1MDB: Embattled Malaysia fund's board offers resignation

- Published

1MDB racked up billions of dollars in debt shortly after it was set up in 2009

The entire board of a Malaysian state fund has offered to resign, after a parliamentary inquiry found it failed to carry out its responsibilities.

The inquiry identified issues in 1MDB's financing and performance, saying it was "unsatisfactory".

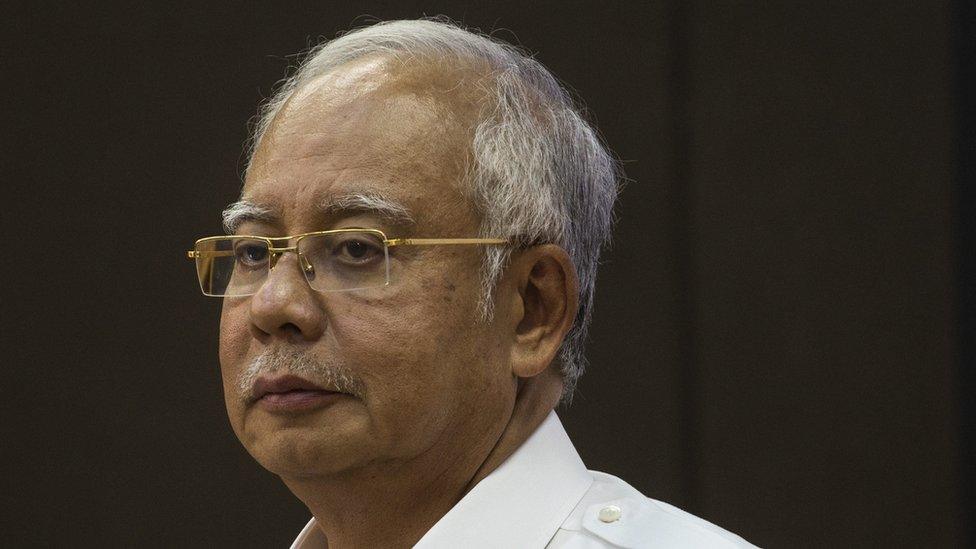

1MDB, which racked up billions of dollars in debt, was set up by PM Najib Razak to promote development.

1MDB has faced repeated allegations of corruption, but has previously denied all wrongdoing.

Mr Najib, who has also been accused of misappropriating funds, has been cleared by Malaysian authorities.

The political scandal has gripped Malaysia, which has seen protests calling for Mr Najib's resignation.

The full background to the 1MDB scandal

Asia Business correspondent Karishma Vaswani: Malaysia PM in the clear?

In a statement, 1MDB's board acknowledged there had been lapses, but that it was strengthening its corporate governance.

It said it had been paying off its debts, which it had to incur because it had insufficient equity to make its investments.

The board members said their offer to resign "has been a difficult decision to take but we believe is the right thing to do, given the circumstances, in order to facilitate any follow-up investigations as recommended" by the parliamentary committee which conducted the inquiry.

'Mismanagement and neglect'

The committee recommended that former chief executive officer Shahrol Azral Ibrahim Halmi be investigated.

It concluded that there were certain restrictions and weaknesses in 1MDB's management and board of directors, and that Mr Shahrol must take responsibility for those, according to the Malay Mail online, external.

Mr Shahrol has yet to comment.

Mr Shahrol, seen here in a 2010 file photo, stepped down as 1MDB's chief executive in 2013

Its report stated that 1MDB's management did not follow the board's instructions and made decisions without board approval, while the board "was not proactive in scrutinising" the management or the fund's cashflow.

It cited at least two examples:

A $1.4bn (£1bn) payment was made to a company named Aabar Investment PJS, said to be linked to Abu Dhabi's sovereign wealth fund - this was done without board approval and without verification if it was the right company.

A transfer of $1bn for a joint venture with Saudi Arabian oil company PetroSaudi was also done without board approval nor due diligence, with the bulk of the money sent to a bank account belonging to a company not involved in the project.

The report also called for the fund's advisory board, which is chaired by Mr Najib, to be removed.

Mr Najib founded state fund 1MDB in 2009

Opposition Member of Parliament Tony Pua, who was on the committee, said the report "confirms gross mismanagement and wanton neglect of all principles of good governance and accountability", and said Mr Najib should be held responsible.

Mr Najib said on his blog , externalthat his government will study and act on the report's recommendations.

- Published22 July 2016

- Published30 January 2016

- Published2 February 2016

- Published1 February 2016