Council tax in Wales: How much is my bill going up?

- Published

The rising cost of social care has added to council funding pressures

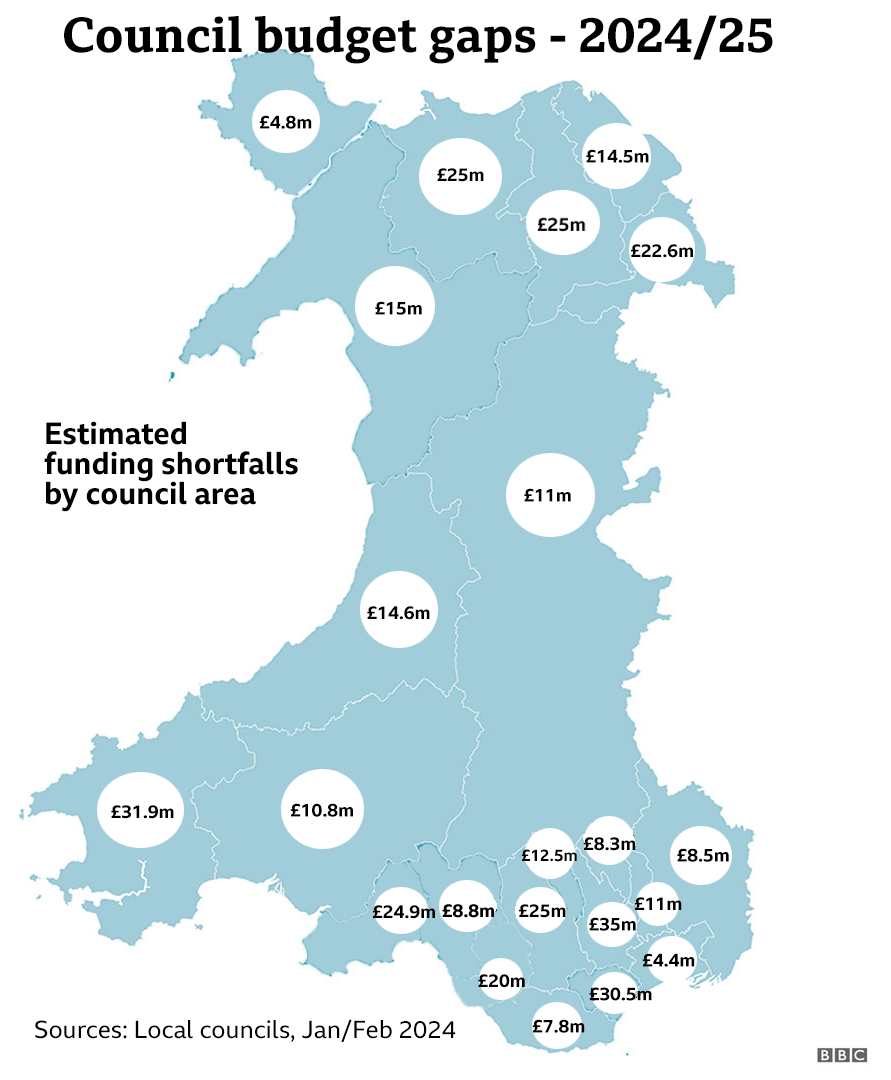

Councils in Wales face trying to plug funding gaps of around £390m in the coming year. The Welsh Local Government Association has estimated the shortfall could be as high as £432m.

