Coronavirus: Councils will take 'generation' to pay for response

- Published

- comments

It will take a generation for Welsh councils to pay for the coronavirus pandemic, according to the body representing them.

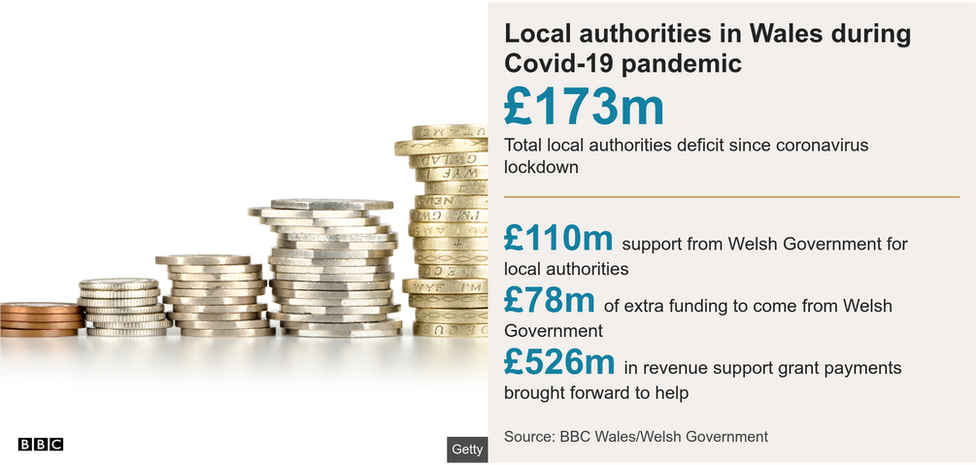

Councils have built up a deficit of about £173m during lockdown, due to a loss of income and increased costs.

Anthony Hunt, from the Welsh Local Government Association (WLGA), warned they were facing a "recovery period of years".

The Welsh Government said it had made £110m available for councils.

One of the concerns raised by local authorities is the spike in applications for council tax reduction, and the cost of the all-Wales "Test, Trace and Protect" initiative.

Mr Hunt, the WLGA's finance spokesman, and also leader of Torfaen council, said: "There's a risk that the legacy of the coronavirus won't just be a medical one but will be a financial one that damages our communities as well."

He added: "I think it's far too early to talk about council tax going up, and I think that's a very undesirable outcome given the strain on people's finances thanks to this."

But Rob Jones, leader at Neath Port Talbot council, warned increases were inevitable "to keep pace with what is going on in the world".

Community hubs for childcare have added to council costs, according to one council leader

He added the potential cost of test and trace would be a "heavy burden for financial and human resources".

All 22 Welsh local authorities have been asked how the pandemic has impacted them, and 19 responded.

Some said increased costs included PPE, community hubs for childcare, free school meals, extra costs in social services, contact tracing, the £500 bonus for care workers, and expenditure on hospitals.

The Welsh Government has so far funded additional expenditure incurred as a result of the crisis, with local authorities submitting claims on a monthly basis, as well as receiving two months' worth of its core funding in advance.

Although some pointed to savings where services have been scaled back or stopped, four said loss of income - not currently covered by the Welsh Government - had been significant.

This is from things including leisure centres, sports and performance venues, parking fees, moving traffic offences, rent on industrial units, licenses and trade waste.

Gwynedd council said, depending on the duration of the crisis, its lost income could total between £5m and £16m.

Cardiff council said there had been more than 5,000 new applications for the council tax reduction scheme since April - up 1,807 on the same period to the end of June last year, with the increase costing them about £33.86m.

Future talks

Guto Ifan, a research associate at Cardiff University think-tank Wales Governance Centre (WGC), said even before the coronavirus crisis, funding for local government was 14% below what it had been in 2010, meaning there was "very little resilience in the system already".

He said increased demands on local authorities as a result of the crisis will be around for a "number of years", and that "sustained increased investment" would be required by both the UK and Welsh governments for a prolonged period of time.

"Relying on local governments increasing council tax might not be the answer," he added.

"We might have to look at using the more progressive income tax powers, for instance, that the Welsh Government now has, but those are debates to be had over the next few years."

If councils generate a deficit, they can sometimes use their reserves, provided they are not earmarked for other projects.

The Welsh Government said it recognised the funding pressures placed on local authorities.

A spokesman added: "We have made £110m available immediately to help local authorities with additional costs and brought forward £526m of revenue support grant payments from May and June to support them.

"We will publish a supplementary budget next week, which will include up to £78m of further funding for local authorities."

A HM Treasury spokesman said the UK government announced £3.2bn of additional funding for all local authorities to "respond to pressures across all their services as a result of Covid-19".

Anglesey

Lost income: £400,000 per month.

Reserves: It may have to use reserves if expenditure exceeds the level it budgeted for.

Spending: In March it received £52,000 to cover costs related to Covid-19. Its claim for April will be higher.

Background: More people have applied for the council tax reduction scheme since the outbreak, and the council expects to have to write off more council tax debt than normal because of the pandemic.

