Tax cut on Welsh homes worth up to £180,000

- Published

- comments

Mark Drakeford has said there is no part of Wales where a first time buyer cannot buy a first home for £180,000.

Abolishing the tax on homes costing up to £180,000 will benefit house buyers who need the most help, Finance Secretary Mark Drakeford has said.

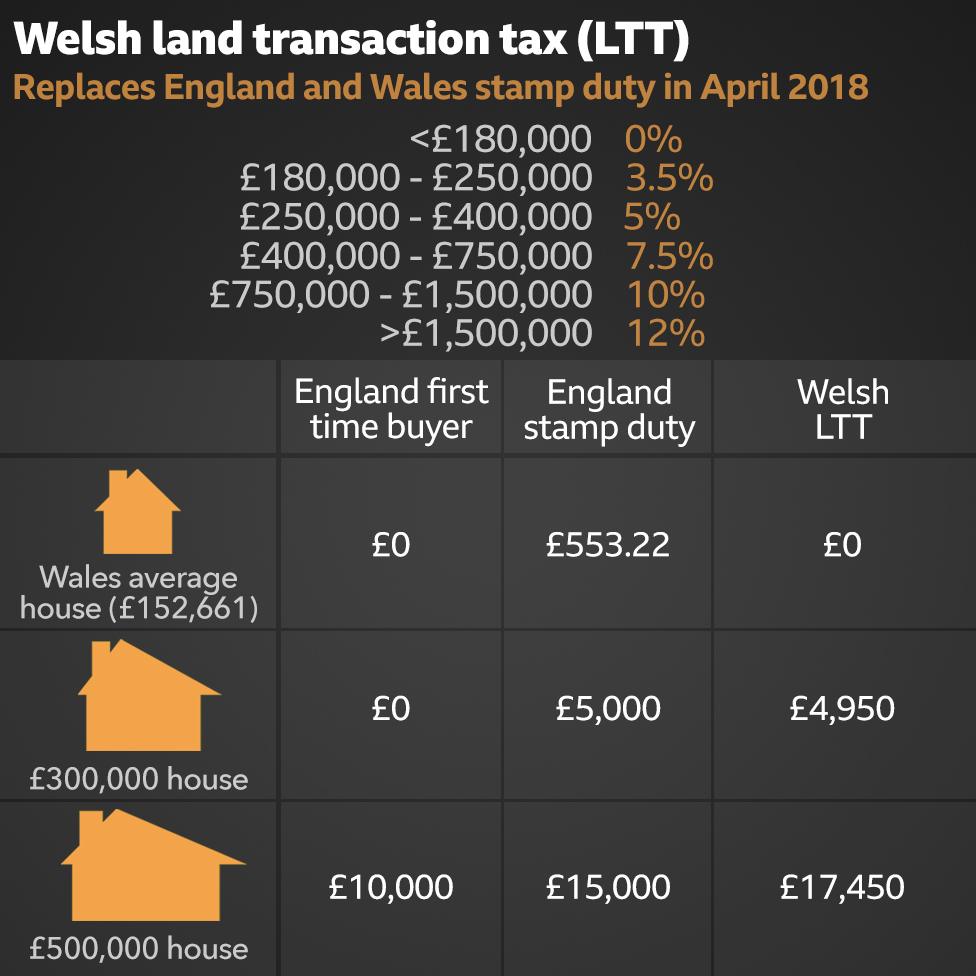

A stamp duty waiver for first-time buyers spending up to £300,000 will disappear in Wales, but not England, next April.

Instead, no-one will pay the new Welsh version of the tax when buying a home up to £180,000.

The minister said more people in Wales would benefit under his plans.

Stamp duty is replaced by the Welsh Government's new land transaction tax (LTT) from next April.

The chancellor announced last month first-time buyers would not pay duty on homes up to the value of £300,000.

Mark Drakeford's original proposal for the new tax was that all homes in Wales up to the value of £150,000 would be exempt from April, but he has now decided that the threshold will be £180,000.

"I don't think there's any part of Wales that a first-time buyer cannot buy a first home for £180,000," Mr Drakeford told BBC Wales.

"Where people choose to spend more than that there's no problem at all in them doing it, and they will get the full £180,000 worth of benefit.

"I don't think there's a strong taxpayer case for help being concentrated on those people who are already at the greatest advantage in the market.

"I think there's a much stronger case for using the money we have to help those people who need help more - and that's the way we will be doing things in Wales."

Setting Welsh rates meant "we are able to adapt the tax to meet Welsh circumstances", Mr Drakeford said.

"I understand that the Chancellor has to think about house prices in the south-east of England and no doubt there, some first-time buyers will be spending £300,000," he added.

"In Wales, the average first-time buyer buys a property for £131,000."

Prof Drakeford said: "Some people will get a little bit less help in Wales because of the way we are doing it. But a far larger number of people will get more help in Wales than they would in the equivalent circumstances over the border."

The Welsh Government said the move would reduce the tax burden for about 24,000 homebuyers here - whereas keeping the chancellor's scheme would help around 4,500.

It said the average buyer in Wales would save more than £500 under LTT compared to stamp duty, and about 80% of first-time buyers would pay no tax - the same proportion that is set to benefit from the Chancellor's tax relief for first-time buyers.

Those buying a house in Wales worth between £180,000 and £250,000 will pay no stamp duty on the first £180,000 and 3.5% rather than the planned 2.5% on anything over that.

But in practice the higher starting threshold means no-one will pay any more money.

A Welsh Tory spokesman said: "The Welsh Government had no other option to change the threshold following the Chancellor's hugely positive announcement for first-time buyers in last month's budget".

He added that there was concern "that this might exacerbate the problem of Wales' 'brain drain', where our most brightest and most talented young people continue to leave for pastures new over the border".

A Plaid Cymru spokesman said his party had "long advocated that Wales should set distinct and better tax policies than England".

"Now that this argument has been won, Welsh citizens should expect more innovative decisions to be made here," the spokesman added.

- Published22 November 2017

- Published22 November 2017

- Published4 October 2017

- Published3 October 2017