Indian billionaires bet big on homegrown couture

- Published

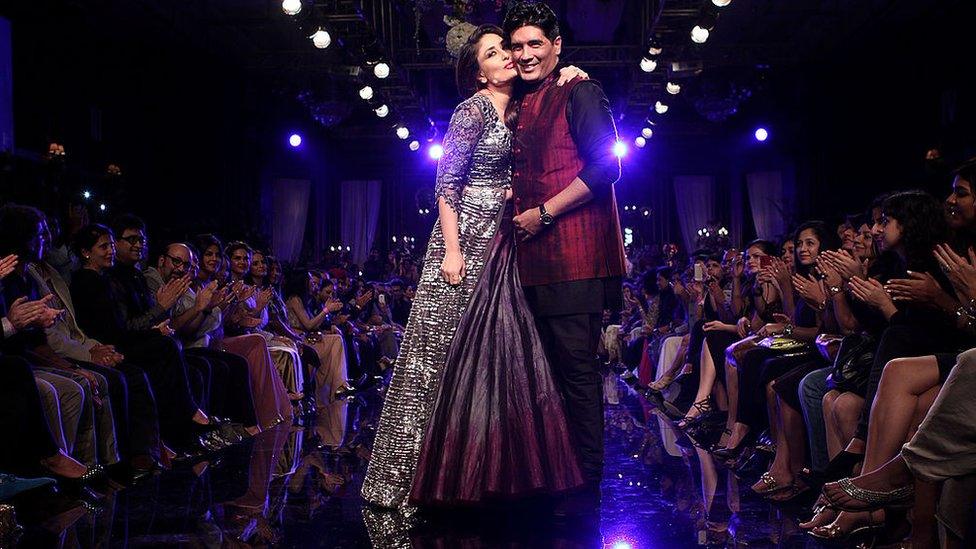

Manish Malhotra (R) has dressed Bollywood star Kareena Kapoor (L) in several films

India's largest conglomerates have been snapping up stakes in high-end, homegrown designer brands to help them scale up and go global.

The trend, experts say, points to a luxury retail market on the cusp of maturity.

In October, Reliance Brands Limited (RBL), a subsidiary of the the oil-to-telecoms Reliance conglomerate, announced it was buying 40% equity in celebrity fashion designer Manish Malhotra's eponymous label. A week later, the company bought more than 50% stake in Ritu Kumar, one of India's oldest fashion houses.

Malhotra, who has been dressing Bollywood's biggest stars for the last 30 years, launched his label about 15 years ago. He has annual revenues in the ballpark of $30m (£22m), according to Forbes.

The call to partner with a corporate house like Reliance was driven partly by his decision to focus on his upcoming Bollywood directorial debut, Malhotra said. But it was also the result of his ambition to expand internationally.

"I have the practical knowledge, but for someone who has not studied the business of fashion, my dreams and stories need that backing to go global," he told the BBC at his design workshop in Mumbai city's Santacruz suburb.

"The label needs to get more organised. It's very family-led."

It's a logical move, and in line with international trends, says Ankur Bisen, senior partner at Technopak retail consultancy.

He points to several fashion powerhouses - Dior, Chanel, Hugo Boss, Saint Laurent (YSL) - who did the same: they "institutionalised" by moving beyond the founder who started the eponymous labels.

Ritu Kumar (R) is the founder of one of India's oldest fashion labels

"Many of the designers in India are now in their 50s, and 60s and having to take that call," Mr Bisen said.

Reliance is keen to set up more flagship stores by Malhotra, and also hasten the company's foray into e-commerce.

RBL's current portfolio of brand partnerships includes marquee global brands such as Armani Exchange, Bottega Veneta, Jimmy Choo, Kate Spade New York, Michael Kors, Tiffany & Co. among others.

But RBL isn't the first or only company to invest in homegrown labels. Aditya Birla Fashion, owned by the India-based multinational Aditya Birla Group, has done the same - in recent years it has acquired stake in major couturiers like Sabyasachi, Tarun Tahiliani and Shantanu & Nikhil.

The shift towards domestic designer brands was long overdue, experts say.

"International brands are not going to appeal to an Indian audience. They've tried," said Nonita Kalra, editor in chief of Tata CliQ Luxury.

"Apparel in India remains very specifically Indian in its taste. If you want to grow in the fashion market, you'll have to grow keeping very specific Indian tastes in mind,"

She added that since couture shopping in India is largely driven by weddings and religious festivals, the allure of homegrown labels lies in their emphasis on bridal and ethnic fashion.