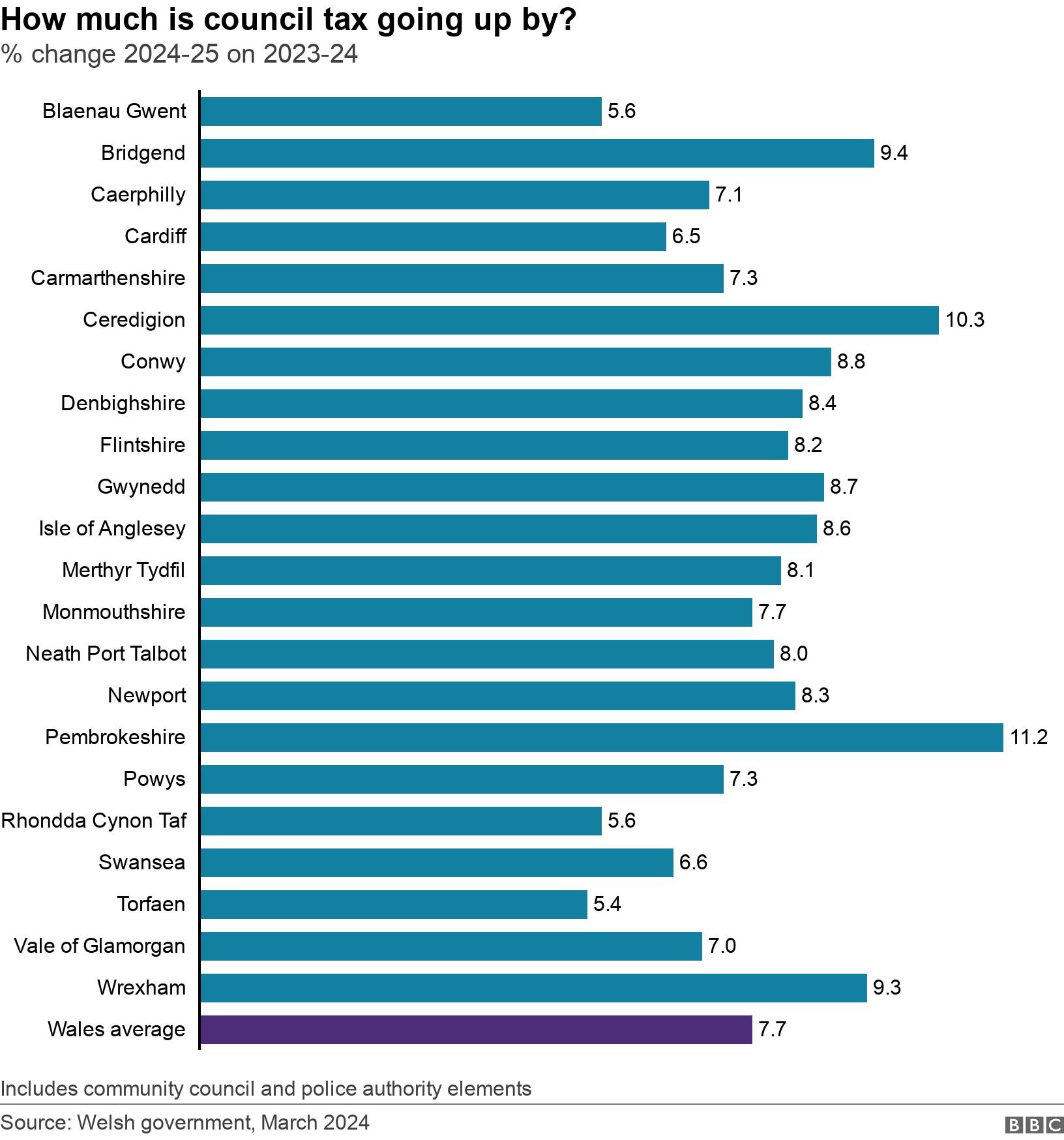

Council taxes are rising by various amounts - from around 5% in Torfaen to more than 11% in Pembrokeshire.

The average council tax for a band D property for 2024-25 is £2,024. This is an average rise of 7.7% on the previous year.

What is council tax?

Council tax is a compulsory charge on properties in England, Scotland and Wales set by local authorities to raise money to spend on providing services in their area.

Homes are graded into different bands according to how much they were worth at a certain point in time.

People with more expensive properties are in a higher category.

In Scotland, councils also have complete freedom to set rates.

In Wales councils set rates, but the government can cap council tax rises that are deemed "excessive".

Northern Ireland is not covered by the council tax system, and operates a separate domestic rating system.

How much more will I have to pay?

