Bank closures: 239 Welsh branches closed in five years

- Published

- comments

Barclays was the last bank left in Llandovery in Carmarthenshire when it closed for good in June

Urgent action is needed after Wales lost more than 40% of its bank branches in five years, a group of AMs has said.

A report by the assembly economy committee said 239 branches closed between January 2015 and August 2019.

The number of free-to-use cash machines fell by 10% in the 12 months to March 2019, according to Which? research.

Peter James, a restaurateur in Llanwrtyd Wells, Powys - which has no banks - said: "You can see a decline in expenditure for our community."

The Federation of Small Businesses told the committee foreign tourists preferred to use cash because they can pay high charges for credit card transactions and "the absence of cash facilities in areas heavily dependent on tourism is impacting significantly on local businesses in Wales".

The report warned "money is being drained from smaller communities and high streets to the bigger towns" and said ministers needed to act.

Although banking regulation is a matter reserved for Westminster, AMs said the Welsh Government could "intervene and make a difference".

A Welsh Government spokesman said: "We have been vocal in our calls for commercial banks to maintain a strong presence on Welsh high streets, although banking regulation ultimately rests with the UK Government and it has the power to regulate the industry to ensure these vital services are available to local businesses, customers and communities."

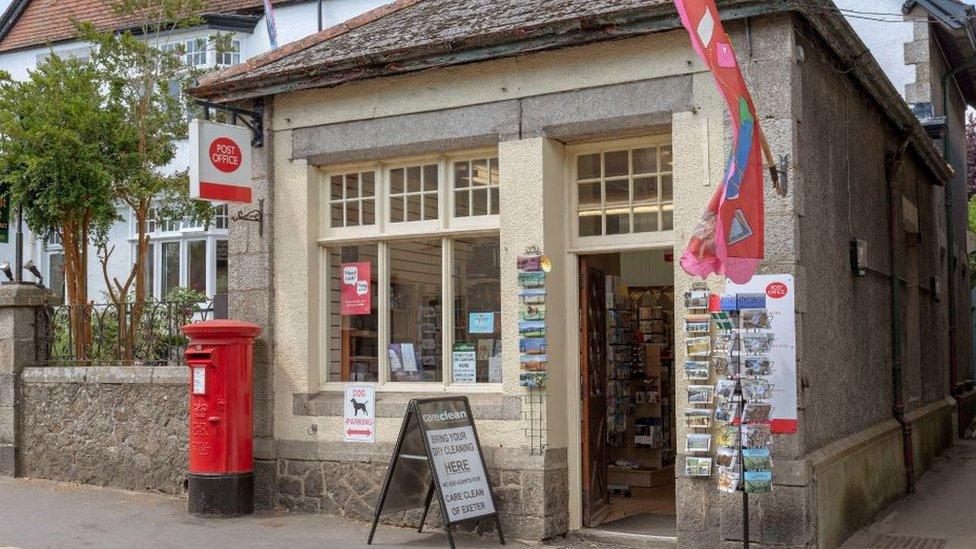

The last bank in Llanwrtyd Wells closed in 2015. It now has one free-to-use cash machine and a Post Office branch in a garage.

Mr James, who owns The Drovers Rest, said Llanwrtyd was built on tourism and it was "difficult for tourists to be able to get hold of cash to spend at events which are cash-run".

Peter James says tourists struggle to get cash for cash-only events

The report also said "digital exclusion" - areas where internet connectivity is poor - made it difficult for people to bank online and pointed out 51% of people over 75 were not internet users.

People at a weekly lunch in Llanwrtyd Wells said they were nervous about banking online.

Edna James, 86 said: "I'm a telephone person. I'm not one to go on a computer - press the wrong button and you'd lose all your money. I find it very frustrating."

Cathy Richards-Jones said: "I do bank online but you still need to go to a Post Office to withdraw cash - you still need to get money out."

Cathy Richards-Jones (left) banks online but Margaret Watkins fears she would "mess it up"

Margaret Watkins said if she needs a bank, she has to travel to Carmarthen, which is nearly 40 miles away.

"I'm afraid I wouldn't be able to go online - I'd mess it up - I'm 81 and I'm not used to the equipment."

The report said current alternatives "cannot fill the gap - there is a limit to the services offered by the Post Office and credit unions, and barriers to online banking that mean it cannot be the only long-term solution".

Wales lost one in 10 of its free-to-use cash machines in a year, according to Which? research

The committee called on Welsh ministers to change planning rules to protect banks and take into account the impact of branch closures when planning community regeneration schemes.

It also warned evidence about the feasibility of a community bank for Wales, planned by ministers, was "not conclusive", although the rationale was convincing.

Conservative AM Russell George, chairman of the assembly's economy committee, said the "alarming escalation of bank closures and the loss of cash machines" was "hitting communities hard".

"Wales is not ready to go cashless and online banking is not right or possible for everyone," he added.

- Published24 September 2019

- Published8 October 2019

- Published9 June 2019

- Published23 January 2019