And by partnering with corporate companies, she said, designers can "fine-tune and layer" their products so they can reach a larger market through more affordable luxury wear.

In fact, earlier this year, Sabyasachi became the first Indian designer to launch a collection in partnership with Swedish fashion giant H&M. And Rahul Mishra, a rising haute couture designer, collaborated with a popular Indian affordable label - W - to launch a collection ahead of the festival season this year.

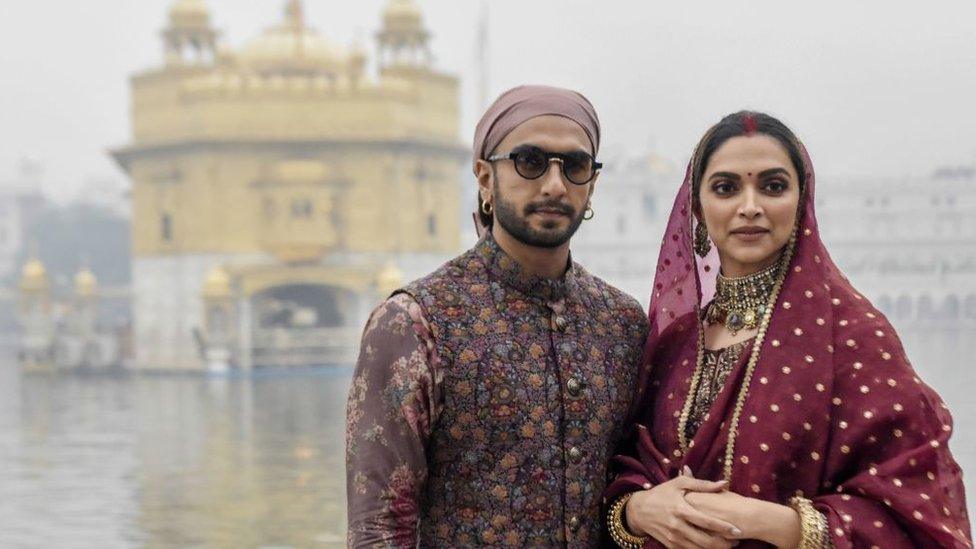

Bollywood star couple Deepika Padukone and Ranveer Singh wearing Sabyasachi, including on a 2019 visit to the Golden Temple

According to data from McKinsey, India's apparel market will be worth $60bn in 2022, making it the sixth-largest in the world, comparable to the UK and Germany.

Couture labels occupy a small sliver of it currently, and are still modest in size, compared to their global counterparts. The annual turnover in India's top 10 couture houses ranges between $25-$100m, according to the Economic Times.

But the interest in them is "not because of who they are today, but what they can be tomorrow," Ms Bisen said. "Also the alternative for retailers - label development, building design talent and creating brand recall - is too expensive and time-consuming."

That is, it's easier to invest in a label that already has all of that.

But making a global play with ethnic couture might be easier dreamt than achieved. Both demand and supply are a challenge.

In a world where fashion trends are set largely in Europe and America, and the market is patronised by consumers from China and the Middle East, making Indian ethnic wear aspirational is a tough proposition. It's also difficult to introduce a supply chain that suits the global industrial model to Indian fashion, which still relies on weavers, handiwork and a vast informal talent pool.

While the pandemic was a temporary setback, industry watchers say the revival has been quick, aided by e-commerce.

This has also made it easier for local designers to tap into India's wealthy and 18 million-strong diaspora.

Aditya Birla Group has invested in the eponymous label by Shantanu Mehra (L) and Nikhil Mehra (R)

"Increasingly nomadic customers who are cosmopolitan in their outlook have reshaped our approach of looking at customers in a geography-agnostic way," said Darshan Mehta, president and chief executive of RBL.

As the world opens up after the pandemic, Indian designers are also keen to expand overseas.

Access to capital was a huge handicap for these labels, but that is no longer a hurdle. After the investment from Aditya Birla Fashion, Sabyasachi has announced that he will open a sprawling 60,000 sqft (5,574 sqm) store in New York in 2022. And in February this year, he showcased a selection of clothes and accessories in the city's luxury department store, Bergdorf Goodman.

Given the flurry of announcements, experts believe the sector is riding a wave of optimism.

"Luxury needs help," Ms Kalra said.

"I think we are going to see a very accelerated rate of acquisition, change and growth. It won't always be easy, and there will be dramatic break ups, and pleasant falls outs and conscious uncouplings."

"But I think things as we know it are going to change forever."

Fashion graduate Kate Harper has top tips for reducing your clothing footprint