Mortgage help offered for struggling homeowners in Wales

- Published

- comments

Loans will be interest-free for five years for those who cannot afford increases to rates

Homeowners in Wales who are struggling with their mortgages could get loans that are interest-free for the first five years under a new £40m scheme.

Repayments for some types of mortgages have increased in the past few years, on the back of bigger interest rates.

The loans, which are also repayment-free for five years, will be offered to people who cannot afford the increased rates, but not everyone will qualify.

The Welsh government said the plan aims to help avoid homelessness.

The Help To Stay loans - part of the Welsh Labour ministers' co-operation deal with Plaid Cymru - will be have to be repaid within 15 years.

But because it is an equity loan applicants could face paying more back than the amount they initially borrowed if the value of their house goes up.

The Welsh Conservatives objected to the scheme, saying it was not "the role of the Welsh government to hand out loans to pay off people's mortgages".

To tackle rising prices the Bank of England has raised interest rates since late 2021 to 5.25%.

Although the bank has recently kept them frozen for the second time in a row, they are at the highest level for 15 years.

People paying tracker and standard variable rate mortgages have seen their repayments increase as a result.

What are Help to Stay Wales loans?

The Welsh government will offer equity loans to people who cannot afford their mortgage payments.

It will be open to people in homes worth up to £300,000 and with household earnings of no more than £67,000.

Eligible applicants could borrow as much as £147,000 to pay off some of their mortgage and lower their monthly payments.

They will need to give evidence of the difficulties they have, and will need to speak to an independent debt adviser before receiving the loan.

Because it is an equity loan, the money that has to be repaid could go up or down according to the market value of the home at the time that it is sold.

The loan is interest and repayment free for the first five years, but recipients could be forced to sell their home if they do not repay.

Despite recent concerns about the Welsh government's budget - with cuts made to help support the NHS - ministers have set aside £40m over the next two years for the Help To Stay scheme.

The cash has come from a pot of money separate to that used for day-to-day government spending, and that can only be used for loans.