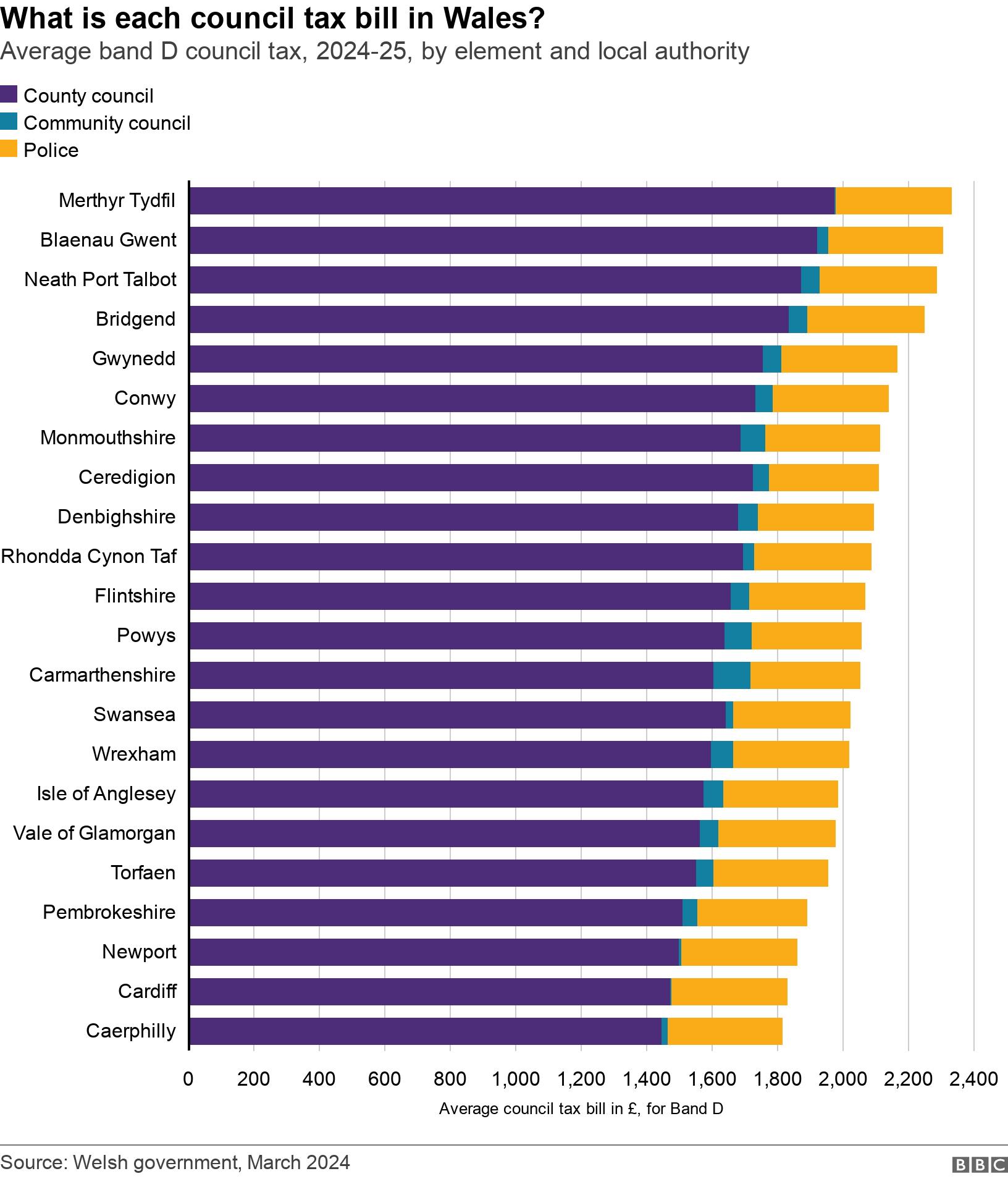

This is how council tax rises look like across Wales, including community council and police authority elements.

On average, for those living in a band D home, the rise will be £145.

The average band D bill ranges from £1,813 in Caerphilly to £2,329 in Merthyr Tydfil.

