Cost of Living: How much VAT do you pay on your chocolate biscuit?

- Published

Choosing a chocolate chip cookie over a chocolate covered cookie could mean you avoid paying tax

Do you prefer your biscuit with the chocolate in it, or on it?

Your answer could cost you an extra 20% on the cost of your favourite treat.

The reason? Value added tax (VAT), a tax we all pay on many things we buy, and while most food is VAT free, it does get slapped on some snacks - and being wise to its weird ways could save you some money.

The Treasury said it applied VAT relief on items including food, public transport and property rental.

Kemi Nevins ran a café in Cardiff for many years and said getting to grips with VAT rules was a challenge.

"It's a shopping nightmare, really, and you've got to be a very savvy shopper to know all the little ways of saving money," she said.

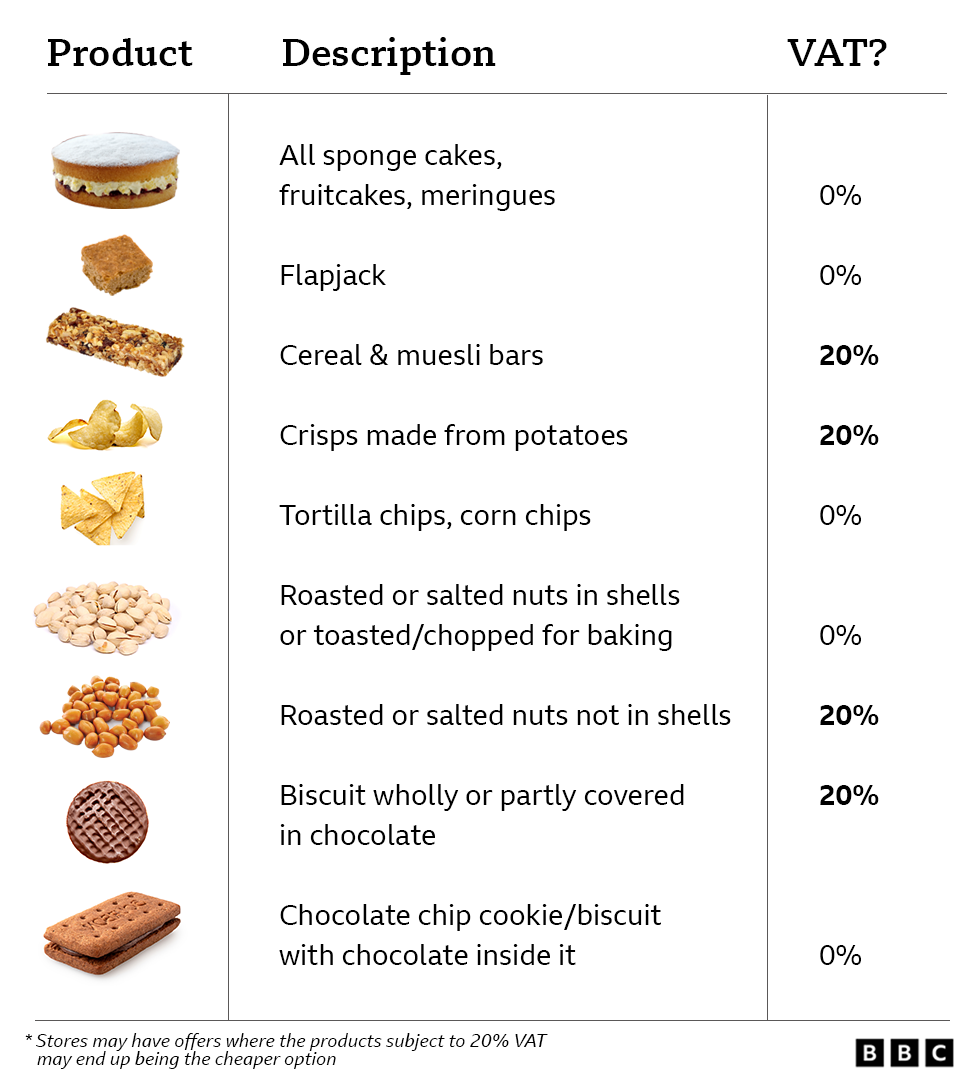

"It sounds crazy but you can have crisps made from potato which have standard rate VAT, that's 20% on top, but if you like your corn chips they're zero rated. So it's a no-brainer, get the corn chips."

Former café owner Kemi Nevins said getting to grips with VAT rules was a "shopping nightmare"

So what about biscuits? Well there is no VAT to pay on them unless they are wholly or partially covered in chocolate, in which case there is an extra 20% in tax.

But, if the chocolate is inside the biscuit, for example a chocolate chip cookie or if it is sandwiched in between two halves of a biscuit, there is no VAT to pay.

Clear as mud, or chocolate, right?

Here is a handy guide to some of the deeply confusing rules on the VAT status of some popular snacks.

Remember that sometimes stores will have offers where the products subject to 20% VAT may end up being the cheaper option - so it is always worth checking prices before you buy.

Overall in Wales we pay more VAT than income tax and for hundreds of thousands of people it is the single biggest tax they pay.

Guto Ifan, an economist at the Wales Governance Centre, has been crunching the numbers.

He said: "About 46% of adults don't pay income tax which means that inevitably they'll pay more through the VAT system."

As a tax on spending, VAT takes a bigger chunk out of the disposable incomes of the poorest households compared to the richest, though the overall UK tax and benefits system does redistribute money from the richest to the poorest.

But the debate over whether that system is generous enough to people on low incomes is a constant political debate, especially given the current cost of living pressures.

The Labour MP for the Cynon Valley, Beth Winter, wants to see changes to the entire tax system and sad VAT was particularly unfair.

"We live in a very unequal country and this indirect tax clearly impacts the poorest in society much more than the wealthy and it needs changing," she said.

MP Beth Winter said the current tax system impacts the poorest in society more

But Paul Johnson, director of the Institute for Fiscal Studies, said VAT reform on its own could not provide extra support for the poorest.

"If you want additional progressivity in the tax system, which you may well do, the VAT system is not the place to look for it," he said.

"You need to look through wealth taxes, income taxes, capital gains taxes, all those sorts of things. Or indeed through the welfare system, by increasing benefits."

The sheer complexity of VAT, which applies to most of the goods and services we buy, has led to many court cases and often makes it a magnet for ridicule as well criticism.

Choosing a chocolate chip cookie over a chocolate covered one could mean you avoid paying tax

In one case, more than 20 years ago, Lord Justice Sedley said: "Beyond the everyday world… lies the world of VAT a kind of fiscal theme park in which factual and legal realities are suspended or inverted."

VAT has been with us for 50 years and it is a now major source of income for the UK government raising £143bn in 2021-22.

In responding to calls for reform, the Treasury said: "We recognise households should not have to bear all the VAT costs they incur and apply generous VAT reliefs on items like food, public transport and property rental."

They say that means "45% of economic activity is not subject to VAT".

TALK DISABILITY: How an autism café created jobs, a safe space, and thriving community

FOOD FEST WALES: A culinary tour of Wales is on the menu!

Related topics

- Published6 April 2023

- Published15 May 2023

- Published22 February 2023

- Published7 October 2022