Wales tax powers: Promise of 'good, fair, strong deal'

- Published

Some AMs fear extra cash raised by Welsh ministers through income tax could affect Treasury grants

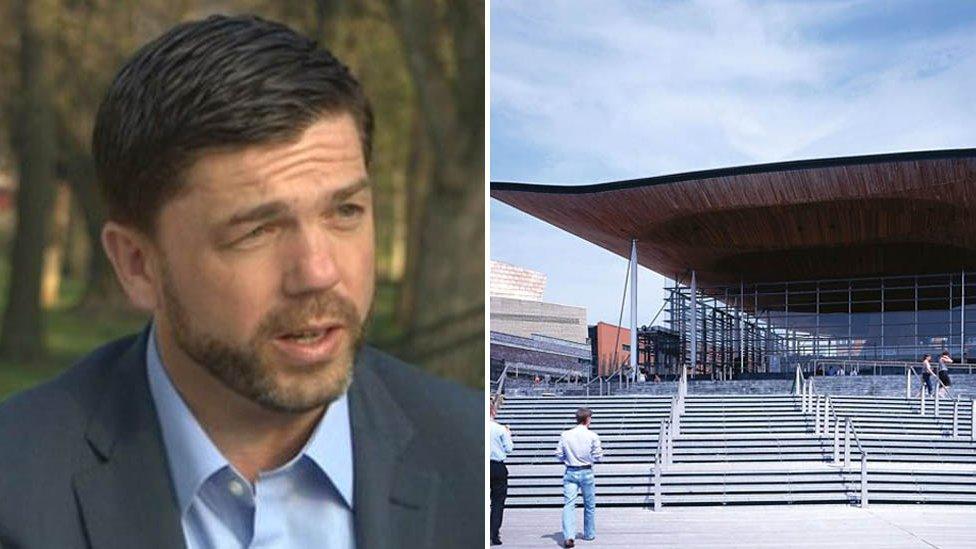

Income tax powers will not be imposed on Wales without a fair settlement on UK government funding, the Welsh secretary has said.

Alun Cairns has published a revised Wales Bill which confers some income tax powers without a referendum.

First Minister Carwyn Jones has said he fears the assembly will be "stitched-up" when the Treasury sets its grant.

But Mr Cairns told BBC Radio Wales the assembly would get a "good, fair, strong deal" on central funding.

The power to vary rates of income tax by up to 10p in the pound is one of the more controversial elements of the bill, which also offers the assembly increased powers over energy, transport and its own elections.

Some AMs have voiced fears that income tax devolution would be a trap, locking Wales into what they claim is a history of underfunding by the UK Treasury.

Speaking to BBC Wales on Tuesday, the first minister said: "Surely the assembly should be able to consent to those powers being transferred.

"The worry I have is that we're going to get stitched-up when it comes to the financial framework that is agreed.

"My objection to income tax has not been the principal necessarily, it's the deal that's on the table.

"Now, at the moment, the Treasury holds all the cards. It shouldn't be that way."

Alun Cairns he was 'optimistic' of getting a settlement 'that works for Wales'

Mr Cairns said he and Mr Jones both wanted to see a fair settlement for Wales.

"Every mature legislature takes responsibility for raising much of the money that it spends," he told the Good Morning Wales programme on Wednesday.

"I want Wales to come out with a good, fair, strong deal," he added, referring to negotiations with the Treasury.

"We want to devolve tax varying powers that empowers the assembly to make so many changes that it would want to change, but any adjustment then to the block grant would take that into account.

"We want to get to a fair settlement in exactly the same way as a positive discussion was held between the Treasury and the Scottish Government - they got to a good position.

"Our circumstances are different but we will get to a good position - I am very optimistic that we can work together to come out with an outcome that works for Wales."

The Scottish Parliament has had the power to vary income tax rates from UK levels since its creation in 1999, but has never done so.

In a statement to the assembly on Wednesday, Mr Jones said: "I have made clear that I will not be able to support income tax devolution without a clear overall fiscal framework agreed by both governments, and that this agreement will be a precondition of supporting a legislative consent motion for the bill."

The first minister added that he welcomed the progress made so far, but felt that "significant further improvement is needed to make the bill fit for purpose and fit for the assembly to consider giving its consent".

- Published7 June 2016

- Published15 March 2016

- Published7 March 2016

- Published29 February 2016

- Published29 February 2016

- Published28 February 2016

- Published20 October 2015