Domestic abuse survivor left with £10,000 debt after escaping

- Published

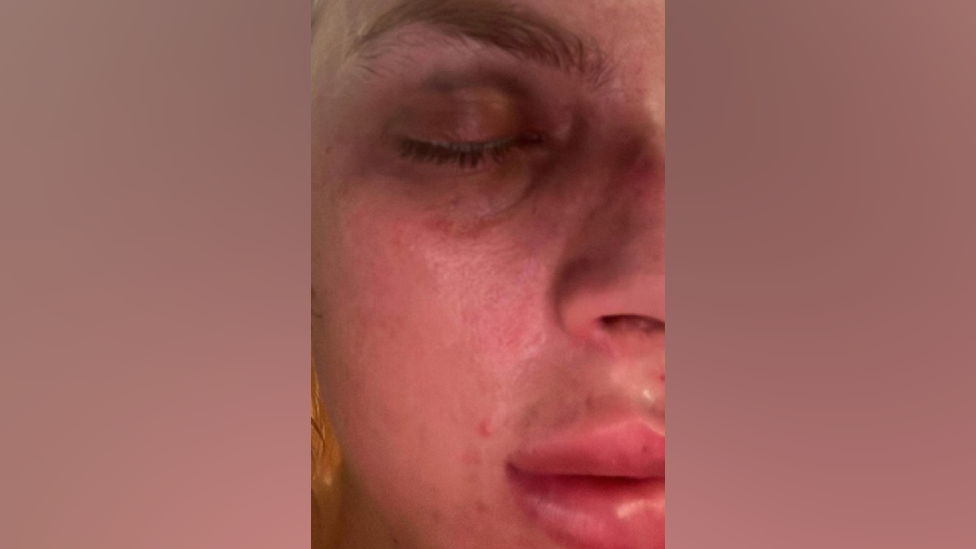

Helen said she finally left after her ex-partner started killing her pets

A woman left struggling with thousands of pounds of debt after escaping a violent partner feared getting help would allow him to find her.

Helen - not her real name - realised getting her £10,000 debt written off meant her address being published on a register of people unable to pay.

"If he could get his hands on me, he would kill me," she said.

After advice, Helen stopped this from happening and has urged others in similar situations to seek help too.

She still has nightmares and flashbacks to the abuse, which included her ex killing her pets and stopping her from eating.

Helen, in her forties, tried to end the relationship several times, but said: "He threatened my family."

"I let him back in because I was scared," she added.

"The people he knew, I mean he'd only have to snap his fingers and they'd be at my parents' house."

She described her ex-partner as having "complete control" of her bank cards and said bills were not paid.

He would also stop her from eating, she said, adding: "With domestic violence, they chip away at you until you've got nothing, you're like a shell. But then something inside you snaps."

For Helen, that moment came when he abused her pets.

"He killed one of my animals and then he killed the other," she said.

"I ran. I was barefoot. I had nothing with me. I pounded on a door up the street and I didn't know them.

"But they let me in and the police were called and then I was taken. He was arrested again."

Helen went to a refuge and moved five times to make sure her abuser could not find her.

'Taking control of money'

"Everywhere you go, everywhere you look. Sometimes I've seen people who look similar and your heart stops," she said.

She has since been diagnosed with post traumatic stress disorder, external.

While she had escaped the abuse, Helen was £10,000 in debt - some of which had been run up in her name by her former partner.

Financial and economic control is an "incredibly common" feature of domestic abuse, according to Stephanie Grimshaw of Welsh Women's Aid.

"It's all about the coercive control that the perpetrator can have over the survivor, so that's whether it's taking control of the money….or control of vital resources like food and sanitary products," she said.

Helen sought advice and decided that a Debt Relief Order (DRO) was her best option.

A DRO is a way to have personal debts written off if you owe less than £30,000, have spare income of less than £75 per month and do not own items worth more than £2,000.

It is a form of insolvency, which means that a person or a company is officially recognised as being unable to pay their debts.

Usually people recognised as insolvent have their name and address published on the insolvency register which is a public document.

But Helen was told she could apply for a court order, known as a PARV (Person At Risk of Violence) order, to stop her address appearing.

Some courts charge a fee for a PARV order application, but it is possible to apply to have the fee waived.

Helen said getting to the end of the process was a great feeling.

"It's a bit of a cliché, but it was a weight off my shoulders," she said.

A DRO is not suitable for everyone with debt problems and there are strict eligibility criteria and restrictions attached to it.

That is why debt charities encourage anyone with money worries to seek free, confidential advice.

Rhys Edwards from Citizens Advice says there is "always an option" for people with debt

Rhys Edwards, a debt advisor for Caerphilly Blaenau Gwent Citizens Advice, said help was tailored around the person.

"I've had clients with very large sums of debt, I've had clients with very little. There's always an option, no matter what your income is, no matter what your expenditure is," he said.

For Helen, life is getting better.

"I got a new flat. I signed for that in September. It's lovely. So I'm thinking all decorating ideas going round in my head at the moment and [my new] relationship is lovely," she said.

If you are affected by any of the issues in this article you can find details of organisations that can help via the BBC Action Line.

Related topics

- Published5 May 2022

- Published27 April 2023