Cost of living: How can I make extra income?

- Published

Neesha Craig explains four ways to earn some extra money

A woman who has been side hustling since she was 12 says pressure on family budgets means more people are seeking out ways to make extra income.

Neesha Craig believes "absolutely anybody" can make extra cash on the side.

She now works full-time running her website The Fun Money Club but began side hustling after learning computer coding as a child.

Recent rule changes have led to concerns about new taxes on income.

But anyone making less than £1,000 a year from a side hustle, does not need to tell HMRC, which provides guidance about when to declare additional income, external.

As a child Mrs Craig, 34, from Gorseinon, near Swansea, set up a doll building website, which was a craze in the 1990s.

"It was like a drag and drop where you'd create a doll graphic," she said.

"I ran Google ads on my website, and Google paid me."

Ms Craig needed her parents to drive her to the bank on Saturdays to pay in the cheques.

She said her parents thought she was "mad" at first for spending so much time at the computer, but when the cheques started arriving they said: "Oh, OK, we can understand now."

On her current website, Mrs Craig sets readers a challenge to make an extra £5 every day.

"If you're making 50p here and there you don't realise how quickly it adds up," she said.

Playing mobile phone games is one of her favourite side hustles at the moment.

"It's something I do in the evening anyway while watching TV, so why not get paid to do it?

"Advertisers pay platforms according to the number of people viewing their adds, so some platforms will pay players to play the games."

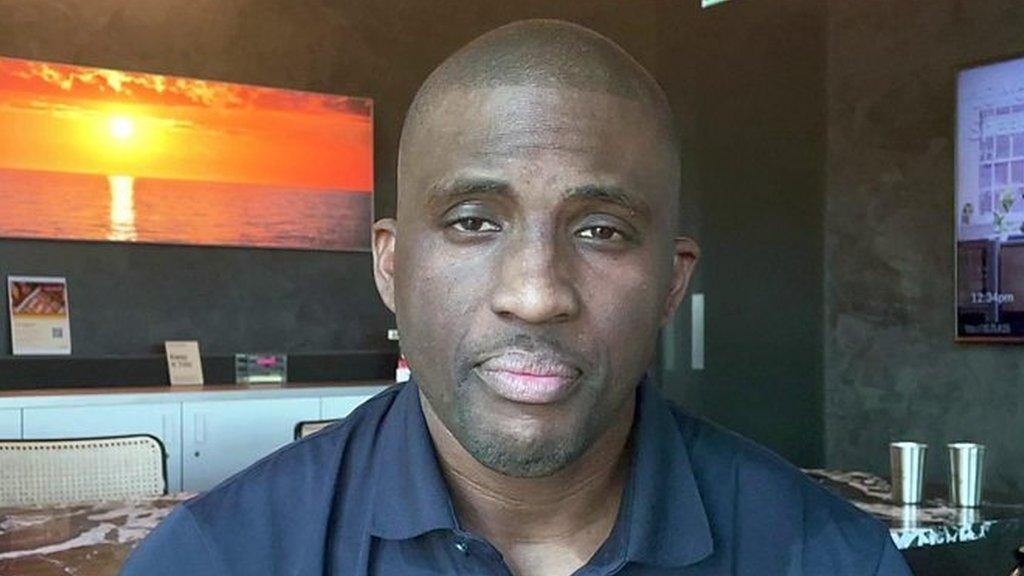

Lucy Cohen runs Bridgend based online firm Mazuma Accountants

New reporting rules were introduced by the UK tax authority, HMRC, at the beginning of 2024.

Digital platforms such as AirBnb, eBay and Vinted are now obliged to collect and provide information on sellers' transactions and income.

Lucy Cohen, co-founder of Mazuma Accountants, said for sellers - or anyone with a side gig - the £1,000 trading limit remains the same.

"So if you're selling under £1,000 every year and it never goes over that, and that's most hobby sellers, you don't have to worry," she said.

Side hustlers earning more than £1,000 in a tax year may be required to report the income via a tax return.

Emily Watts, from Barry in the Vale of Glamorgan, has been selling her unwanted clothes and household items for 15 years.

Emily Watts said people do not need to be buying more new items

Ms Watts said that buying and selling second hand goods was better for the environment and people should be "encouraged" to do it.

She was concerned that the confusion over the new rules would put sellers off.

Mrs Craig said her younger self would be amazed that side hustling would turn into a full-time job and an award winning website.

"It's not talked about in schools, you're not told about the opportunities that you can make for yourself," she said.

"I was making money at 12, and it's just something that people don't realise is possible."

TOURIST TRAP: Meet the team selling Wales to the world

FOR THE LOVE OF SPORT: The biggest names in Welsh sport and the stories behind them

- Published9 January 2024

- Published12 June 2023

- Published8 August 2022

- Published27 April 2022

- Published18 January 2019