More homes on Anglesey are applying for council tax relief

Blaenau Gwent

It is too early to judge the full economic impact of the pandemic as the lockdown measures remain largely in place.

The council is in discussions with the Welsh Government about the financial challenges presented by the pandemic.

Bridgend

Lost income: £4m by end of June.

Additional spending: £5m as a direct result of the pandemic.

Reserves: May need to draw on reserves if financial pressures grow such as increase in applications for council tax support and current efforts to establish 'Test, Trace and Protect' services.

Background: No staff furloughed. Medium-term effects could place more pressure on the council and these may not be funded by Welsh Government.

Caerphilly

Lost income: £3.2m since April.

Additional spending: £4.5m since April on social care, the provision of PPE, community hubs for childcare and free school meals.

Reserves: The use of them is under review in light of the pandemic.

Background: The majority of the council's services are still being offered although some have been scaled back. No staff furloughed yet.

Cardiff

Lost income: £11m by end of June.

Additional spending: More than £18m by end of June as a direct result of Covid-19.

Background: Further costs will come from work to establish 'Contact Track and Trace'. It has seen a significant increase in the number of applications for the council tax reduction scheme and is concerned about the ongoing recovery of costs as current funding arrangements are confirmed only until the end of June.

Cardiff is projected to spend an extra £18m by the end of June

Carmarthenshire

No information provided.

Ceredigion

Lost income: £1.1m by the end of June

Reserves: "Sufficient reserves" to cover any deficit for the immediate future.

Background: No impact on debt so far.

Conwy

It said it was difficult to say what the financial consequences will be as it is uncertain how long the situation will last.

The council was waiting to hear what support it would get from the Welsh Government.

Denbighshire

The council said it was inappropriate to provide information until it knows the level of support the Welsh Government intends to provide.

It added the position will become clearer in the coming weeks.

Flintshire

Lost income: "Significant losses".

Additional spending: It has spent more on services such as social services.

Background: The council has seen a "sharp increase" in applications for the council tax reduction scheme and this, as well as income loss, are two main areas of cost exposure.

A former day centre in Queensferry has been used as a night shelter on an occasional basis in Flintshire since lockdown began

Gwynedd

Lost income: Expects "dramatic" income losses of £6.8m.

Additional spending: £1.2m up to June.

Background: Depending on the duration of the crisis, the council said it could see losses of up to £16m. It said there is "an obvious need" for compensation for lost income from the Welsh Government, and that expected income is "unlikely to recover for many years possibly".

Merthyr Tydfil

Referred to the WLGA figures, which estimated the total income loss of all Welsh councils to be £95m and total additional spending to be £101m.

Monmouthshire

Lost income: £3.5m by the end of June.

Additional spending: £521,000 on costs relating to the pandemic.

Background: It has reduced expenditure by £634,000 where services are not operating or are reduced, and the council has furloughed 240 staff. Funding announced by the Welsh Government falls significantly short of budgetary projections and it wants the Welsh Government to ensure councils will be able to borrow money as a last resort.

Neath Port Talbot

Lost income: £4.9m.

Additional spending: £5.2m.

Reserves: It has £18m of general reserves which would be exhausted by next April if there was no further support.

Background: "Modest" savings have been made through suspending services but future costs, such as the cost of keeping care homes running and contact tracing, needed to be considered.

The council estimates it would lose £7.5m through reduced council tax payments and has already borrowed £20m from Public Works Loan Board to make sure it could deliver Business Grants as quickly as possible.

Suspending services in the Neath Port Talbot area has allowed "modest" savings to be made

Newport

The crisis is placing "pressure" on spending and income. The council said it was adjusting its financial forecasts because of the pandemic.

Pembrokeshire

Lost income: £3.5m by the end of June.

Spending: £3.8m by the end of June.

Background: Recovery will be lengthy and complex. The main concern is loss of income, as current Welsh Government funding only covers additional expenditure.

Powys

Reserves: Without further support its "limited" reserves could cover the deficit for four months.

Background: The pandemic has had an "unprecedented impact" and Powys could have a deficit of £10m by the end of June, leaving the council with a "bleak" financial future.

There is a risk the council "may not be able to financially sustain itself" for current financial year, while council tax receipts are down £600,000 from the start of the new financial year.

Powys, home to part of the the Brecon Beacons National Park, could run into funding problems this financial year

Rhondda Cynon Taff

Spending: £4.5m a month on the pandemic.

Background: It also had additional costs due to Storm Dennis at the start of the year.

Swansea

No information provided.

Torfaen

No information provided.

Vale of Glamorgan

Lost income: £2.4m by end of June.

Additional spending: £2.4m of extra costs by the end of June including providing PPE, temporary homeless accommodation and free school meals vouchers.

Background: "Non-essential" spending has been stopped but no permanent decisions have been made to reduce services. It has had additional funding but it's "too soon to say" whether this will be enough to cover all losses.

Wrexham

The council said it was working with the Welsh Government and other councils.

TRANSLATOR: What do all the terms mean?

A SIMPLE GUIDE: How do I protect myself?

LOOK-UP TOOL: Check cases in your area

MAPS AND CHARTS: Visual guide to the outbreak

- Published25 May 2020