Energy bills: Fears power cuts will switch off nebuliser

- Published

Susan and Paul Clifton would be "up the creek without a paddle" without his disability payments

"If I didn't laugh, I'd cry but there's no point - it's not going to get me anywhere."

This is Susan Clifton's verdict on the coming storm that energy prices and cost of living rises are bringing to many people as the winter approaches.

The 67-year-old pensioner has all her costs planned out on a spreadsheet that runs through to next spring, and has to hope no unforeseen emergencies arise.

Annual energy bills are predicted to rise by 80% to £3,549 come October.

It follows the raising of the energy price cap, external, in part because of a cut in the supply of gas from Russia to Europe.

Costs could reach £6,000 for the average household per annum by April.

The new Conservative leader has been announced as Liz Truss and she will take office as PM on Tuesday.

The new PM is expected to be given a series of options this week by Whitehall to help struggling households cope with the soaring energy bills, one of which includes a freeze on energy bills.

For Susan, from Crynant, Neath Port Talbot, the rising cost of living means rigidly documenting how much her fuel bill will be each week and budgeting for it all the way through to next spring.

"I'm putting £75 a week aside [at the moment] for gas and electric," she said.

"When it goes up in October, it will be £80, and then I've put it up to £110 come January. Then £105 in April so that will be a bit less, but the heating will go off then."

Susan lives in a two-bedroom housing association bungalow with her husband Paul, who is also 67, has chronic obstructive pulmonary disease and needs to use a nebuliser four times a day to help his lungs function.

Worried about energy bills? The BBC's Colletta Smith tells you - in a minute - about four discounts and payments that could help

As the machine is run off the mains, Susan worries about what will happen if there are power cuts this winter.

She has also made plans for this eventuality.

"I'm ordering a bottle gas cooker and extra bottles, and candles and solar and rechargeable batteries. If we get a power cut I'm really worried because he relies on his nebuliser four times a day," she explained.

"If he didn't get on it four times a day, he starts filling up with fluid and can get pneumonia which he's had twice. In our old place it was very damp. I nearly lost him last time.

"We were waiting four years [to move]. We got offered this while he was in hospital with the second bout of pneumonia."

No impulse buys

The improved housing is a big relief but it has not relieved the strain increased costs are now putting on her budget.

When she goes shopping, there is no room for impulse buys.

"Literally everything has to be written down. I have never been so anal," she said, managing a laugh.

But she added: "I've stocked up on tins in case there's snow and I can't get to the shops as I need to catch public transport. I've got a barbeque in case the power goes.

"The only thing I can't plan for is his nebuliser."

Any emergencies will wipe out her small amount of savings, which she has already had to defer spending because of the fear of not being able to cover bills.

She said: "If we didn't get personal independence payments [for Paul's disability] we'd be up the creek without a paddle. It's being used for food and things like that and it's not supposed to be used for that. It's supposed to be for him, for his [disability] needs."

'There's nothing more I can do'

Jean Davies wonders if her small savings will survive rising costs if she lives for another decade or two

Jean Davies, 70, is another retiree who tried to plan ahead as much as possible.

A former civil servant from Brecon, Powys, she was made redundant at 58. She downsized a few years back and now lives alone in a two-up, two-down house which she spent a good part of her savings making improvements to in order to be as energy efficient as possible.

She explained: "I moved in here and I renewed everything. I had a new roof, new windows, a back and front door.

"I'm as tight and cosy as can be for saving energy. There's nothing more I can do."

Although she is managing at the moment, she worries what the soaring costs could do to her finances if they persist into the future, with talk of annual bills of £6,000.

"I have a small pension of under £1,000 a month. I'm 70 - I could live to be 80 or 90. The small nest egg I've got is going to be depleted at that rate."

To keep her costs down, she keeps the radiator in the second bedroom turned off. She shops at budget supermarket Aldi, always cooks two meals at once, doing double helpings of potatoes or peas, and only puts the washing machine on when she has a full load.

She got rid of her car a number of years ago when "the MOT would have cost more than the car was worth" and is thankful for her senior bus pass, which at least enables her to visit friends and family for free.