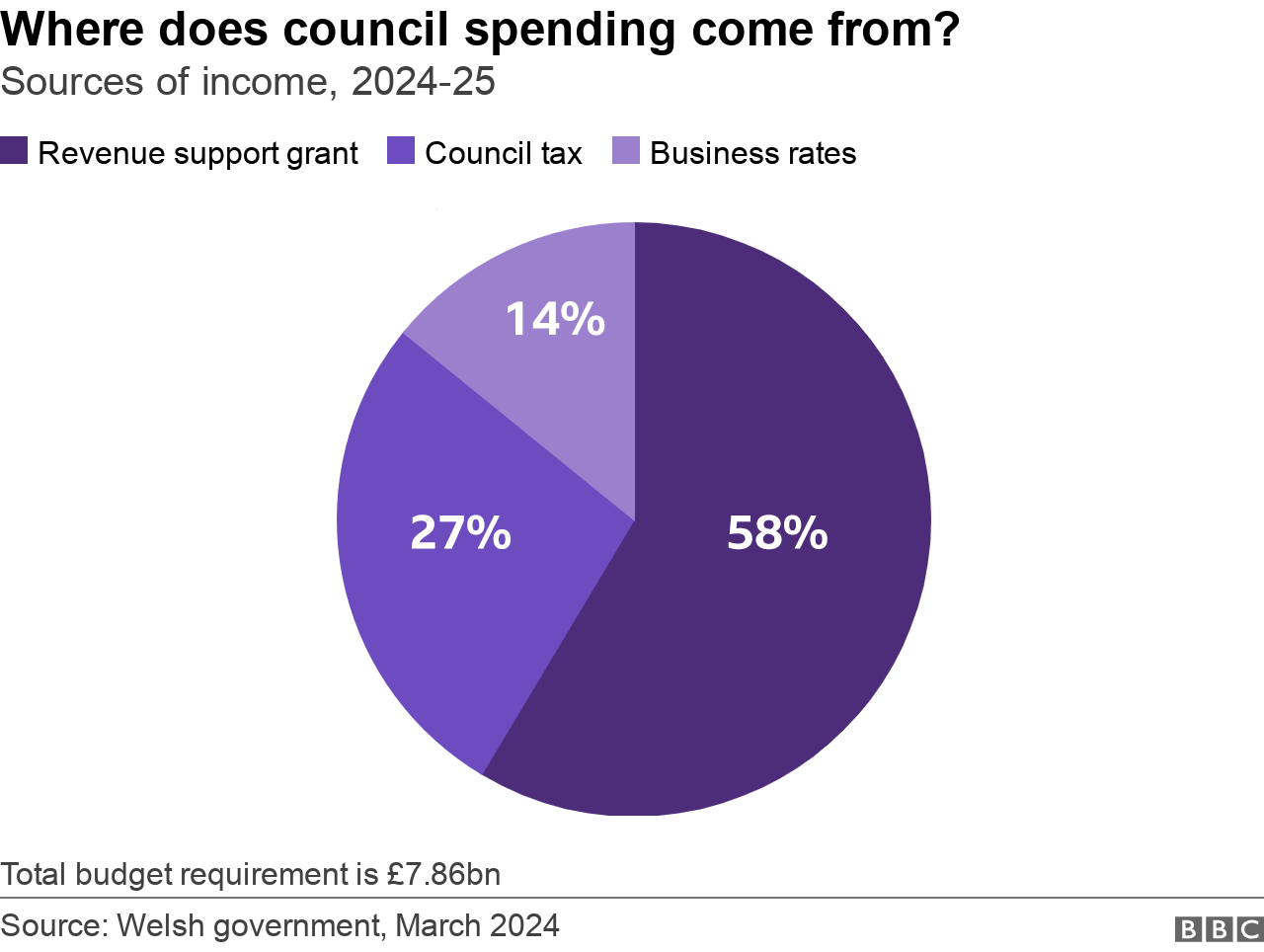

But council taxes make up only some of the money which pays for local government services, which range from social care, education to waste collection and libraries and leisure centres.

