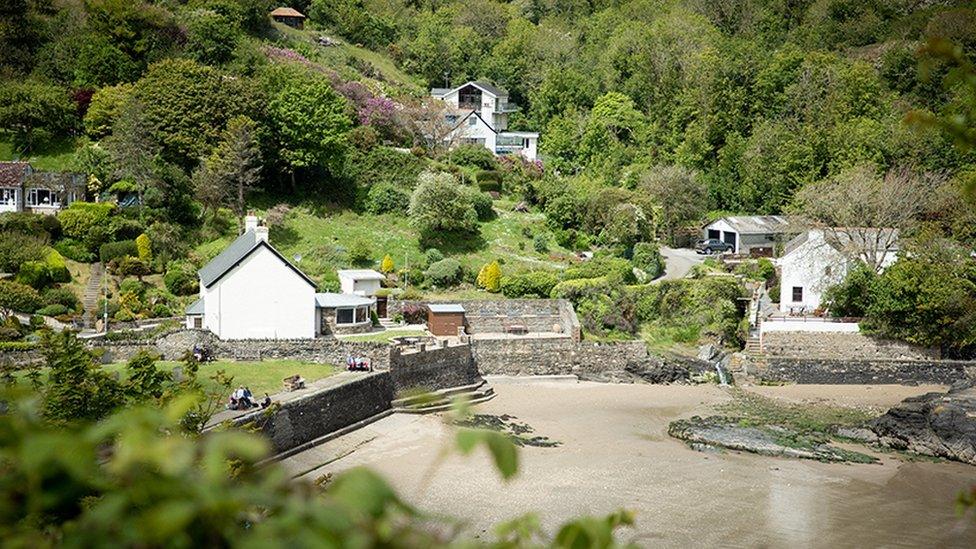

There have been numerous protests against second home ownership in Wales in recent years

Mr Martin's cottages are converted outbuildings on his property and are rented to a charity for disabled children on weekends and school holidays.

He said closing his site could put more pressure on housing in the village.

"If you buy a house in the village and it used to be lived in by someone and you turn it into a holiday let then someone's lost a home," he said.

"But these cottages were never lived in, they're part of my home.

"If I'm forced to close then other properties would have to offer the services I provide here, putting more pressure on the housing in the villages."

He added he felt like he was going to be "taxed into oblivion" and it was "quite punitive to try and treat all holiday lets as if they are second homes".

James Evans said there were problems with second homes, but the Welsh government was introducing a "poor policy"

James Evans, Conservative Member of the Senedd for Brecon and Radnorshire, said he had been "inundated" with emails about the changes, and referred to the legislation as "using a sledge hammer to crack a nut".

He said: "This is a poor policy. This is the Welsh government thinking they can solve a problem just by taxing their way out of it and it's not right and it's not right for our genuine businesses across Wales."

The Welsh government said: "The change in criteria is intended to ensure the properties concerned are being let regularly as holiday accommodation businesses.

"We consulted on the policy approach last year and are currently analysing the responses to the recent technical consultation on the planned changes."

BORN DEAF, RAISED HEARING: Jonny Cotsen explores what it means to live in two different worlds

MARGINS TO MAINSTREAM: Michael Sheen introduces new writers revealing their truths

Related topics

- Published2 March 2022

- Published4 May 2022

- Published6 April 2022