"It's hard to know what to do to cut it down [further]. I am being as careful as I can," she said, adding she feels for people with children who have "multiple loads of washing to do, school uniforms to buy".

"I wouldn't have the heating on all the time. I'm one of 10 children. I was brought up with no gas or electric heating and I never have the heating above 20C," she said, adding she knew how to dress to stay warm in the house.

One thing which does worry her is something like a dental emergency arising. Her dentist has moved from the NHS to private practice, and having had one tooth out while it was still an NHS practice she said she would not be able to afford to have similar treatment at the private rates.

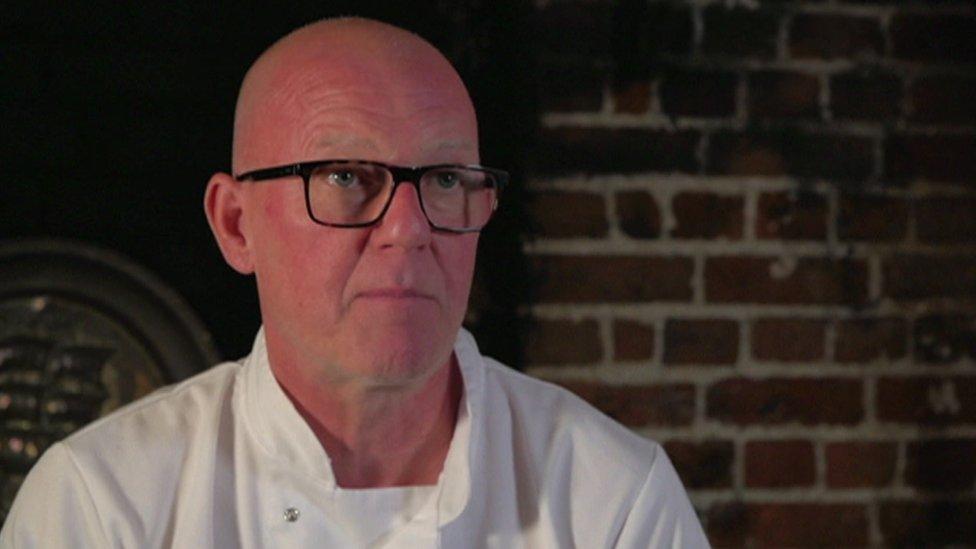

Gareth Collier has tried to make his house as energy efficient as possible

In Barry, Vale of Glamorgan, Gareth Collier has long been aware of the need to make his home as energy efficient as possible.

After retiring from the merchant navy at the age of 56 in 2015 because he needed knee replacements, he had work done on his three-bedroom semi-detached house including

This included a new roof and loft insulation, double-glazed windows and a new porch.

For most of the winter, he only has radiators on in the living room and kitchen, and one in a bedroom running on a low setting.

He has a smart home heating system and will turn the thermometer down from its usual position at 20C to 13C an hour before he leaves the house and let "nature take its course".

Gareth uses smart meters to keep an eye on his energy usage, including one he can see in the kitchen.

"This year I have run a few experiments just to see consumption in certain conditions," he said.

"An electric double oven is a very thirsty item. I have a microwave, slow cooker and an air fryer and find these items much more efficient and quicker in the microwave case.

"I do economise where I can. One trick I have found is cooking hard boiled eggs off in the saucepan of my steamer set whilst steaming veg, gas hob cooking. The steamer itself is a very efficient way to cook, only one hob for all veg."

He says because he is currently on a fixed tariff with his energy supplier, he is not so worried for himself as the first round of price rises looms, but is concerned for others.

"It is very worrying for people on state pension and low earners," he said. "Help must be given quickly to these groups."

Related topics

- Published2 September 2022

- Published31 August 2022

- Published31 August 2022

- Published30 August 2022

- Published27 August 2022

- Published26 August 2022

- Published26 August 2022

- Published22 September 2022

- Published3 April 2024

- Published23 August 2022

- Published22 August 2022

- Published11 August 2022

- Published29 November 2023