Who pays council tax?

As a general rule, anyone who is over 18 and owns or rents a home has to pay council tax.

It is the responsibility of the tenant, not the landlord, to pay council tax.

Some exceptions and discounts apply and include:

If you are in a property solely occupied by students

If you work away from home and your property is empty, you can get a 50% discount

If you live alone, you get a 25% discount

The Council Tax Reduction Scheme is also available for households who are entitled to Job Seekers Allowance, Employment Support Allowance, Pension Credit, Income Support. You can read more on this here, external.

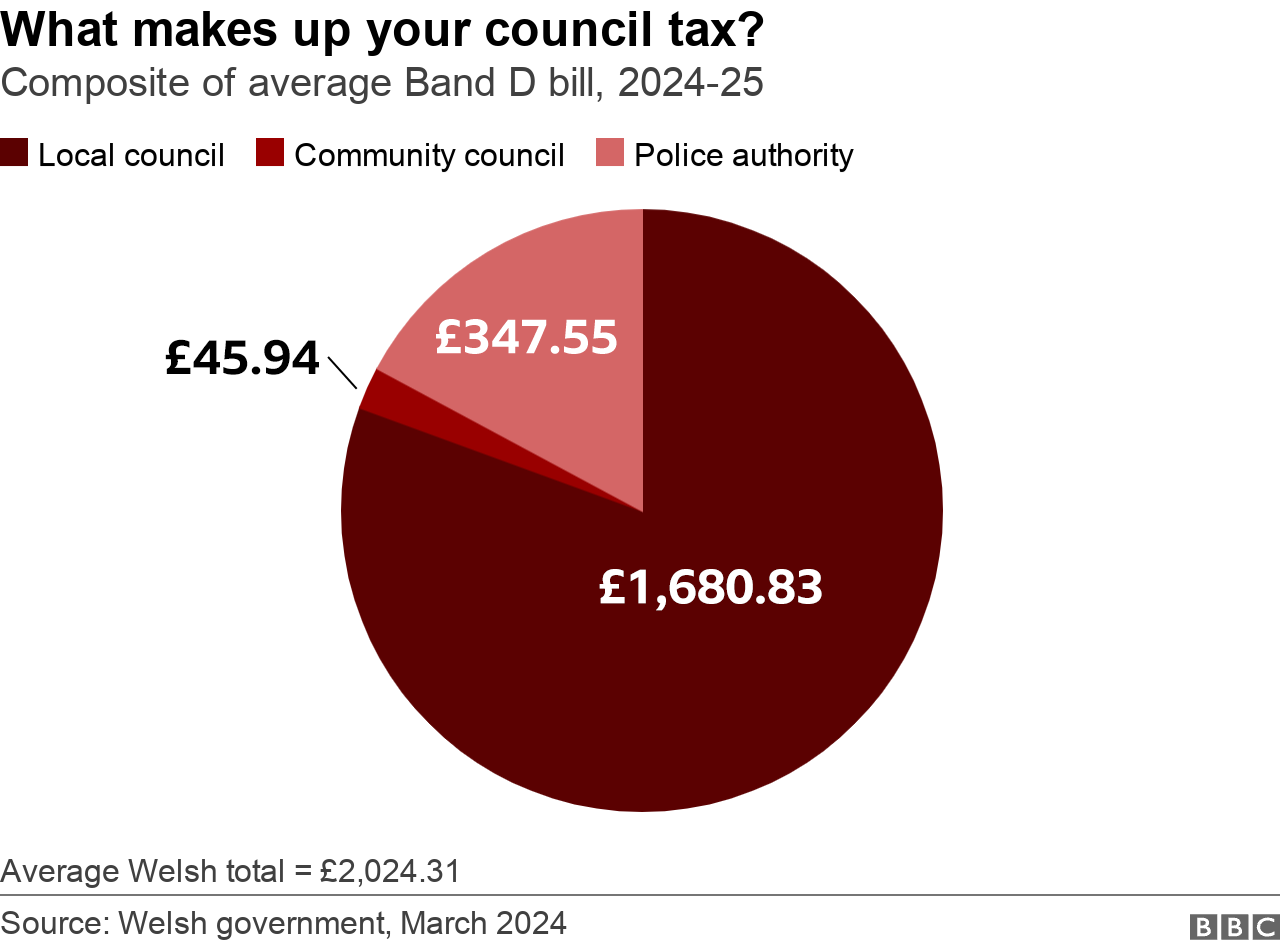

Most of your council tax pays for local authority services, but there are elements in your total bill which pay for the running of community councils and local police authorities.

