Ghana enforces controversial emissions levy

- Published

Ghana is the third African country to introduce a form of carbon tax, after South Africa and Mauritius

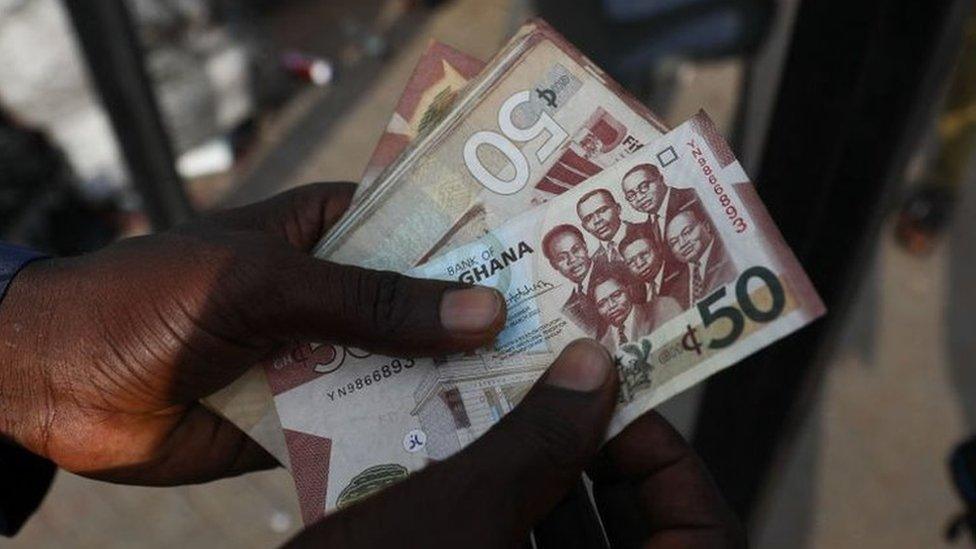

A fuel emissions levy has taken effect in Ghana, sparking mixed reactions.

The government now requires Ghanaians to pay an annual levy for the carbon emissions produced by their petrol or diesel-powered vehicles.

Several citizens are opposing the charge, which they see as an added burden amid an ongoing economic crisis.

But some leaders and environmental groups are endorsing it, saying it will cut the country's emissions and help raise more revenue for the government.

Ghana is the third African country to introduce a form of carbon tax, after South Africa and Mauritius.

The tax agency, the Ghana Revenue Authority (GRA), has said that the levy aligns with the government's plans "to promote the use of eco-friendly technology and green energy".

The GRA began collecting the annual levy, approved by parliament in December, on Thursday. Fees range from 75 Ghanaian cedis ($6; £4) for motorised tricycles and motorcycles to 300 cedis ($24) for vehicles with a capacity of 3,000cc or higher.

Benjamin Boakye, the head of the think-tank Africa Centre for Energy Policy, said the government was "not being sensitive" by imposing the levy on top of already-existing fuel and road-use taxes. He also argued that the new policy would not actually lower emissions.

"This is not going to prevent anybody from driving. They know you don't have a choice. You will have to pay for it. The carbon will still be generated because the Ghanaian will have to move from one point to the other," Mr Boakye was quoted as saying by the Modern Ghana news website.

The union of commercial and public transport providers has also criticised the levy and said it was not consulted by the government.

The union now plans to hike transport charges by as much as 60% to reflect the added costs of the levy.

Critics fear that it could have a ripple effect on the struggling economy, further intensifying the cost-of-living crisis that has already pushed up the prices of necessities like fuel.

Related topics

- Published6 October 2023

- Published18 May 2023

- Published13 February 2023