No rise in devolved income tax rate, says Carwyn Jones

- Published

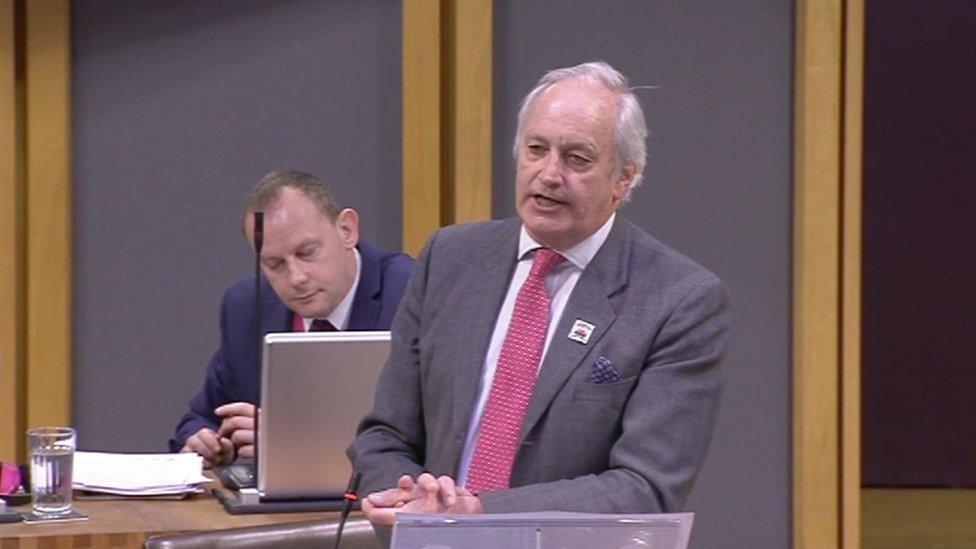

Carwyn Jones was questioned about his income tax position by UKIP's Neil Hamilton

First Minister Carwyn Jones has ruled out raising the Welsh element of income tax when it is devolved, despite UK Labour saying higher earners will pay more if it wins the general election.

The shadow chancellor has said those on over £80,000 a year would pay "a modest bit more" to fund public services.

Income tax in Wales could be varied by 10p within each tax band from 2019.

Labour pledged in the 2016 assembly election campaign not to raise income tax in the current assembly term.

During First Minister's Questions on Tuesday, the leader of the UKIP group at the assembly, Neil Hamilton said: "The Labour Party nationally is apparently going to stand on a policy of increasing the top rate of income tax from 45p to 50p."

Mr Jones said he would stand on a platform of ensuring that those who can afford to pay a little bit more do so in order to ensure that we have the public services that people expect.

'Enormous increase'

Mr Hamilton then said: "I take it from that response that it is now the policy of the Welsh Government when tax powers are devolved to this assembly to follow the Labour Party's manifesto nationally of increasing the top rate of tax in Wales.

"Because the evidence from the last time this happened in 2013 was that reducing the tax rate from 50p to 45p led to an enormous increase in revenue of about £8bn."

The first minister replied: "As far as the Welsh rate of income tax is concerned we've already pledged that we will not increase the rate of income tax during the course of this assembly."

Neil Hamilton said raising tax rates does not necessarily increase government revenue

Plaid Cymru has said it would look at the possibility of a ring-fenced tax rise to pay for health and social care when a Welsh rate is devolved.

The Welsh Conservatives have called for cuts to the higher and basic rate, the Liberal Democrats have also proposed cutting the basic rate once the power passes to Wales

Tax devolution will give Welsh ministers powers over about 20% of the money they receive to spend on public services.

But most of their budget - currently around £15bn a year - will continue to come from an annual block grant from the UK Treasury.

- Published19 December 2016

- Published19 December 2016