All those elements saw rises of more than 7%, compared to the previous year.

Where else does the money come from?

Every year, each council gets grant funding from the Welsh government. On average, this has gone up 3.1% for the coming year and is worth well over half of local authority revenue.

But some councils got more than others. Newport council has an extra 4.7%, while Conwy and Gwynedd have each had only a 2% rise.

Conwy council said it had the highest proportion (27%) of over-65s in Wales and the funding formula did not take this into account, and the rising cost of social care for the elderly hit it hard.

It said it may be "forced to consider a range of unpalatable decisions on the level and quality of the services that we provide, which will impact negatively on our residents".

How much are the budget shortfalls?

Councils up until the last minute were working to find ways of saving money and to find efficiencies, even in those areas which they have a duty by law to provide.

One estimate showed there were around £390m worth of savings councils needed to find. Local government leaders had estimated it could be as high as £432m.

Why are things costing so much?

Inflation - the rising cost of energy and fuel for example - and paying the real living wage are two of the cost pressures.

Because councils are responsible for some services by law - like social services and environmental health - there can be little room for manoeuvre when costs go up.

That can leave other services, like libraries and leisure centres, more vulnerable.

Councils this year are reporting significant pressures on the demand and cost of social care and children's services particularly.

Wrexham council, for example, has seen its social care budget rise by 49% in four years but said demand outstripped the funding available. The authority is still looking to find £9.2m to balance its overall budget.

In Pembrokeshire, children's social care costs have risen from 6% of its budget to more than 10% in five years.

But if it did not look to any budget savings, council taxes in Pembrokeshire would have to rise by 42% to balance the books.

Although its council tax has seen the steepest rise this year, the average bill (£1,885 at band D) is still one of the lowest in Wales.

Ceredigion council faces a £14.6m budget shortfall and set a 10.3% council tax increase. It called it the "starkest budget yet and worse than was previously forecast."

The smallest council, Merthyr Tydfil, faced a £13m shortfall and called the position "a significant challenge"., external

Despite setting the highest average band D council tax, 83% of properties in the local authority lie in bands A to C,, external the second highest proportion in Wales.

Another small council, Torfaen, has said it hopes to balance its books after making £5.2m of internal savings.

What has been the response?

The WLGA said councils have lost £1bn in income over recent years, leaving "mammoth funding gaps."

Anglesey councillor Llinos Medi, the leader of the Plaid Cymru group at the WLGA, said last week's Welsh government announcement of an extra £25m for councils "won't touch the sides of the gaping black holes in our local services' budgets."

WLGA leader Andrew Morgan, who heads RCT council, said the scale of the pressures meant "extremely difficult decisions" will still need to be taken including raising council tax rates and around service provision.

The Welsh government, meanwhile, blames the funding it in turn gets from the UK government, and said it had to take some really difficult decisions to radically reshape its budget.

"We recognise the settlement falls short of the funding needed to meet all the inflationary pressures being faced by services and that local authorities face difficult decisions as they set their budgets," it said. "It is important they engage meaningfully with their local communities as they consider their priorities for the forthcoming year."

The average Band D council tax set by local authorities in England, external for 2024-25 was £2,171 and saw an average rise of 5.1%.

JUNE: VOICE OF A SILENT TWIN: The tragic story of June, her sister and their life in Broadmoor

DEATH OF A CODEBREAKER: The man found naked & dead inside a bag

Related topics

- Published12 February 2024

- Published7 February 2024

- Published5 March 2024