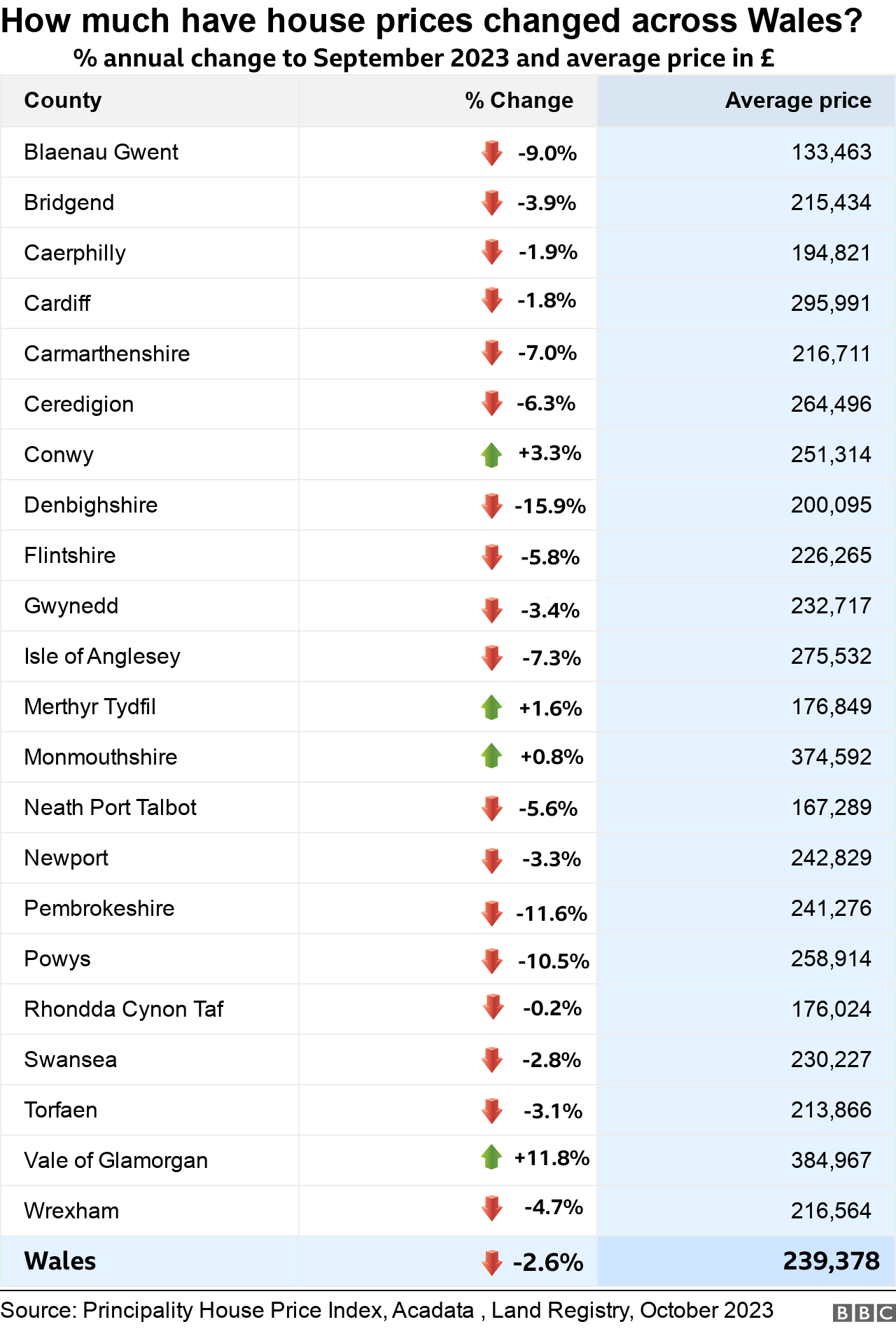

The threshold of £300,000 is below the average house price in two council areas.

Figures from the Principality Building Society placed the average house price in Wales at £239,378 last September. It stood at £295,991 in Cardiff and exceeds £300,000 in Monmouthshire and the Vale of Glamorgan.

Jeanne Fry-Thomas of Ebbw Vale estate agents Bidmead Cook said: "The devil will be in the detail with this scheme.

"We are not seeing repossessions at the moment and we're not seeing people coming onto the market because they can't afford their mortgage payments."

Climate Change Minster Julie James told BBC Wales it made more sense to spend money on the loans "than let people fall into homelessness".

"It's an awful lot cheaper in human terms for sure, but also financial terms to keep people in their own home than it is to treat them as homeless," she said.

The loans come with free debt and financial advice, with the aim of getting people into a better financial situation within five years, when the repayments start.

Help is already available for people in danger of being repossessed, but Help to Stay will be aimed at people who have missed repayments or think they may be about to.

According to UK Finance there were 81,900 homeowner mortgage in arrears of 2.5% or more between April and June 2023 - 7% more than between January and March.

However it is thought that the total level of arrears remains very low by historic standards.

The Welsh government suggests the scheme could help up to 400-500 households a year, with interest charged at 2% above the Bank of England rate after the five year interest free period.

Sian Gwenllian of Plaid Cymru said: "This new, targeted support will help more people at an earlier stage, not just those threatened with repossession, meaning they can stay in their homes and help them avoid the stress of not being able to pay their mortgage."

Welsh Conservative shadow housing minister Janet Finch-Saunders said: "It is not the role of the Welsh government to hand out loans to pay off people's mortgages.

"The UK government has already secured a wide range of support directly from mortgage providers to support people.

"The scheme is flawed, and raises several questions, including whether it is being targeted correctly, and why social landlords are not being supported to invest in homes that are threatened with repossession."

WALES' HOME OF THE YEAR: Which home will be crowned the winner?

BAFTA CYMRU WINNERS: Check out these award winning shows

Related topics

- Published16 October 2023

- Published1 August 2023

- Published7 June 2023